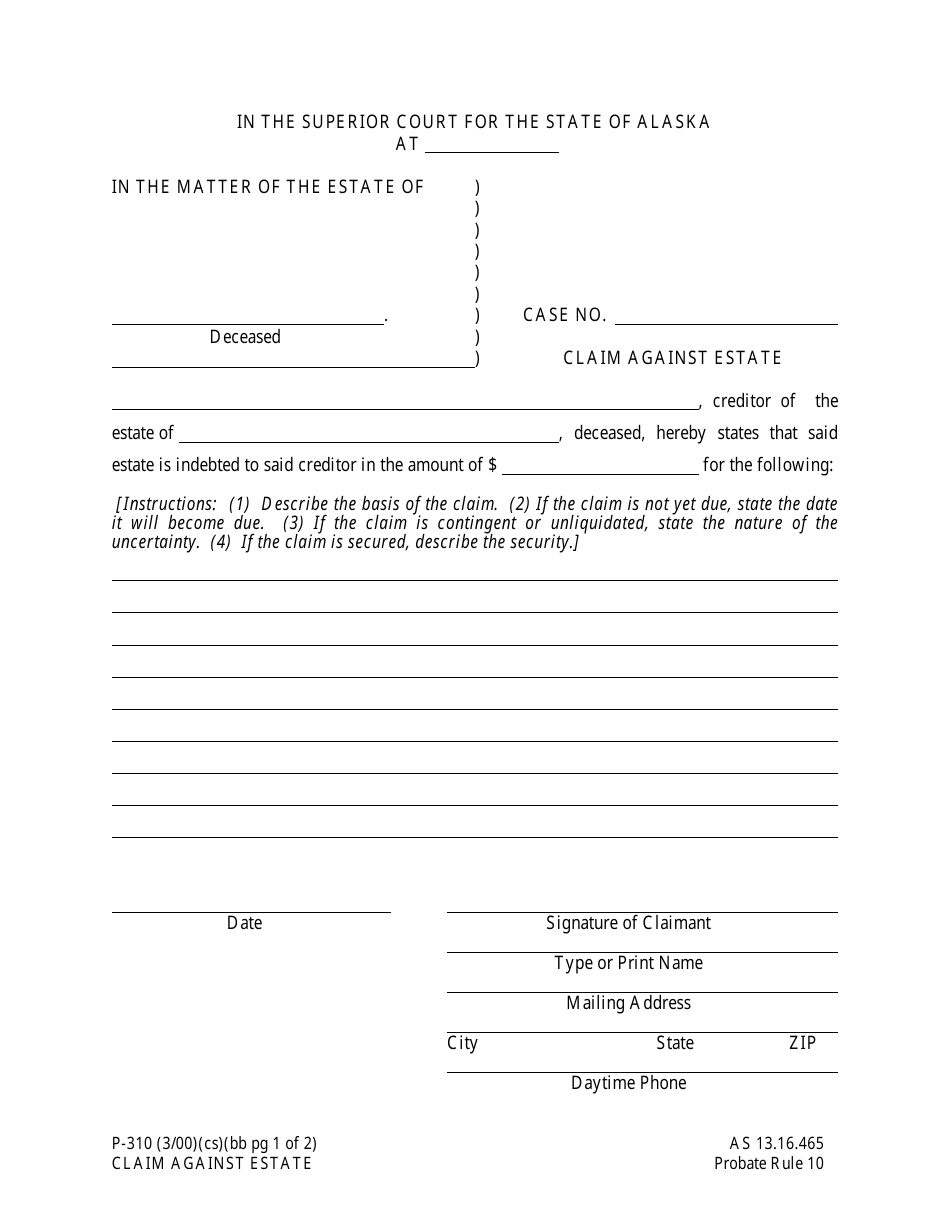

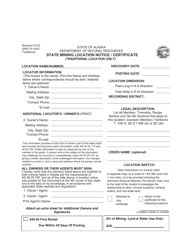

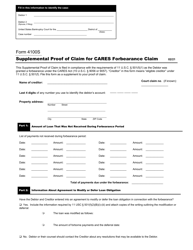

Form P-310 Claim Against Estate - Alaska

What Is Form P-310?

This is a legal form that was released by the Alaska Superior Court - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-310?

