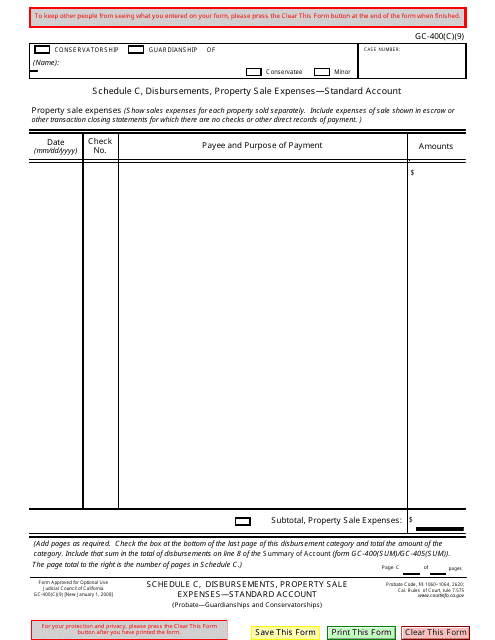

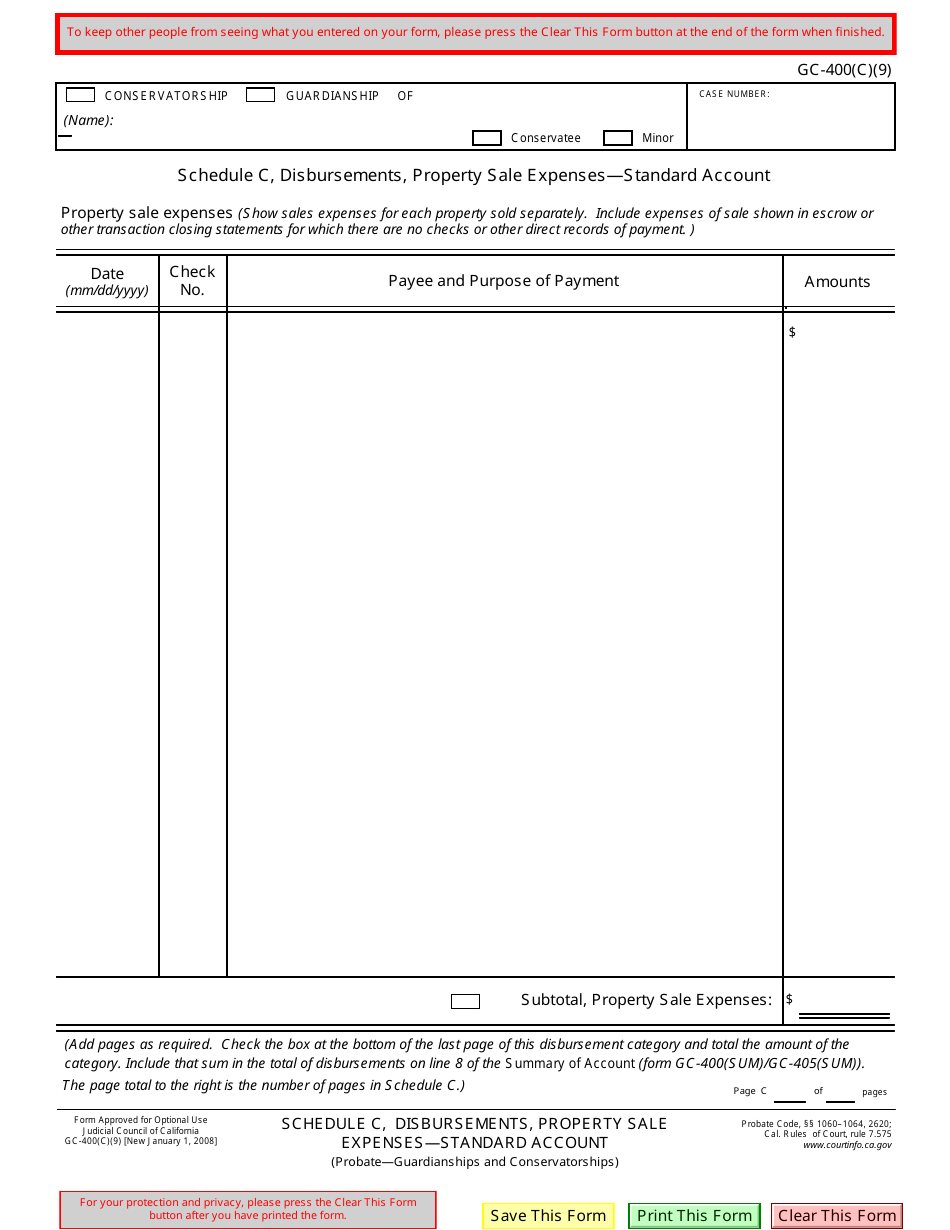

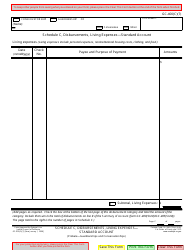

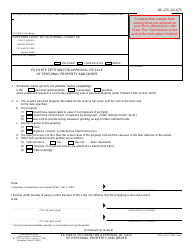

Form GC-400(C)(9) Schedule C Disbursements, Property Sale Expenses - Standard Account - California

What Is Form GC-400(C)(9) Schedule C?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(C)(9) Schedule C?

A: GC-400(C)(9) Schedule C is a form used in California for reporting disbursements and property sale expenses.

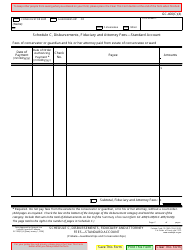

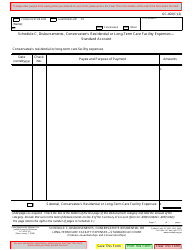

Q: What are disbursements?

A: Disbursements refer to expenses or payments made in relation to a property sale.

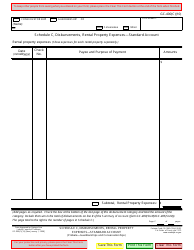

Q: What are property sale expenses?

A: Property sale expenses are the costs incurred during the process of selling a property.

Q: What is a standard account?

A: A standard account is a regular type of account used for recording financial transactions.

Q: Which state is GC-400(C)(9) Schedule C used in?

A: GC-400(C)(9) Schedule C is used in the state of California.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(C)(9) Schedule C by clicking the link below or browse more documents and templates provided by the California Judicial Branch.