This version of the form is not currently in use and is provided for reference only. Download this version of

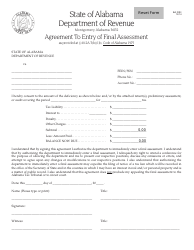

Form BA: RS1

for the current year.

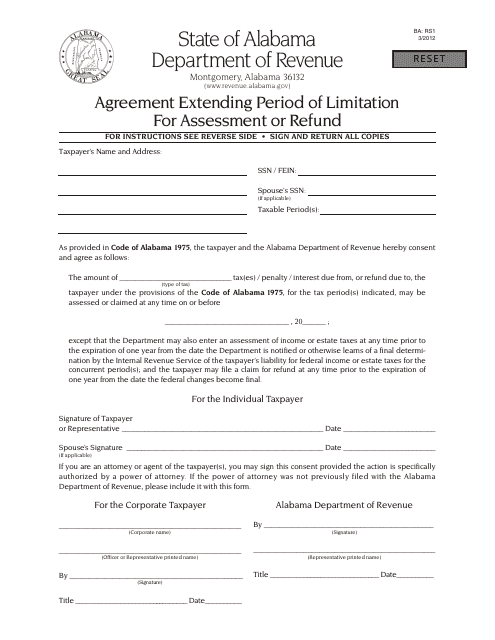

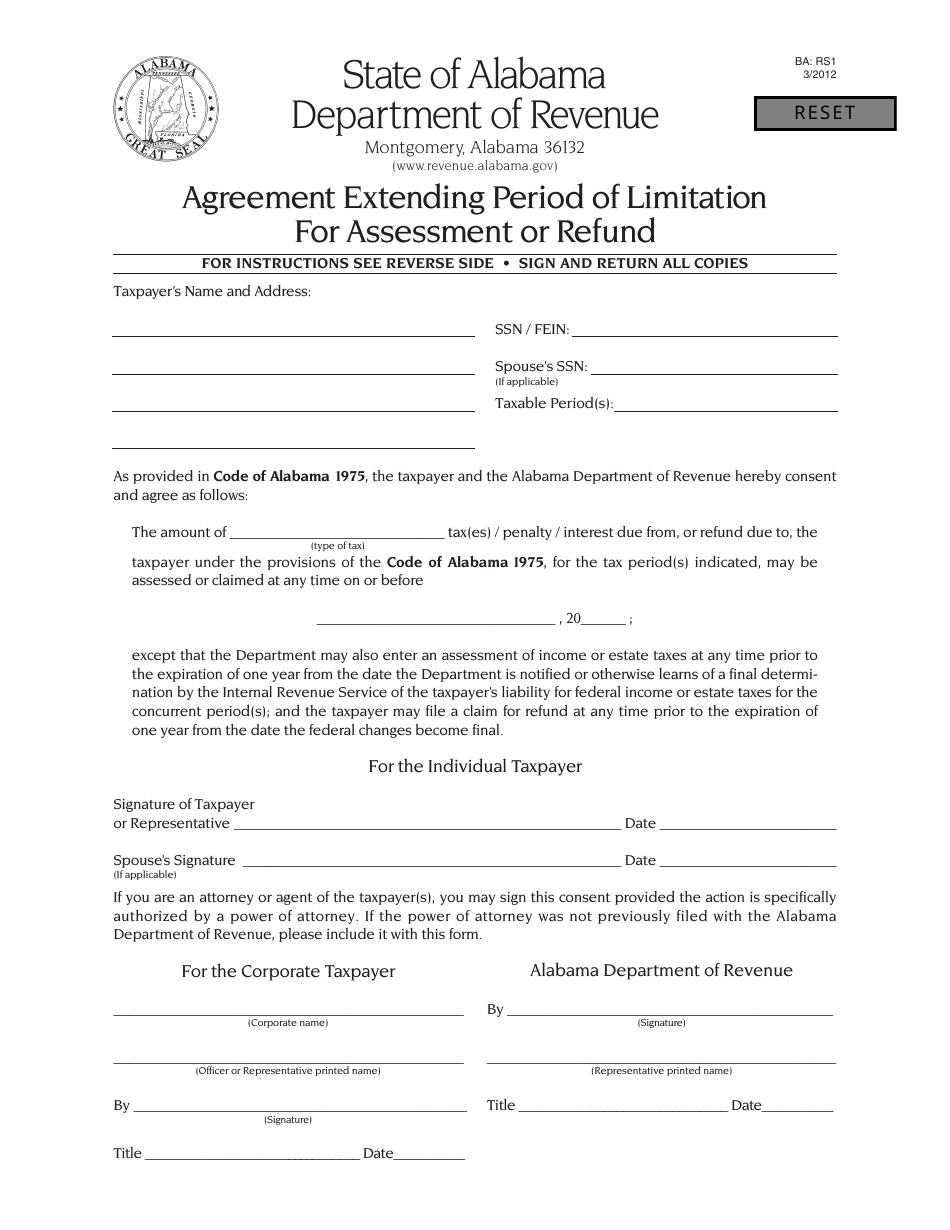

Form BA: RS1 Agreement Extending Period of Limitation for Assessment or Refund - Alabama

What Is Form BA: RS1?

