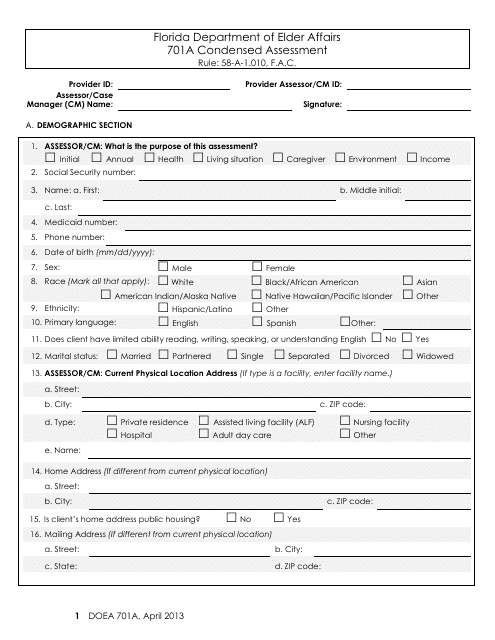

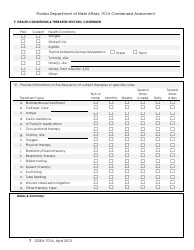

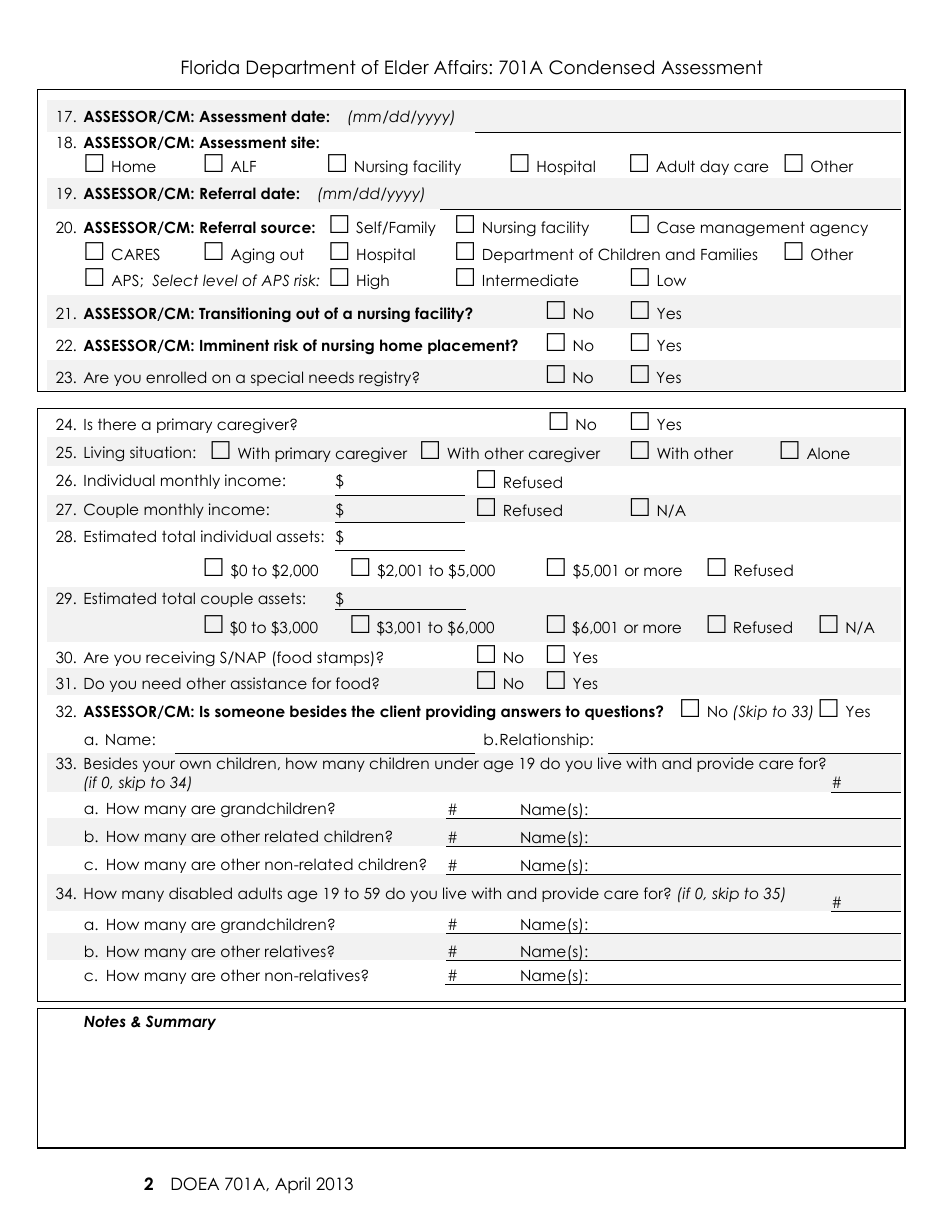

