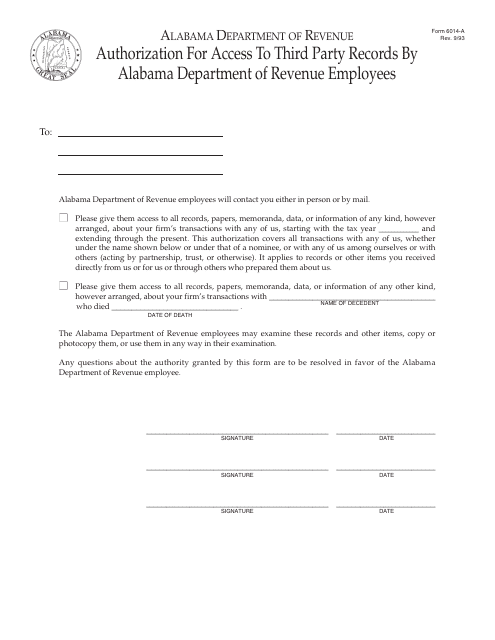

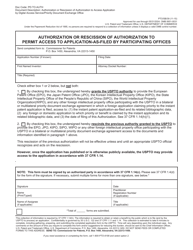

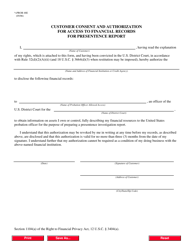

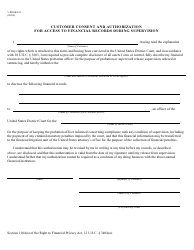

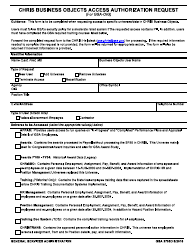

Form 6014-A Authorization for Access to Third Party Records by Alabama Department of Revenue Employees - Alabama

What Is Form 6014-A?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6014-A?

A: Form 6014-A is the Authorization for Access to Third Party Records by Alabama Department of Revenue Employees.

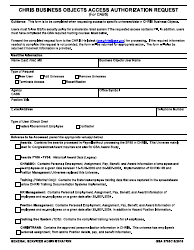

Q: Who is authorized to access third party records with Form 6014-A?

A: Employees of Alabama Department of Revenue are authorized to access third party records with Form 6014-A.

Q: Why is Form 6014-A used?

A: Form 6014-A is used to authorize employees of Alabama Department of Revenue to access third party records for the purpose of tax administration and enforcement.

Q: What type of records can be accessed with Form 6014-A?

A: Form 6014-A allows access to third party financial and non-financial records, including but not limited to bank records, employment records, and business records.

Q: Is Form 6014-A specific to Alabama?

A: Yes, Form 6014-A is specific to the Alabama Department of Revenue and is used by employees of that department.

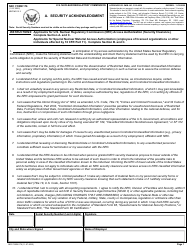

Form Details:

- Released on September 1, 1993;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6014-A by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.