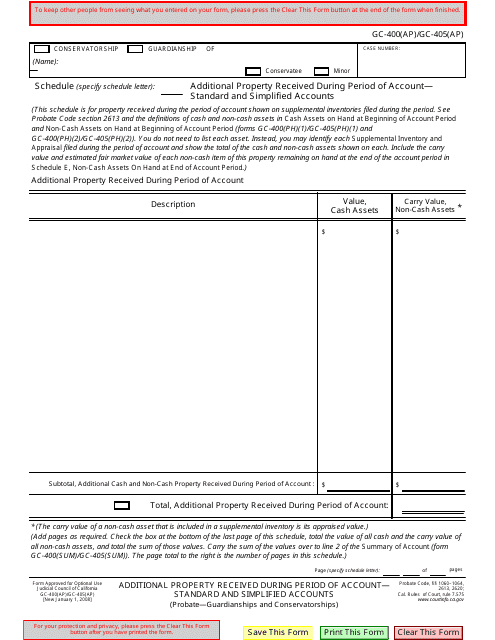

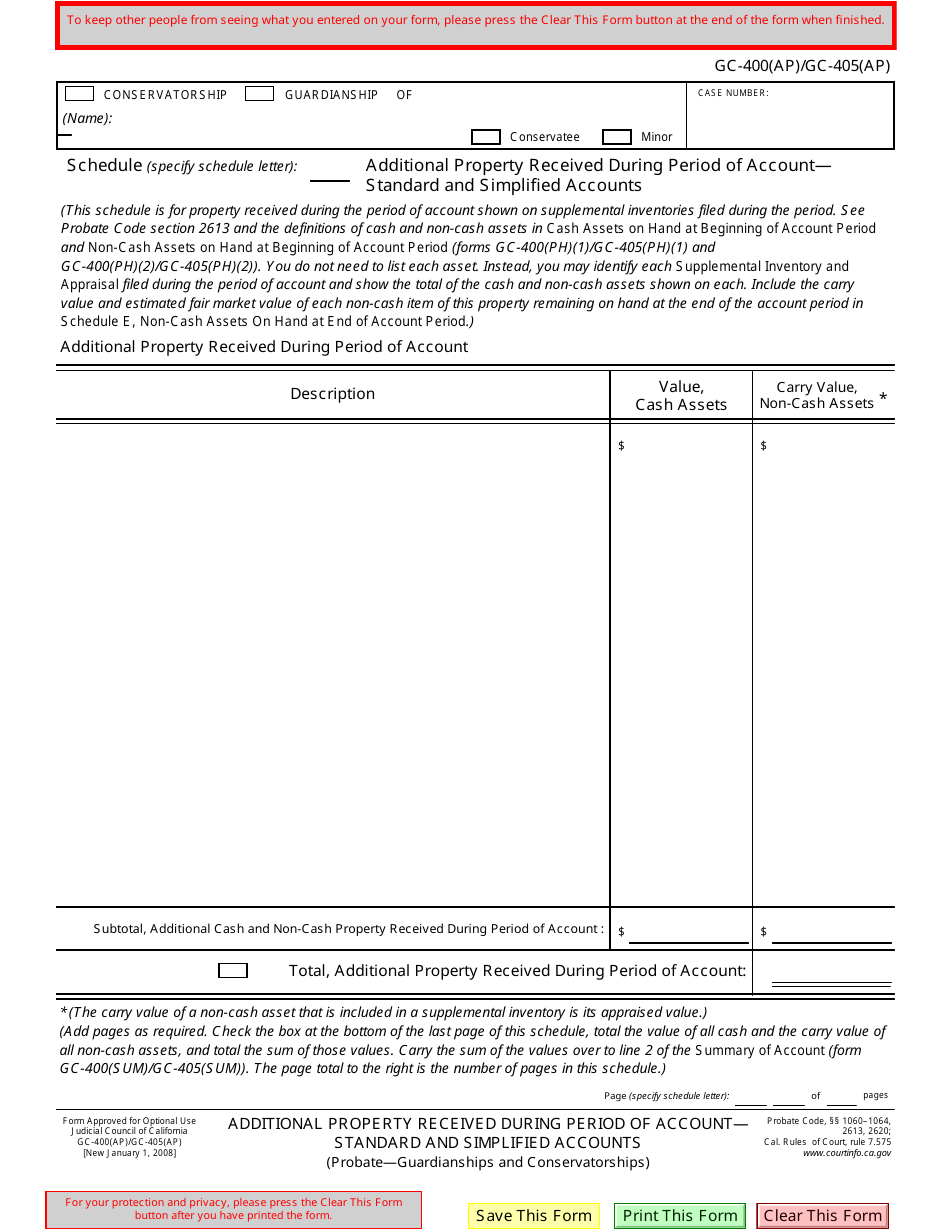

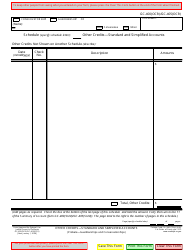

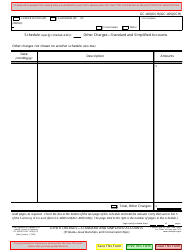

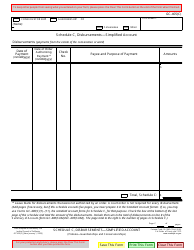

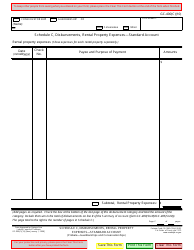

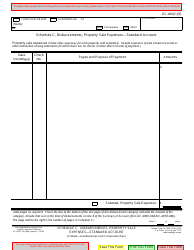

Form GC-400(AP) (GC-405(AP)) Additional Property Received During Period of Account - Standard and Simplified Accounts - California

What Is Form GC-400(AP) (GC-405(AP))?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(AP) (GC-405(AP))?

A: GC-400(AP) (GC-405(AP)) is a form used in California to report additional property received during a period of account.

Q: Who should file GC-400(AP) (GC-405(AP))?

A: This form should be filed by individuals and businesses in California who have received additional property during a period of account.

Q: What is the purpose of GC-400(AP) (GC-405(AP))?

A: The purpose of this form is to report and pay tax on additional property received during a period of account in California.

Q: What are the types of accounts for which GC-400(AP) (GC-405(AP)) is used?

A: GC-400(AP) (GC-405(AP)) is used for both standard and simplified accounts in California.

Q: What information is required on GC-400(AP) (GC-405(AP))?

A: The form requires information about the recipient of the additional property, the type of property received, and the value of the property.

Q: Is GC-400(AP) (GC-405(AP)) mandatory to file?

A: Yes, if you have received additional property during a period of account in California, you are required to file GC-400(AP) (GC-405(AP)).

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(AP) (GC-405(AP)) by clicking the link below or browse more documents and templates provided by the California Judicial Branch.