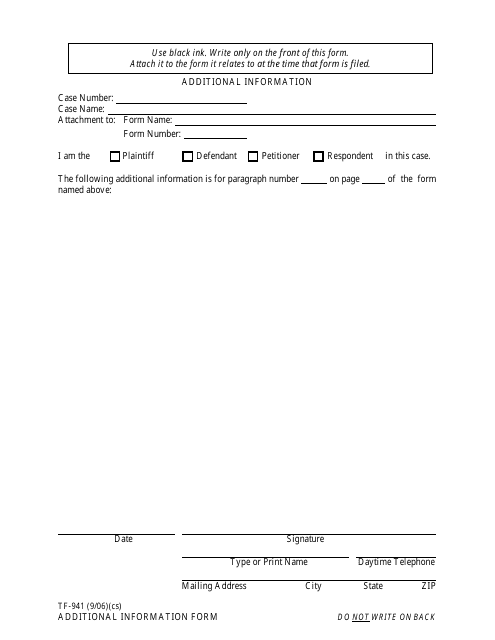

Form TF-941 Additional Information - Alaska

What Is Form TF-941?

This is a legal form that was released by the Alaska Court System - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TF-941?

A: Form TF-941 is a tax form used by businesses in Alaska to report their monthly payments for unemployment insurance taxes.

Q: Who needs to file Form TF-941?

A: Employers in Alaska who are liable for unemployment insurance taxes must file Form TF-941.

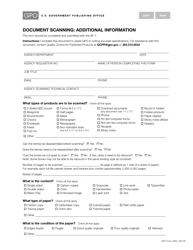

Q: What information should be included on Form TF-941?

A: Form TF-941 requires employers to provide details of their monthly payroll and calculate the unemployment insurance tax due.

Q: When is Form TF-941 due?

A: Form TF-941 is due on the last day of the month following the end of the calendar quarter.

Form Details:

- Released on September 1, 2006;

- The latest edition provided by the Alaska Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TF-941 by clicking the link below or browse more documents and templates provided by the Alaska Court System.