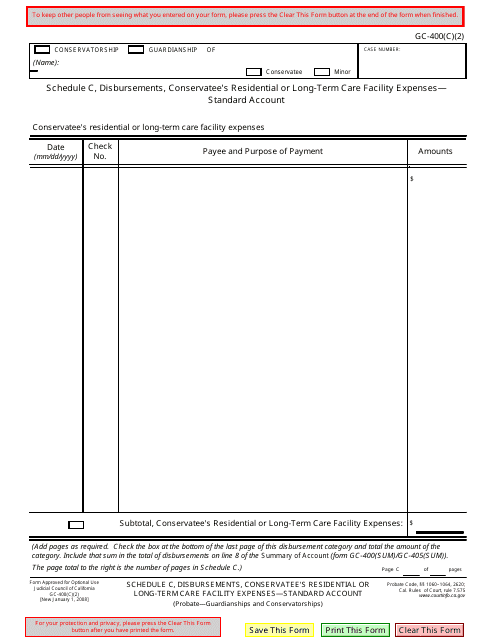

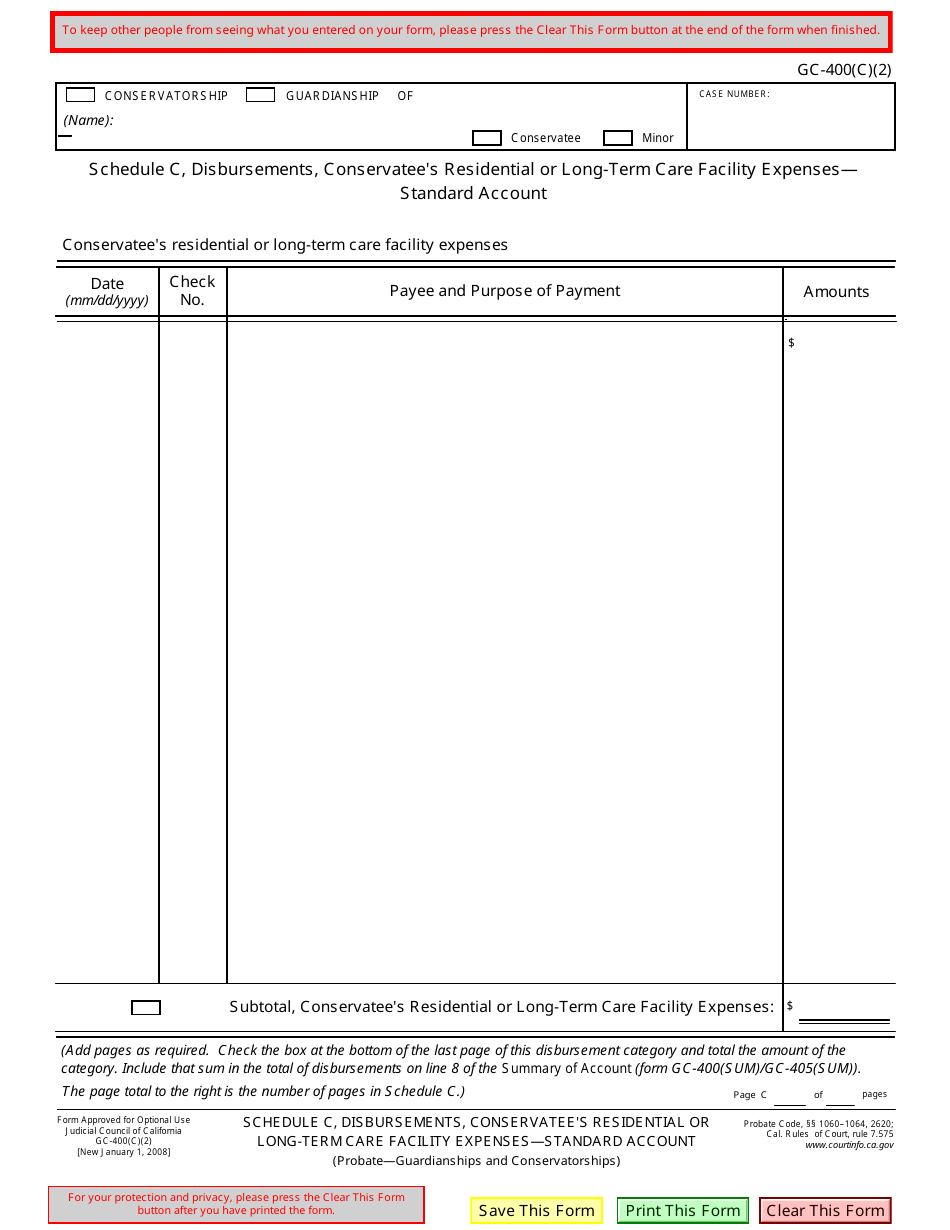

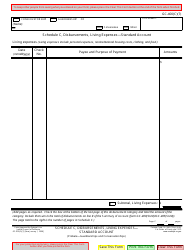

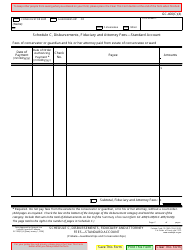

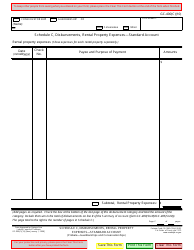

Form GC-400(C)(2) Schedule C Disbursements, Conservatee's Residential or Long-Term Care Facility Living Expenses - Standard Account - California

What Is Form GC-400(C)(2) Schedule C?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GC-400(C)(2)?

A: Form GC-400(C)(2) is a schedule used in California for reporting disbursements related to the residential or long-term care facilityliving expenses of a conservatee.

Q: What is a conservatee?

A: A conservatee is an individual who has been determined by the court to be unable to manage their own personal and financial affairs.

Q: What are disbursements?

A: Disbursements are payments made for expenses related to the conservatee's residential or long-term care facility living.

Q: What is a residential or long-term care facility?

A: A residential or long-term care facility is a place where individuals reside and receive care, such as a nursing home or assisted living facility.

Q: What is a Standard Account?

A: A Standard Account refers to a type of conservatorship account in California where the conservatee's income and expenses are tracked.

Q: What is reported on Schedule C?

A: Schedule C reports the disbursements made for the conservatee's residential or long-term care facility living expenses in a Standard Account.

Q: Is Form GC-400(C)(2) specific to California?

A: Yes, Form GC-400(C)(2) is specific to California and is used in the state's probate court system.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(C)(2) Schedule C by clicking the link below or browse more documents and templates provided by the California Judicial Branch.