This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPF-15

for the current year.

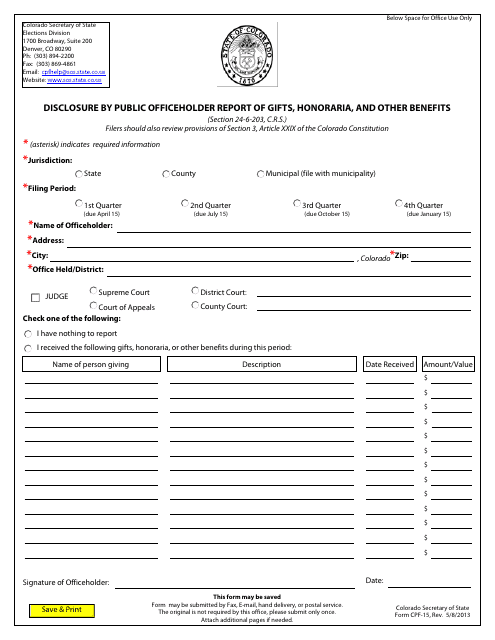

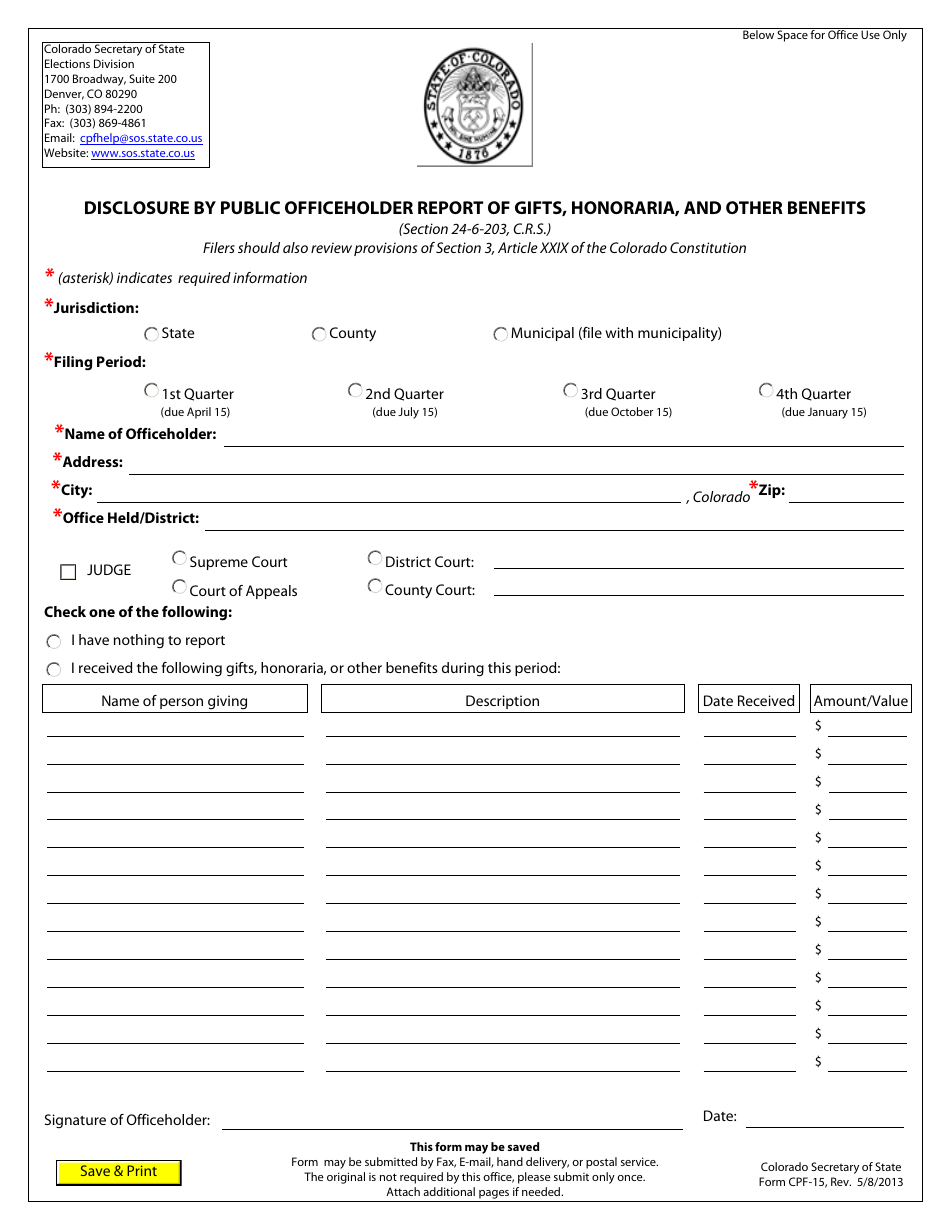

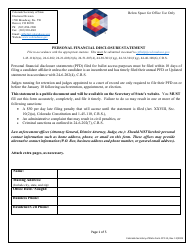

Form CPF-15 Disclosure by Public Officeholder Report of Gifts, Honoraria, and Other Benefits - Colorado

What Is Form CPF-15?

This is a legal form that was released by the Colorado Secretary of State - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

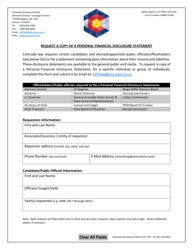

Q: What is the CPF-15 disclosure form?

A: The CPF-15 disclosure form is a report of gifts, honoraria, and other benefits received by public officeholders in Colorado.

Q: Who needs to fill out the CPF-15 form?

A: Public officeholders in Colorado need to fill out the CPF-15 form if they have received gifts, honoraria, or other benefits.

Q: What information is required on the CPF-15 form?

A: The CPF-15 form asks for details about the gift, honorarium, or benefit received, including the value and the source.

Q: When is the CPF-15 form due?

A: The CPF-15 form is due within 30 days of receiving the gift, honorarium, or benefit.

Q: What are the consequences of not filing the CPF-15 form?

A: Failure to file the CPF-15 form can result in penalties or fines for public officeholders in Colorado.

Form Details:

- Released on May 8, 2013;

- The latest edition provided by the Colorado Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CPF-15 by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.