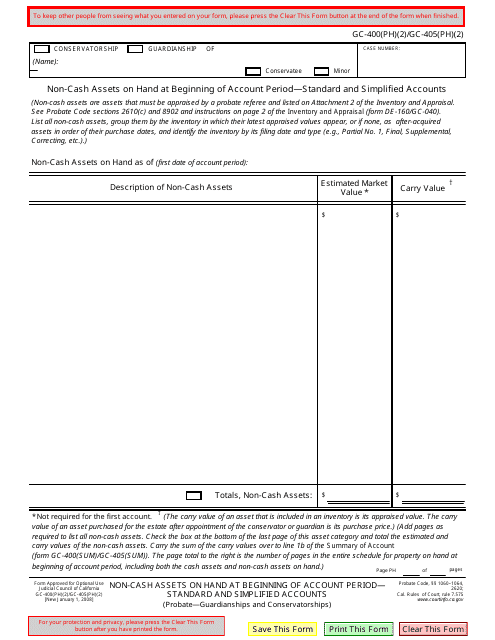

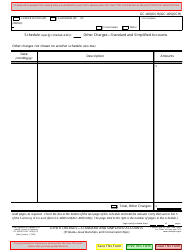

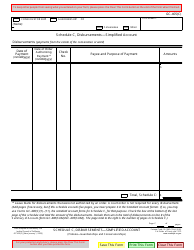

Form GC-400(PH)(2) (GC-405(PH)(2)) Non-cash Assets on Hand at Beginning of Account Period - Standard and Simplified Accounts - California

What Is Form GC-400(PH)(2) (GC-405(PH)(2))?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(PH)(2) (GC-405(PH)(2))?

A: GC-400(PH)(2) (GC-405(PH)(2)) refers to a form used to report non-cash assets on hand at the beginning of the account period for standard and simplified accounts in California.

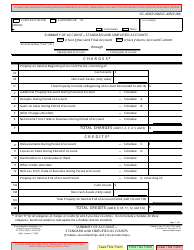

Q: Who needs to file GC-400(PH)(2) (GC-405(PH)(2))?

A: Individuals and organizations with standard and simplified accounts in California need to file GC-400(PH)(2) (GC-405(PH)(2)) if they have non-cash assets on hand at the beginning of the account period.

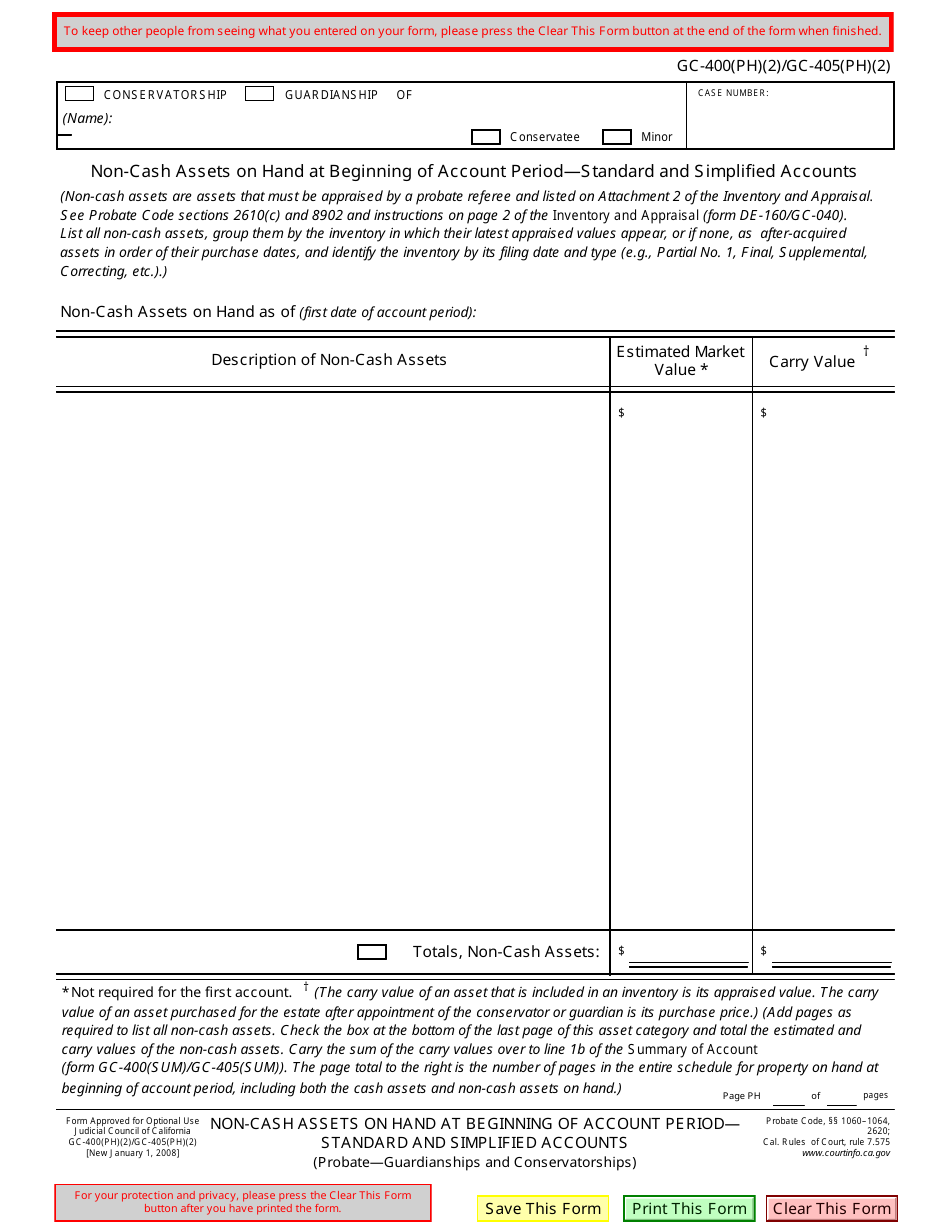

Q: What are non-cash assets?

A: Non-cash assets refer to assets that are not in the form of cash, such as property, vehicles, equipment, investments, and inventory.

Q: What is the purpose of reporting non-cash assets on hand?

A: Reporting non-cash assets on hand helps track and monitor the value of assets owned by individuals and organizations, ensuring accurate financial reporting.

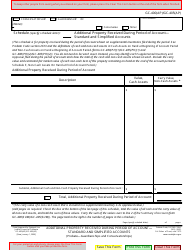

Q: What is the difference between standard and simplified accounts?

A: Standard accounts require more detailed financial reporting, while simplified accounts have fewer reporting requirements and are available to smaller businesses or individuals with less complex financial situations.

Q: Are there any deadlines for filing GC-400(PH)(2) (GC-405(PH)(2))?

A: The deadlines for filing GC-400(PH)(2) (GC-405(PH)(2)) may vary, so it's important to check with the California tax authority or refer to the instructions provided with the form.

Q: Are there any penalties for not filing GC-400(PH)(2) (GC-405(PH)(2))?

A: Failure to file GC-400(PH)(2) (GC-405(PH)(2)) or providing inaccurate information may result in penalties imposed by the California tax authority. It is important to fulfill your filing obligations accurately and on time.

Q: Do I need professional assistance to complete GC-400(PH)(2) (GC-405(PH)(2))?

A: While it is possible to complete the form yourself, seeking professional assistance, such as a tax advisor or accountant, is recommended for ensuring accurate reporting and compliance with California tax laws.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(PH)(2) (GC-405(PH)(2)) by clicking the link below or browse more documents and templates provided by the California Judicial Branch.