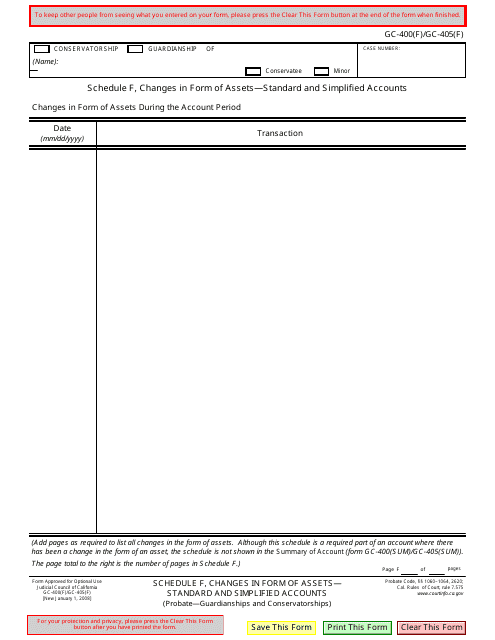

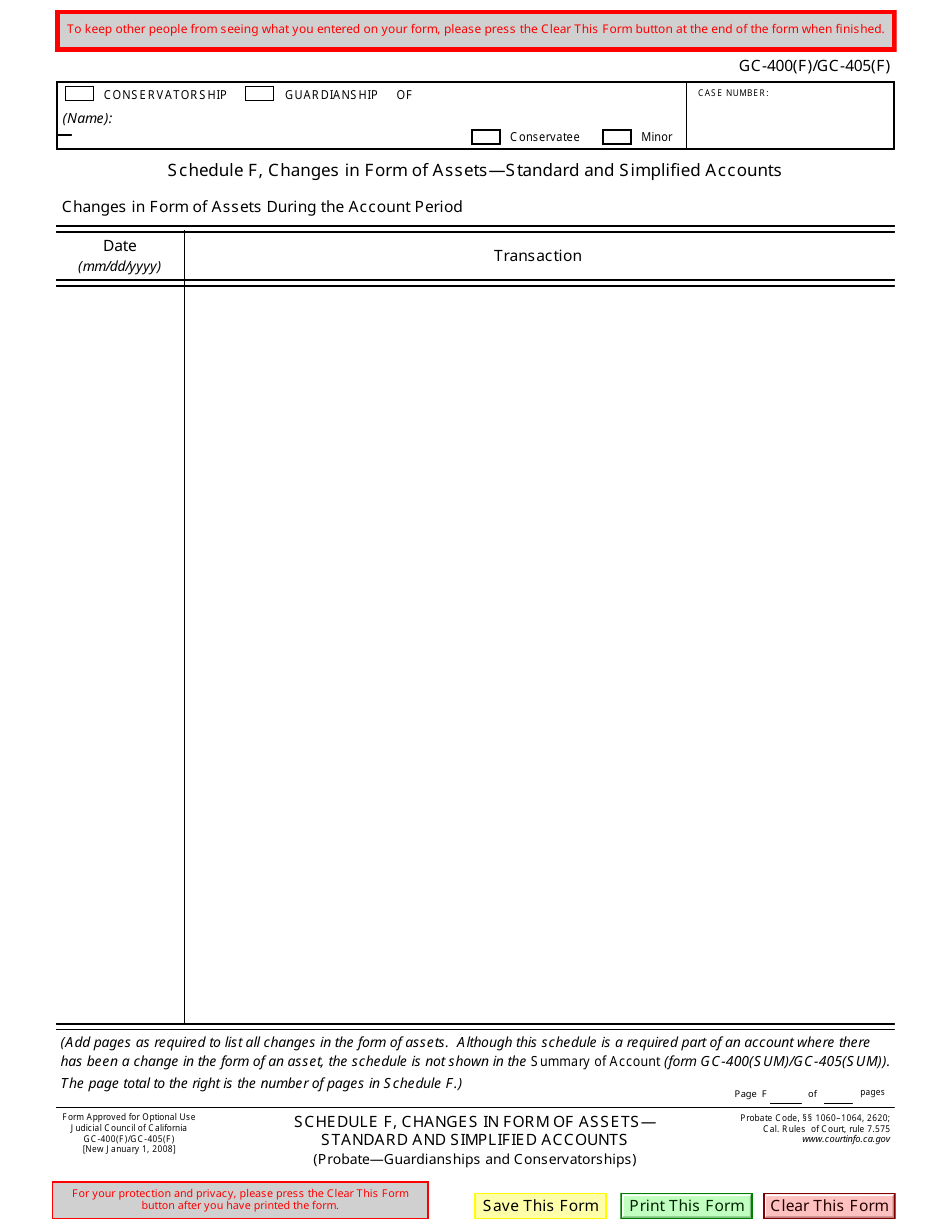

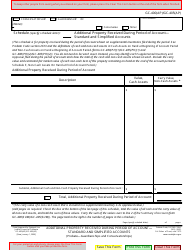

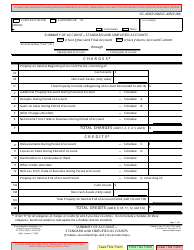

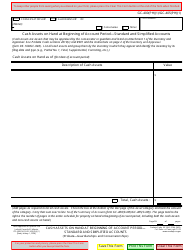

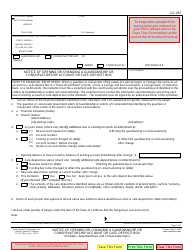

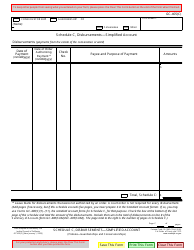

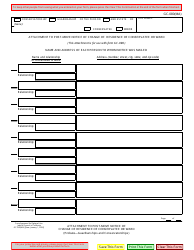

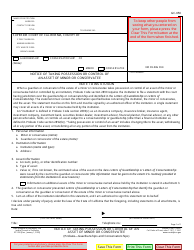

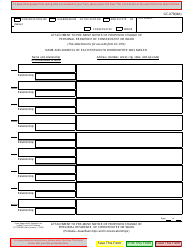

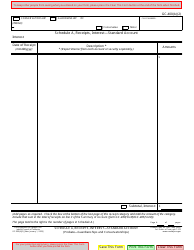

Form GC-400(F) (GC-405(F)) Schedule F Changes in Form of Assets - Standard and Simplified Accounts - California

What Is Form GC-400(F) (GC-405(F)) Schedule F?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GC-400(F) (GC-405(F)) Schedule F?

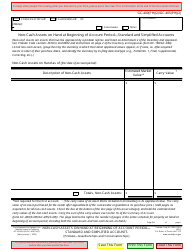

A: Form GC-400(F) (GC-405(F)) Schedule F is a document used in California to report changes in the form of assets for standard and simplified accounts.

Q: What is the purpose of Form GC-400(F) (GC-405(F)) Schedule F?

A: The purpose of Form GC-400(F) (GC-405(F)) Schedule F is to provide information about changes in the form of assets for standard and simplified accounts in California.

Q: Who needs to fill out Form GC-400(F) (GC-405(F)) Schedule F?

A: Form GC-400(F) (GC-405(F)) Schedule F needs to be filled out by individuals or entities who have standard or simplified accounts and have made changes in the form of assets in California.

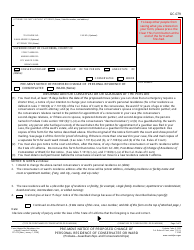

Q: When should Form GC-400(F) (GC-405(F)) Schedule F be filed?

A: Form GC-400(F) (GC-405(F)) Schedule F should be filed when there are changes in the form of assets for standard and simplified accounts in California.

Q: Is there a fee to file Form GC-400(F) (GC-405(F)) Schedule F?

A: Yes, there may be a filing fee associated with Form GC-400(F) (GC-405(F)) Schedule F. The fee amount can vary, so it's best to check with the court or consult the official fee schedule.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(F) (GC-405(F)) Schedule F by clicking the link below or browse more documents and templates provided by the California Judicial Branch.