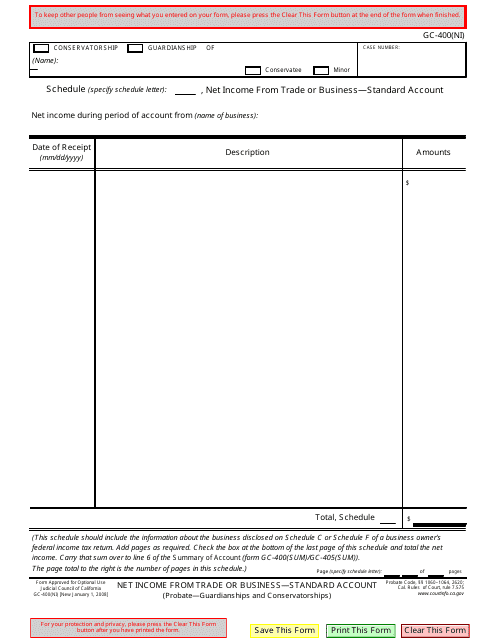

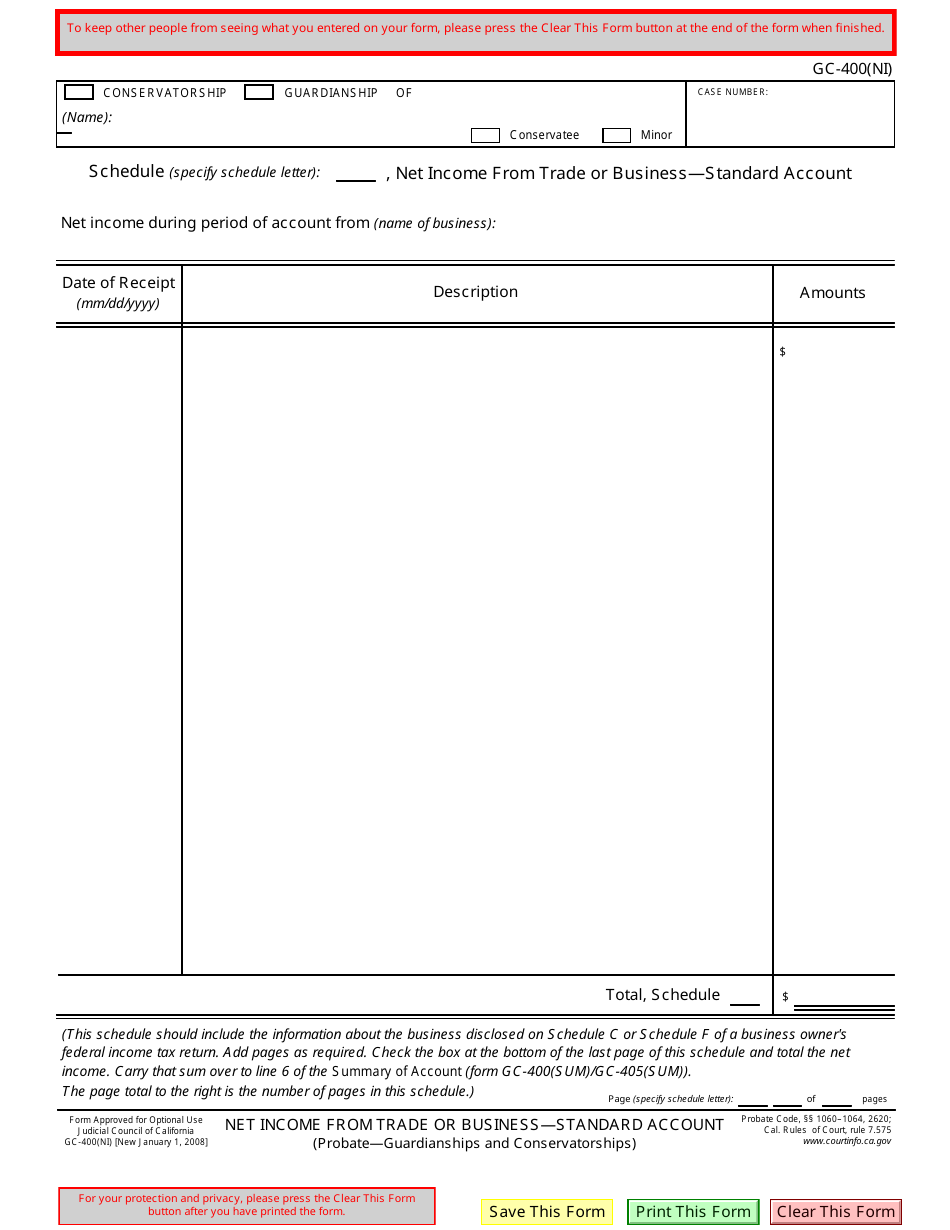

Form GC-400(NI) Net Income From a Trade or Business - Standard Account - California

What Is Form GC-400(NI)?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(NI)?

A: GC-400(NI) is a form used in California to report net income from a trade or business.

Q: What is the purpose of GC-400(NI)?

A: The purpose of GC-400(NI) is to calculate and report the net income earned from a trade or business in California.

Q: Who needs to use GC-400(NI)?

A: Individuals or businesses engaged in a trade or business in California need to use GC-400(NI) to report their net income.

Q: What information is required on GC-400(NI)?

A: GC-400(NI) requires information on the taxpayer's income, expenses, deductions, and other related financial details of the trade or business.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(NI) by clicking the link below or browse more documents and templates provided by the California Judicial Branch.