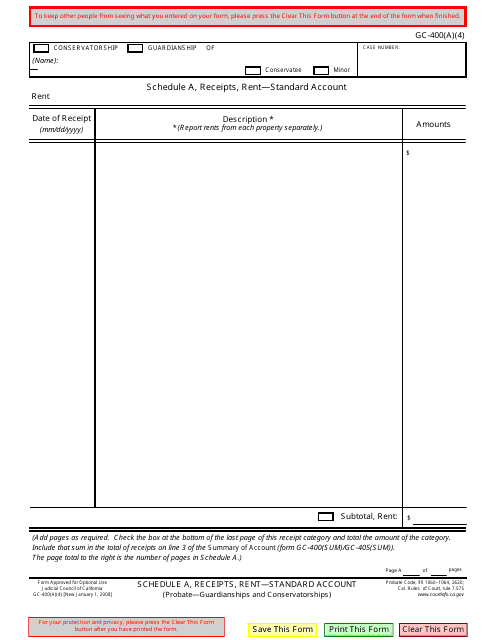

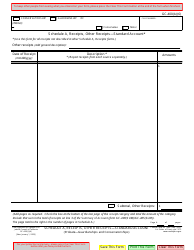

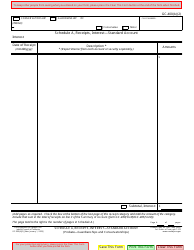

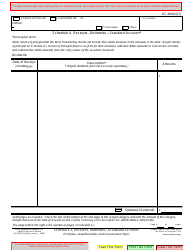

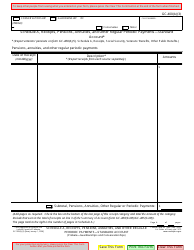

Form GC-400(A)(4) Schedule A Receipts, Rent " Standard Account - California

What Is Form GC-400(A)(4) Schedule A?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(A)(4) Schedule A Receipts?

A: GC-400(A)(4) Schedule A Receipts is a form used in California to report rental income.

Q: What is a Standard Account?

A: A Standard Account is a type of accounting system used for reporting rental income in California.

Q: How do I fill out GC-400(A)(4) Schedule A Receipts?

A: To fill out GC-400(A)(4) Schedule A Receipts, you need to provide information about your rental income and expenses for a specific tax year.

Q: Is GC-400(A)(4) Schedule A Receipts specific to California?

A: Yes, GC-400(A)(4) Schedule A Receipts is specific to California.

Q: What is the purpose of GC-400(A)(4) Schedule A Receipts?

A: The purpose of GC-400(A)(4) Schedule A Receipts is to accurately report rental income for tax purposes in California.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(A)(4) Schedule A by clicking the link below or browse more documents and templates provided by the California Superior Court.