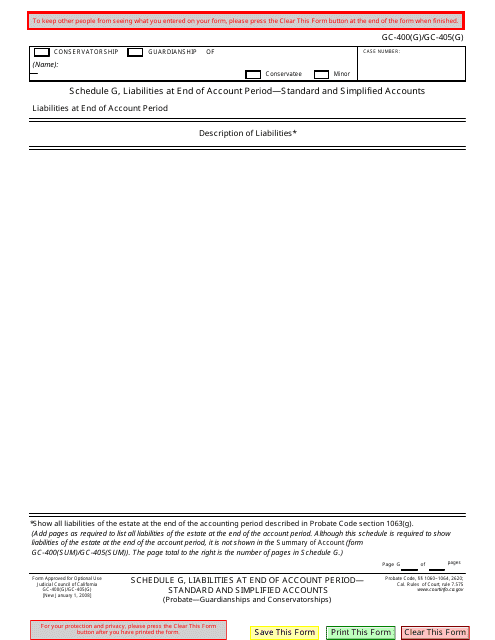

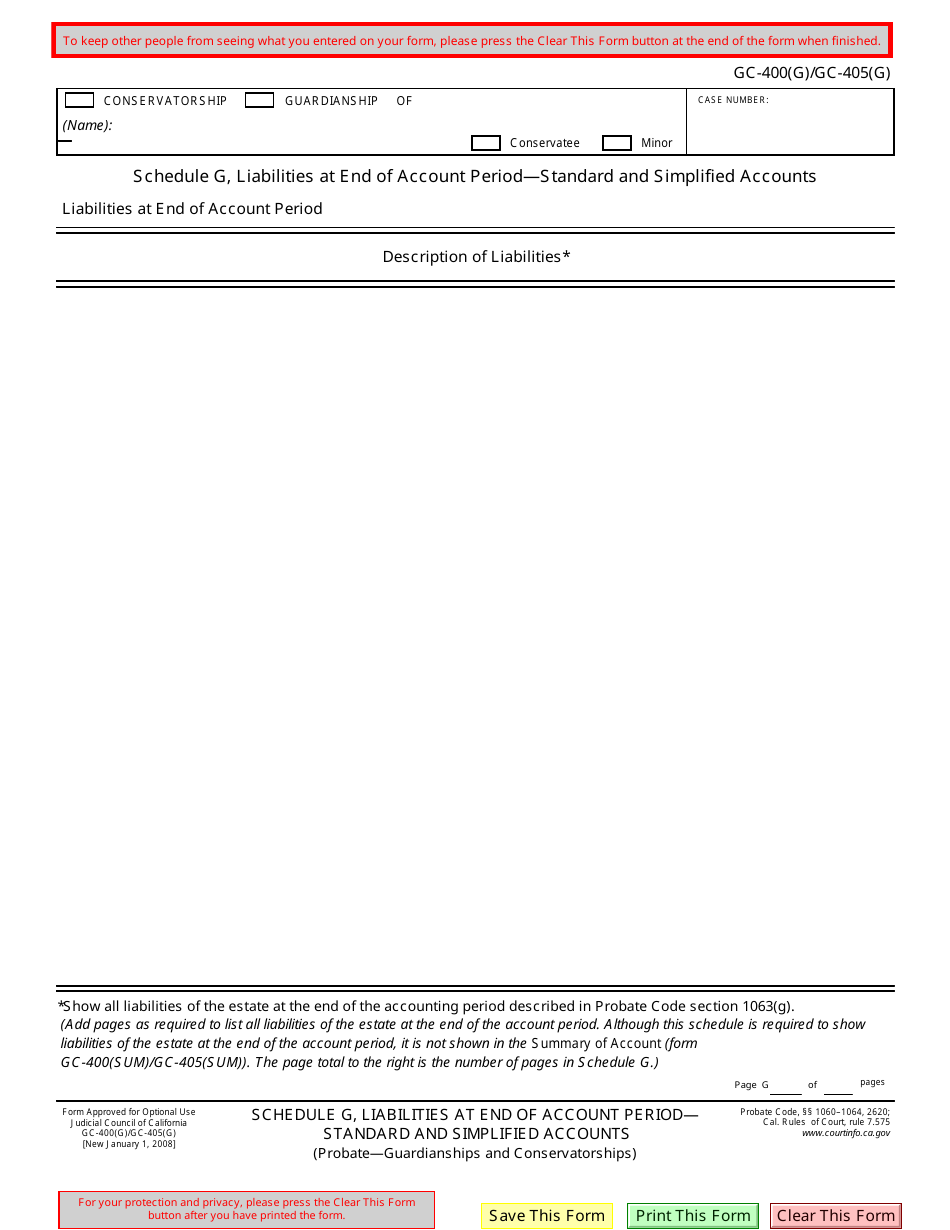

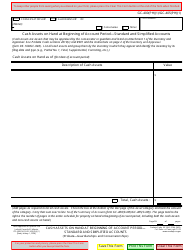

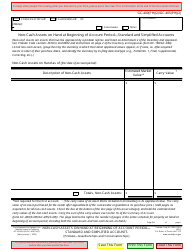

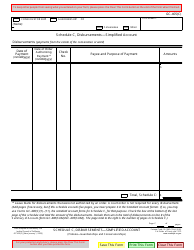

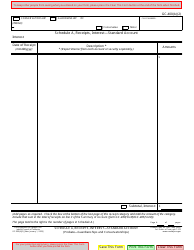

Form GC-400(G) (GC-405(G)) Schedule G Liabilities at End of Account Period - Standard and Simplified Accounts - California

What Is Form GC-400(G) (GC-405(G)) Schedule G?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GC-400(G)?

A: Form GC-400(G) is a form used in California to report the liabilities at the end of an accounting period.

Q: What is Schedule G on Form GC-400(G)?

A: Schedule G is a section on Form GC-400(G) where you report your liabilities at the end of the accounting period.

Q: What are liabilities?

A: Liabilities are financial obligations or debts that an individual or entity owes.

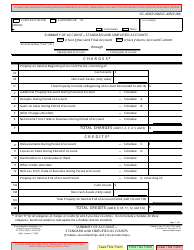

Q: What are Standard Accounts and Simplified Accounts?

A: Standard Accounts and Simplified Accounts are two methods of reporting financial information on Form GC-400(G) in California.

Q: Who needs to file Form GC-400(G)?

A: Individuals or entities in California who have liabilities at the end of an accounting period need to file Form GC-400(G).

Q: Is there a deadline for filing Form GC-400(G)?

A: Yes, there is a deadline for filing Form GC-400(G). The specific deadline can vary, so it's important to check with the California Franchise Tax Board for the current year's deadline.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(G) (GC-405(G)) Schedule G by clicking the link below or browse more documents and templates provided by the California Judicial Branch.