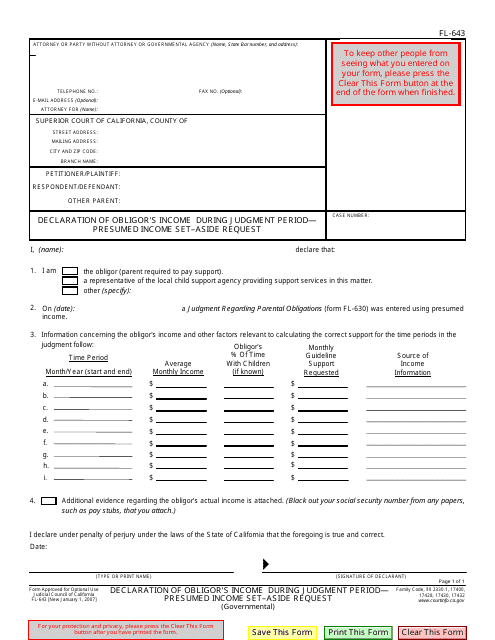

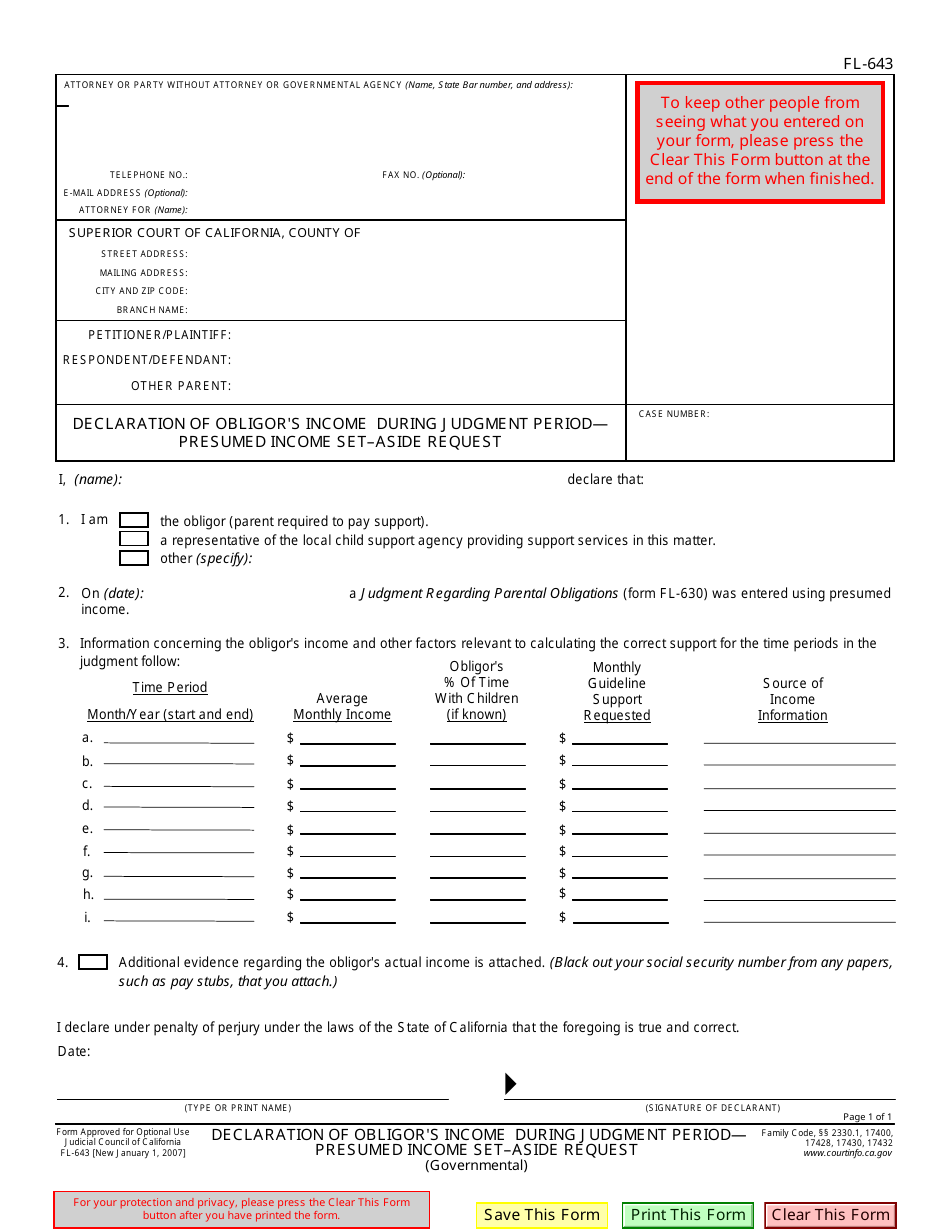

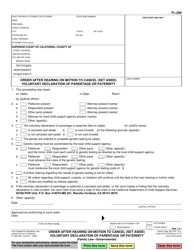

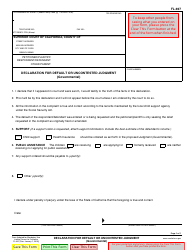

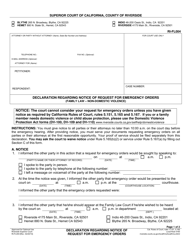

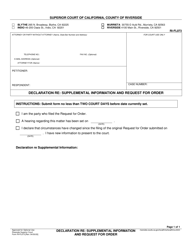

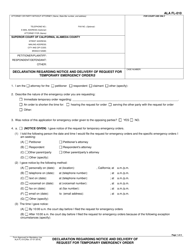

Form FL-643 Declaration of Obligor's Income During Judgment Period - Presumed Income Set-Aside Request - California

What Is Form FL-643?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FL-643?

A: Form FL-643 is a legal form used in California for the Declaration of Obligor's Income During Judgment Period - Presumed Income Set-Aside Request.

Q: Who should use Form FL-643?

A: Form FL-643 should be used by an obligor in California who is requesting a presumed income set-aside during a judgment period.

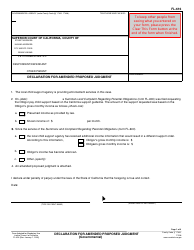

Q: What is a presumed income set-aside?

A: A presumed income set-aside is a court-ordered allocation of income to meet the support needs of the obligor during a judgment period.

Q: Why would someone request a presumed income set-aside?

A: Someone may request a presumed income set-aside if they are unable to pay the full amount of child or spousal support due to financial hardship.

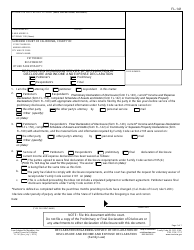

Q: What information is required on Form FL-643?

A: Form FL-643 requires the obligor to provide detailed information about their income, expenses, and financial circumstances.

Q: Are there any fees to file Form FL-643?

A: There may be filing fees associated with submitting Form FL-643, which vary depending on the county where the form is filed. It is recommended to check with the local court for the applicable fees.

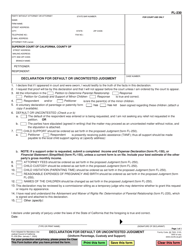

Q: What happens after I file Form FL-643?

A: After filing Form FL-643, the court will review the information provided and determine whether to grant the presumed income set-aside request based on the obligor's financial circumstances.

Q: Can the presumed income set-aside be modified?

A: Yes, the presumed income set-aside can be modified if there is a change in the obligor's financial circumstances. A request for modification can be made to the court.

Q: Do I need an attorney to file Form FL-643?

A: It is not required to have an attorney to file Form FL-643, but it may be helpful to seek legal advice, especially if there are complex financial issues or questions.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FL-643 by clicking the link below or browse more documents and templates provided by the California Superior Court.