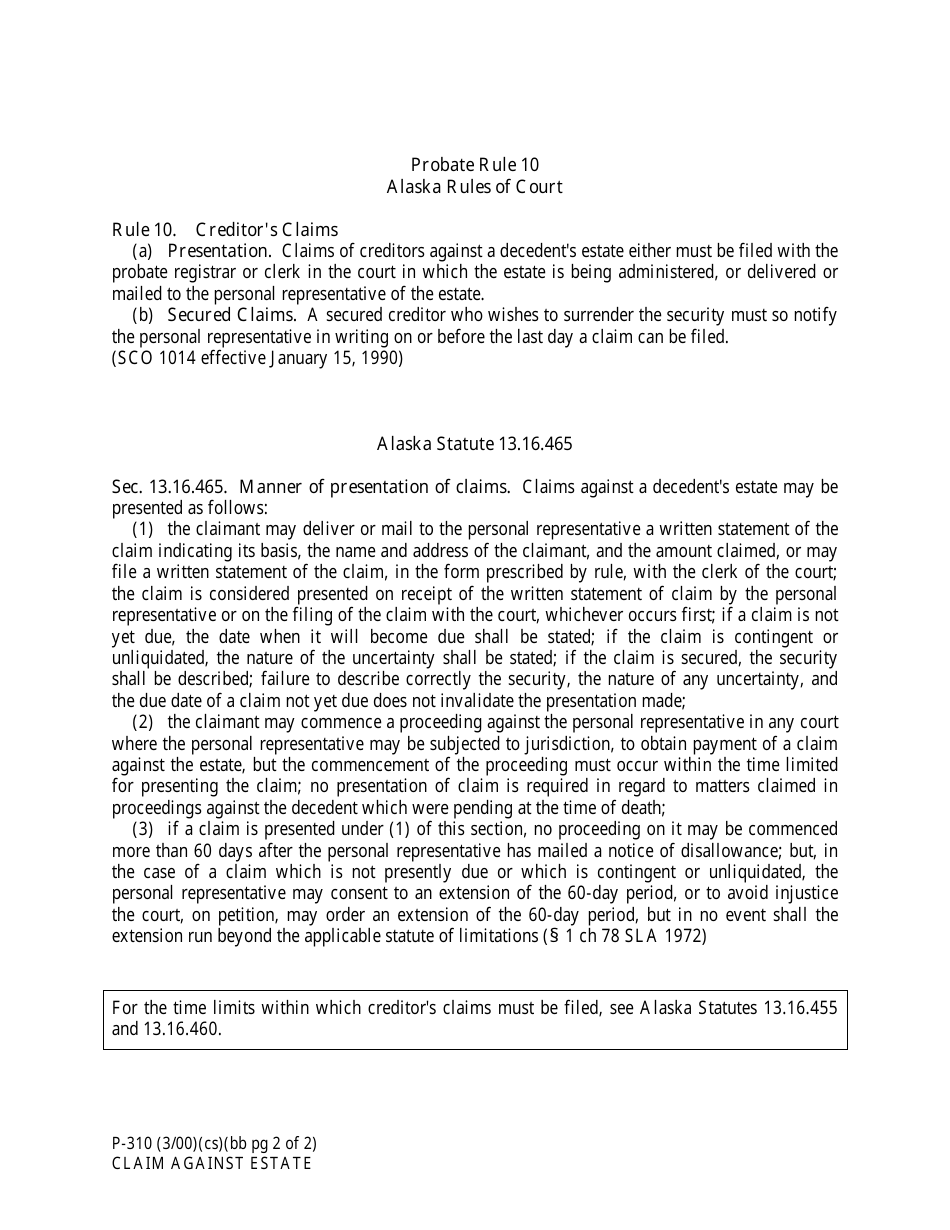

A: Form P-310 is a claim form that allows individuals or creditors to seek payment from an estate in Alaska.

Q: Who can use Form P-310?

A: Any individual or creditor who believes they are owed money by an estate in Alaska can use Form P-310.

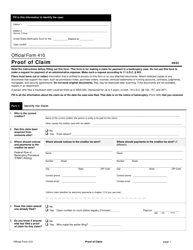

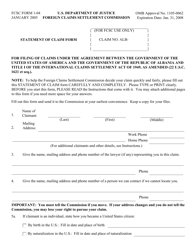

Q: How do I file Form P-310?

A: To file Form P-310, you need to complete the form with the necessary information and submit it to the appropriate Alaska court.

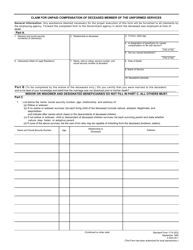

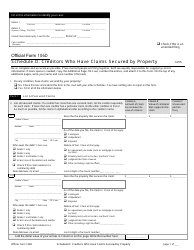

Q: What information is required on Form P-310?

A: Form P-310 requires information such as the claimant's name, address, and contact information, details about the estate, and the amount of the claim.

Q: Is there a deadline for filing Form P-310?

A: Yes, there is a deadline for filing Form P-310. The deadline is generally within four months after the personal representative is appointed.

Q: What happens after I file Form P-310?

A: After you file Form P-310, the personal representative of the estate will review your claim and determine whether to accept or reject it.

Q: What should I do if my claim is rejected?

A: If your claim is rejected, you may need to seek legal advice or explore other options for recovering the money owed to you.

Q: Can I appeal the rejection of my claim?

A: Yes, you may have the option to appeal the rejection of your claim. It is recommended to consult with an attorney to understand the appeals process.

Form Details:

- Released on March 1, 2000;

- The latest edition provided by the Alaska Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form P-310 by clicking the link below or browse more documents and templates provided by the Alaska Superior Court.