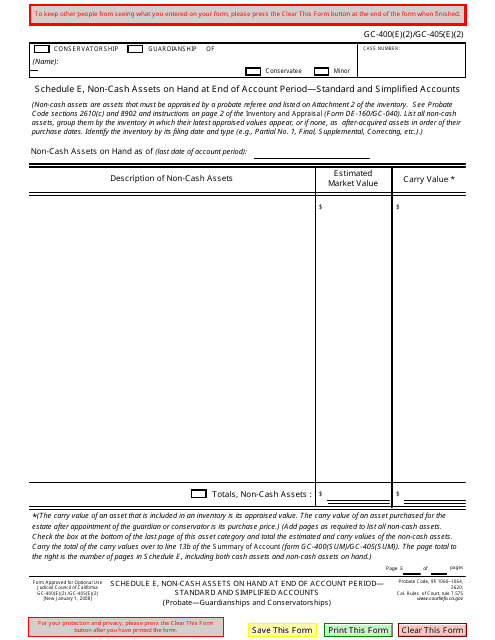

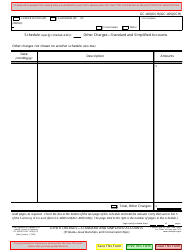

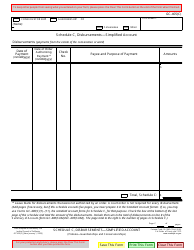

Form GC-400(E)(2) (GC-405(E)(2)) Schedule E Non-cash Assets on Hand at End of Account Period - Standard and Simplified Accounts - California

What Is Form GC-400(E)(2) (GC-405(E)(2)) Schedule E?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form GC-400(E)(2)?

A: The form GC-400(E)(2) is a schedule used for reporting non-cash assets on hand at the end of an account period.

Q: What are Standard and Simplified Accounts?

A: Standard and Simplified Accounts are two methods used in California for accounting and reporting purposes.

Q: What does Schedule E refer to?

A: Schedule E in form GC-400(E)(2) specifically refers to reporting non-cash assets on hand at the end of an account period.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(E)(2) (GC-405(E)(2)) Schedule E by clicking the link below or browse more documents and templates provided by the California Superior Court.