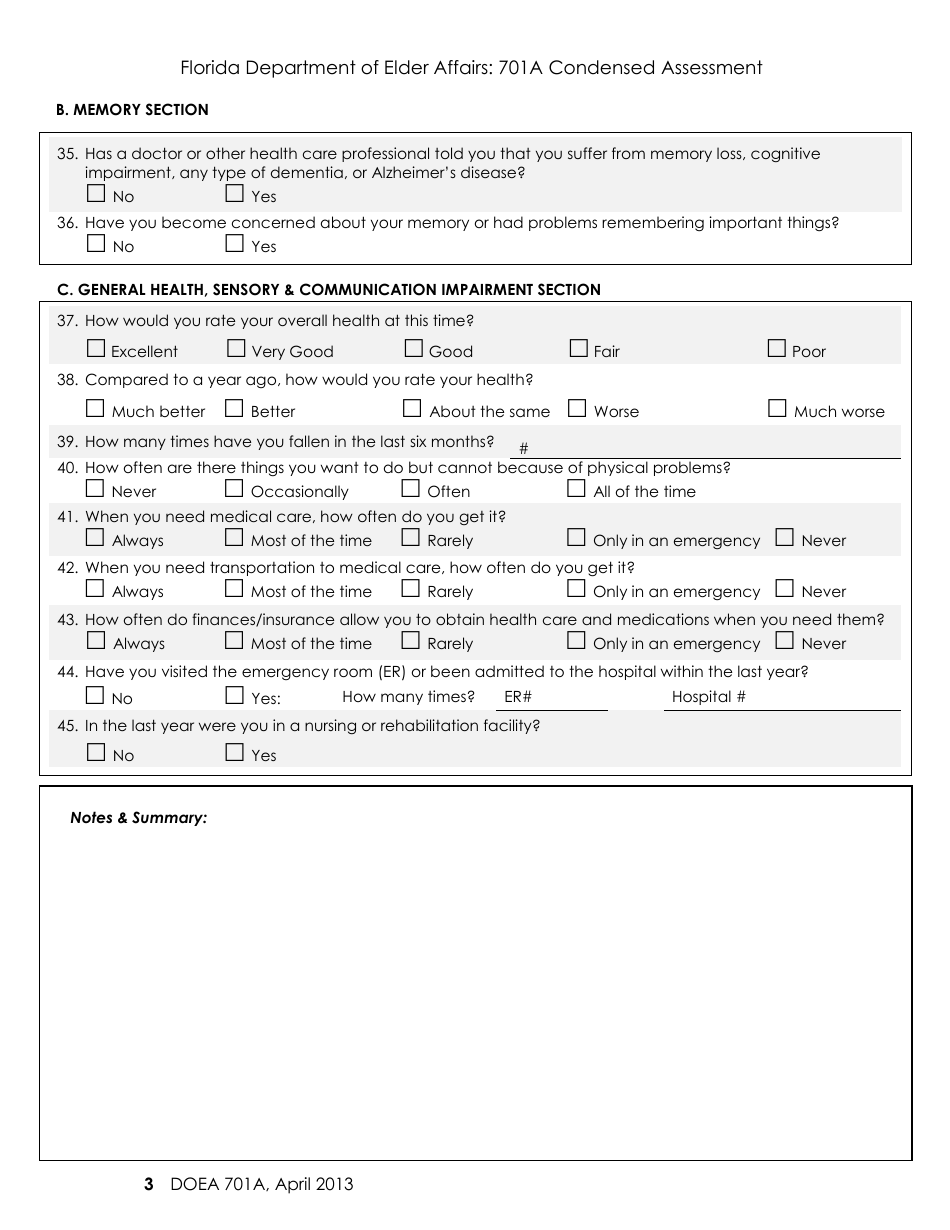

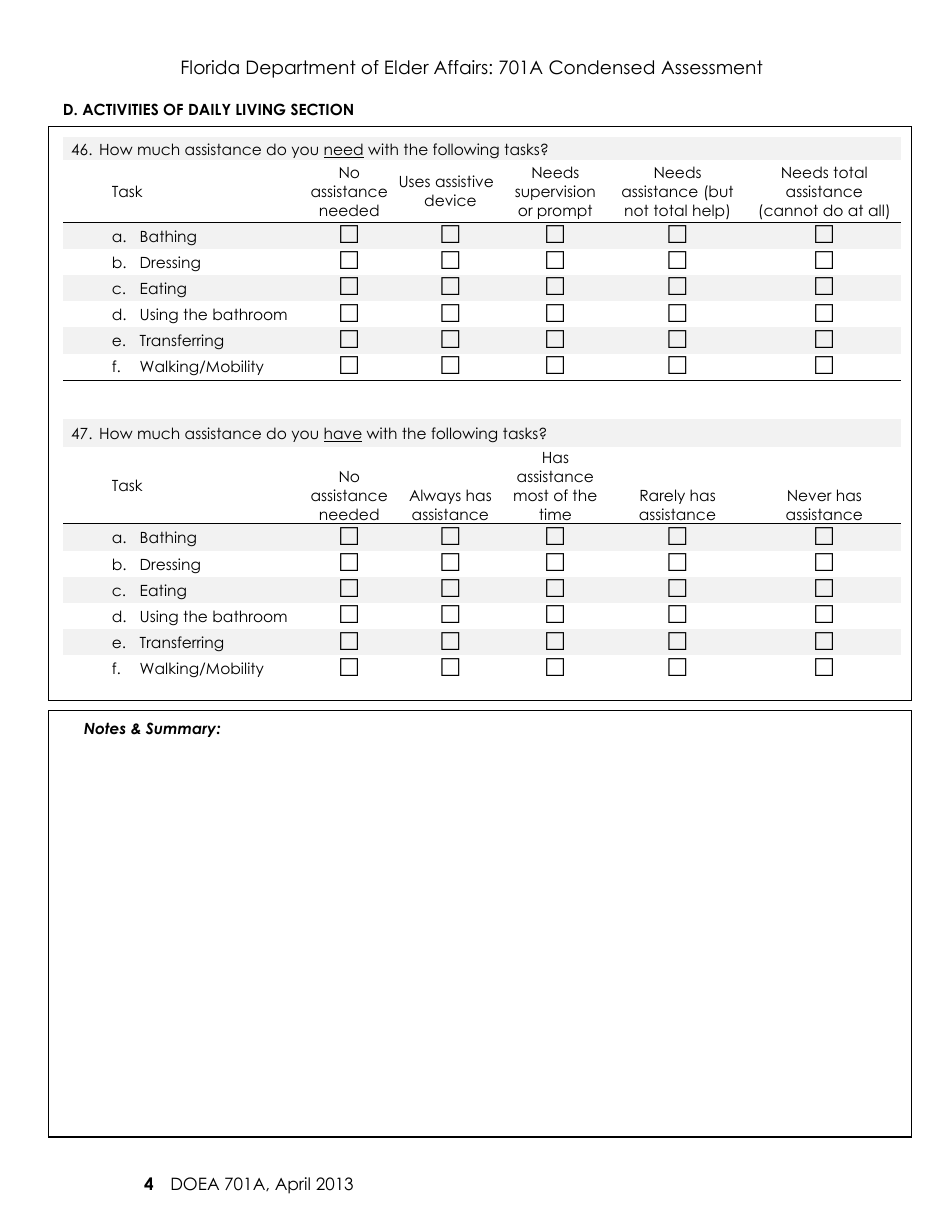

