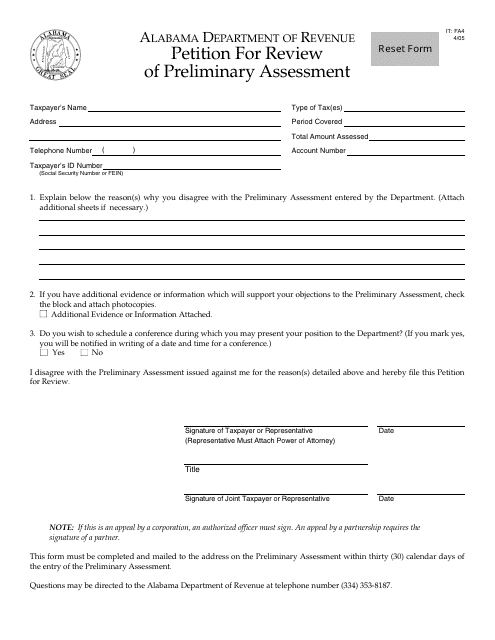

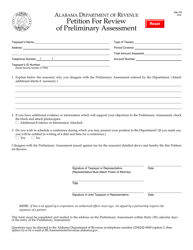

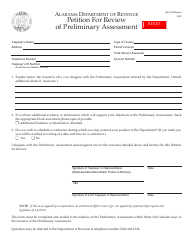

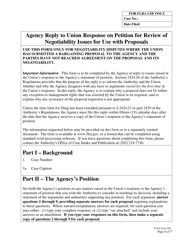

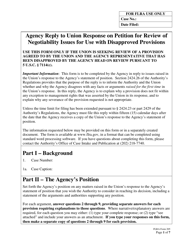

Form IT: FA4 Petition for Review of Preliminary Assessment - Alabama

What Is Form IT: FA4?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT: FA4?

A: Form IT: FA4 is a Petition for Review of Preliminary Assessment specific to Alabama.

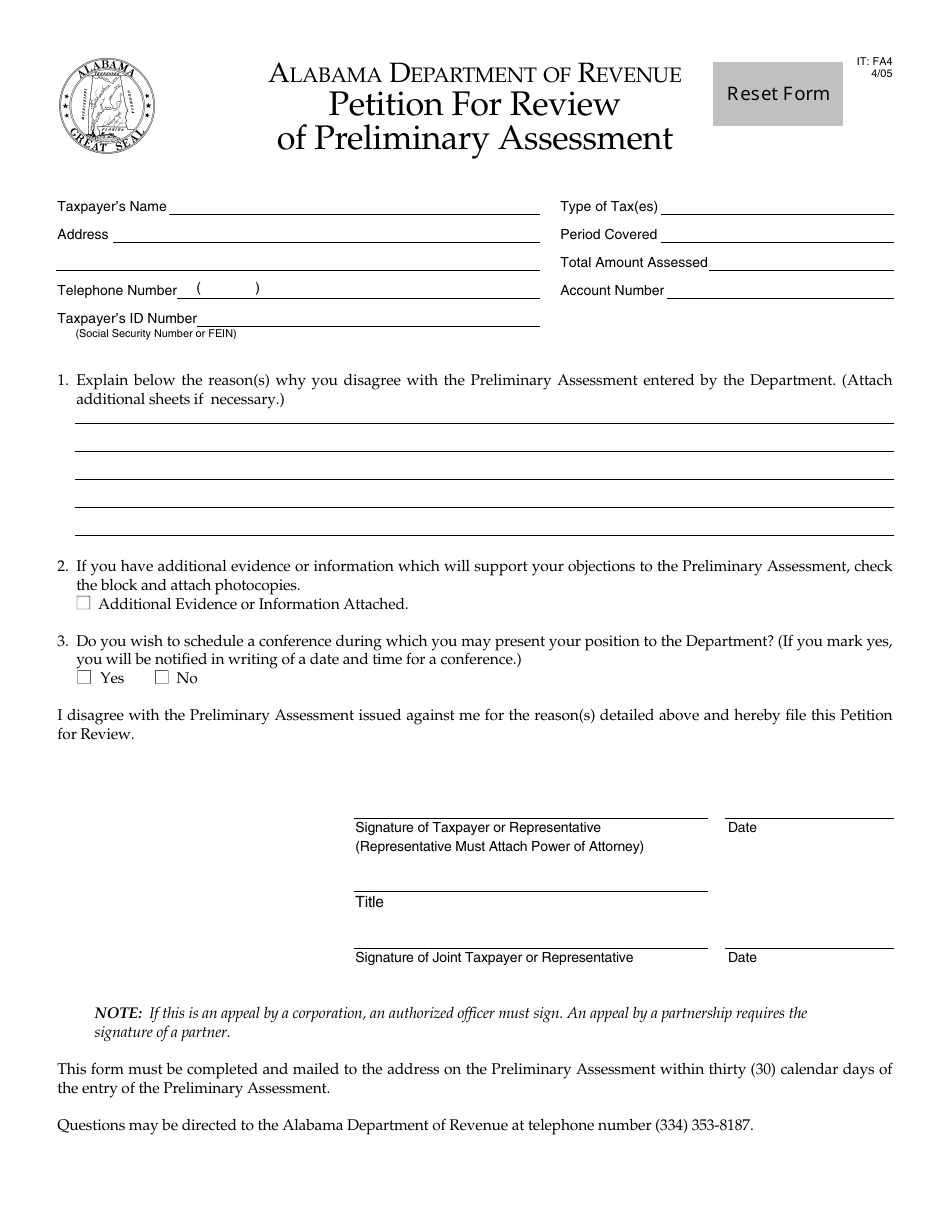

Q: Who should use Form IT: FA4?

A: Form IT: FA4 should be used by taxpayers in Alabama who want to challenge a preliminary assessment made by the Alabama Department of Revenue.

Q: What is a preliminary assessment?

A: A preliminary assessment is an initial determination by the Alabama Department of Revenue regarding the amount of taxes owed by a taxpayer.

Q: What is the purpose of filing a Petition for Review of Preliminary Assessment?

A: The purpose of filing a Petition for Review of Preliminary Assessment is to request a review and potential adjustment of the preliminary assessment made by the Alabama Department of Revenue.

Q: Are there any deadlines for filing Form IT: FA4?

A: Yes, there are specific deadlines for filing Form IT: FA4. It is important to adhere to these deadlines to ensure your petition is considered.

Q: What are the possible outcomes of filing a Petition for Review of Preliminary Assessment?

A: The possible outcomes of filing a Petition for Review of Preliminary Assessment include a reduction in the amount of taxes owed, an affirmation of the preliminary assessment, or further negotiations and discussions.

Q: Is legal representation required when filing Form IT: FA4?

A: Legal representation is not required when filing Form IT: FA4, but it may be beneficial to consult with a tax professional or attorney for guidance and assistance throughout the process.

Form Details:

- Released on April 1, 2005;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT: FA4 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.