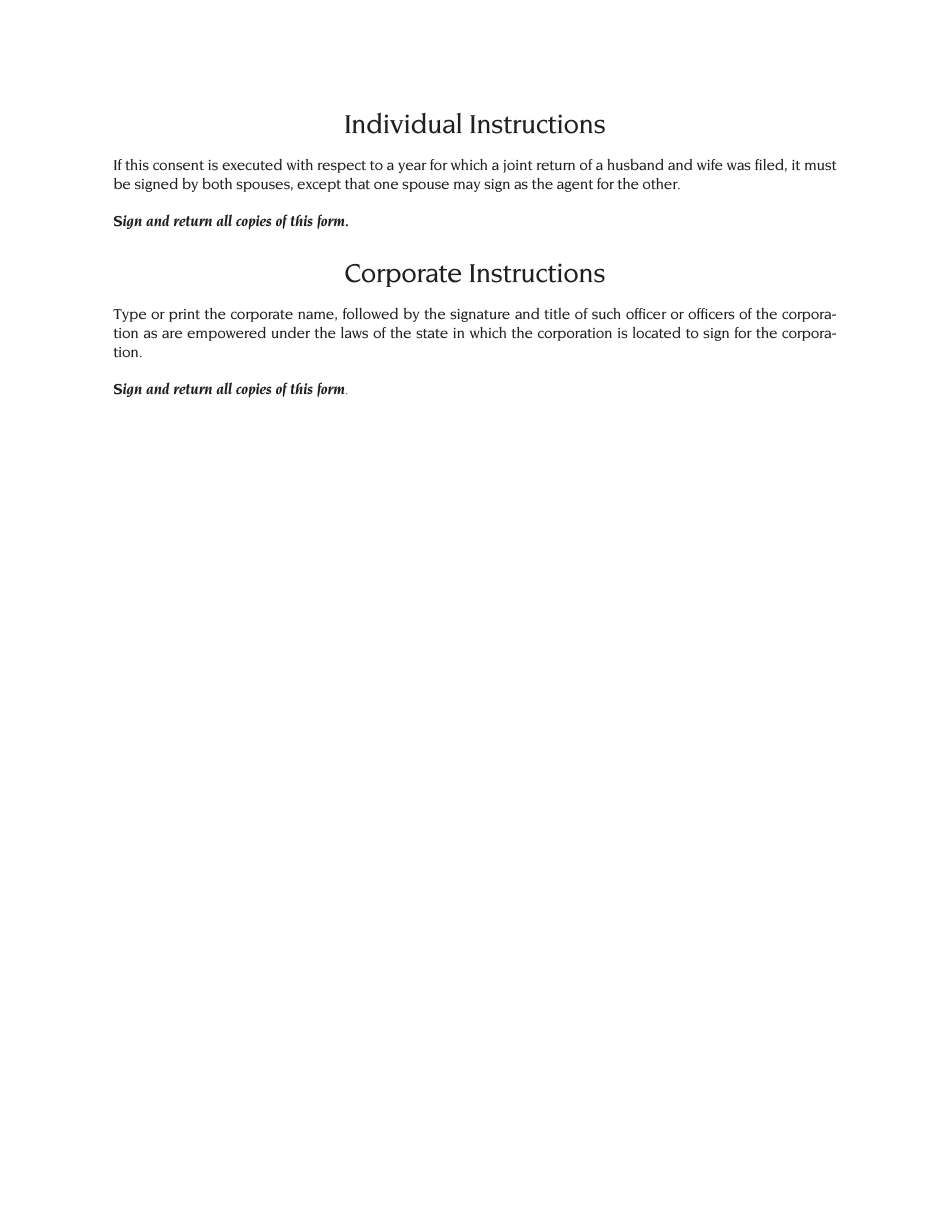

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

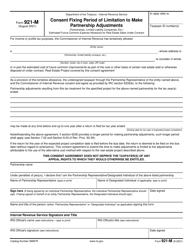

Q: What is Form B

A: RS1 Agreement Extending Period of Limitation for Assessment or Refund?A: Form BA: RS1 Agreement Extending Period of Limitation for Assessment or Refund is a form used in Alabama to extend the time limit for tax assessment or refund.

Q: Who needs to use Form B

A: RS1 Agreement Extending Period of Limitation for Assessment or Refund?A: Taxpayers in Alabama who want to extend the period of limitation for tax assessment or refund need to use Form BA: RS1.

Q: Are there any fees involved in filing Form B

A: RS1 Agreement Extending Period of Limitation for Assessment or Refund?A: No, there are no fees involved in filing Form BA: RS1 Agreement Extending Period of Limitation for Assessment or Refund.

Q: What is the purpose of extending the period of limitation for tax assessment or refund?

A: Extending the period of limitation allows taxpayers more time to file for a tax assessment or refund in Alabama.

Form Details:

- Released on March 1, 2012;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BA: RS1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.