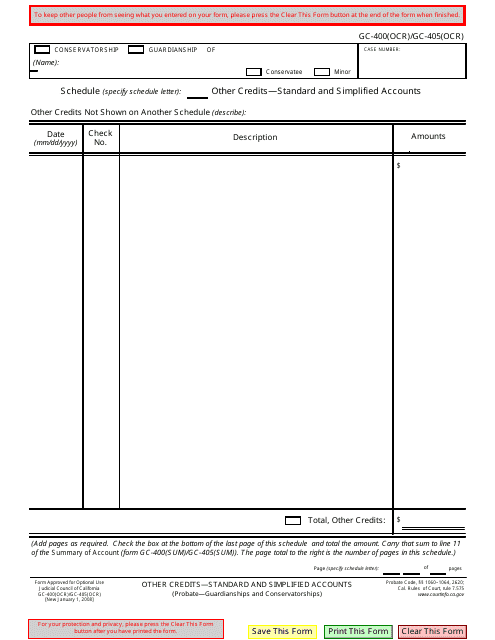

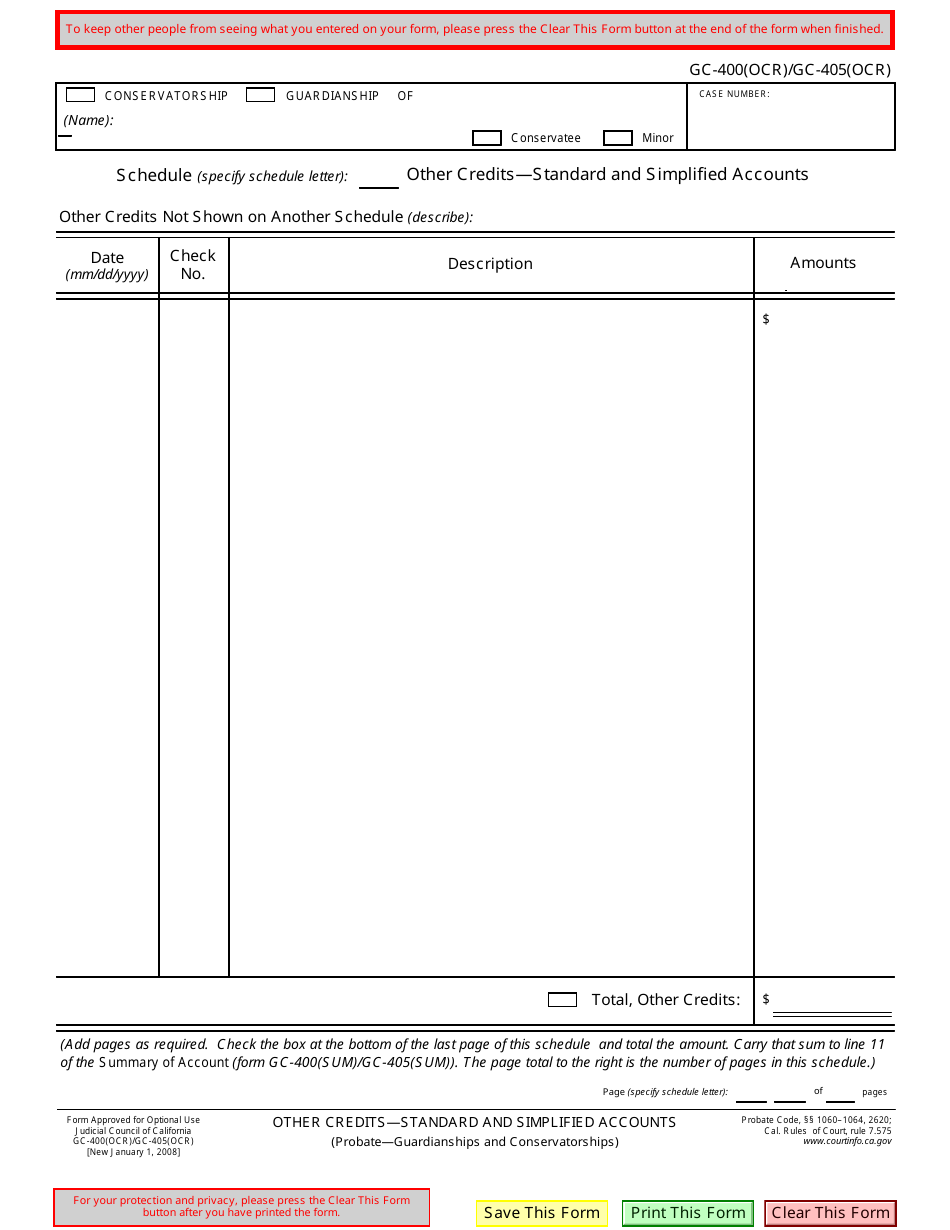

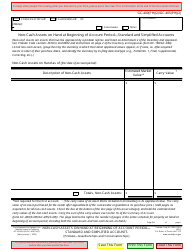

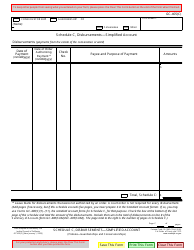

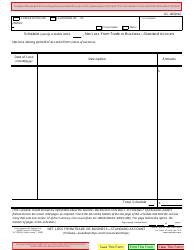

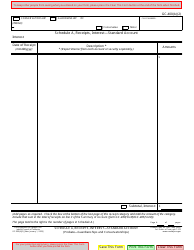

Form GC-400(OCR) (GC-405(OCR)) Other Credits - Standard and Simplified Accounts - California

What Is Form GC-400(OCR) (GC-405(OCR))?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(OCR) form?

A: GC-400(OCR) is a form used in California for reporting Other Credits - Standard and Simplified Accounts.

Q: What is GC-405(OCR) form?

A: GC-405(OCR) is a form used in California for reporting Other Credits - Standard and Simplified Accounts.

Q: What are Other Credits - Standard and Simplified Accounts?

A: Other Credits - Standard and Simplified Accounts are a type of credits that can be claimed on a tax return in California.

Q: Who needs to file GC-400(OCR) form?

A: Anyone who wants to claim Other Credits - Standard and Simplified Accounts on their California tax return needs to file the GC-400(OCR) form.

Q: What information is required on the GC-400(OCR) form?

A: The GC-400(OCR) form requires you to provide information such as your name, social security number, and details about the credits you are claiming.

Q: Are there any specific instructions for filling out the GC-400(OCR) form?

A: Yes, there are specific instructions provided by the California Franchise Tax Board on how tofill out the GC-400(OCR) form. It is important to follow these instructions carefully.

Q: When is the deadline to file the GC-400(OCR) form?

A: The deadline to file the GC-400(OCR) form is the same as the deadline for filing your California tax return, which is usually April 15th of each year.

Q: Are there any fees associated with filing the GC-400(OCR) form?

A: No, there are no fees associated with filing the GC-400(OCR) form.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(OCR) (GC-405(OCR)) by clicking the link below or browse more documents and templates provided by the California Judicial Branch.