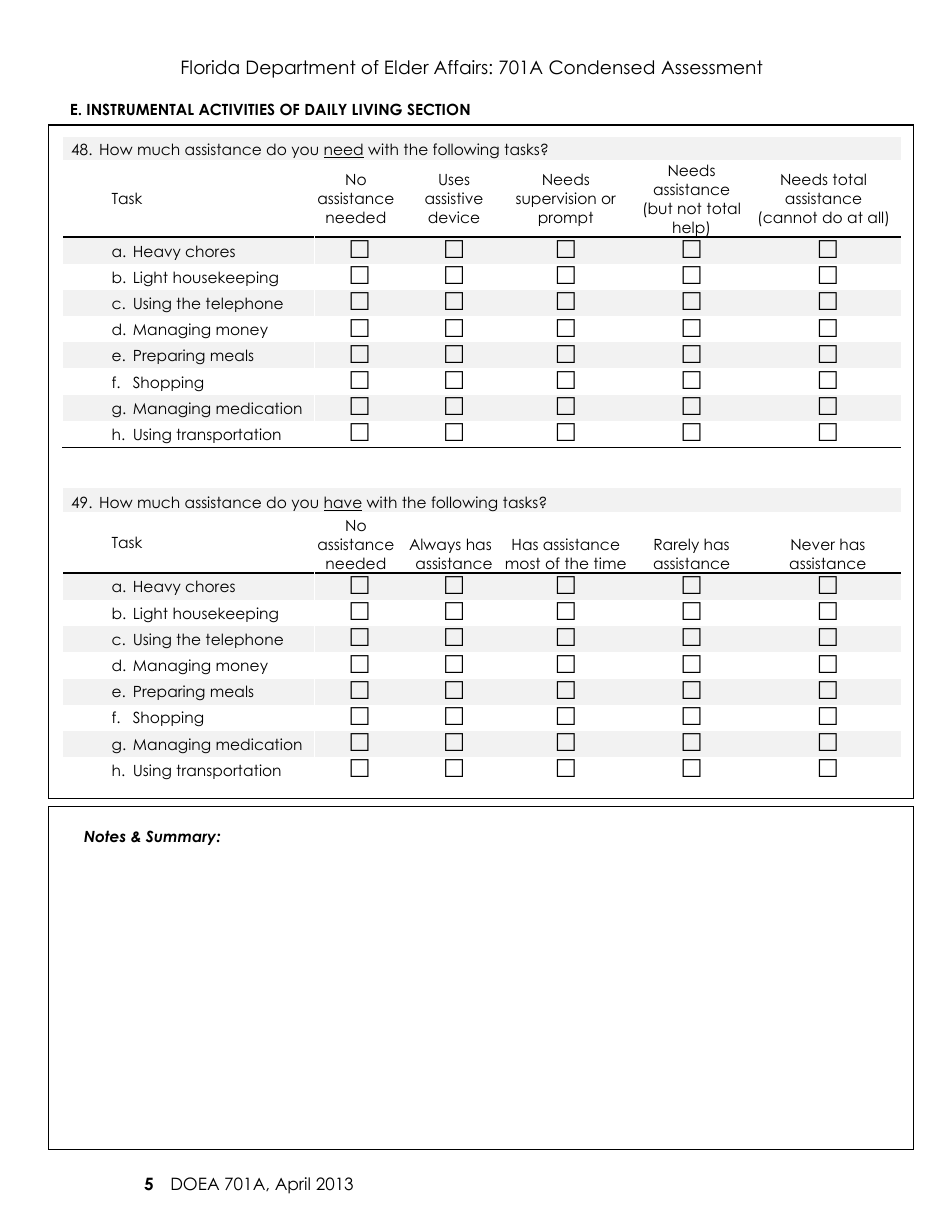

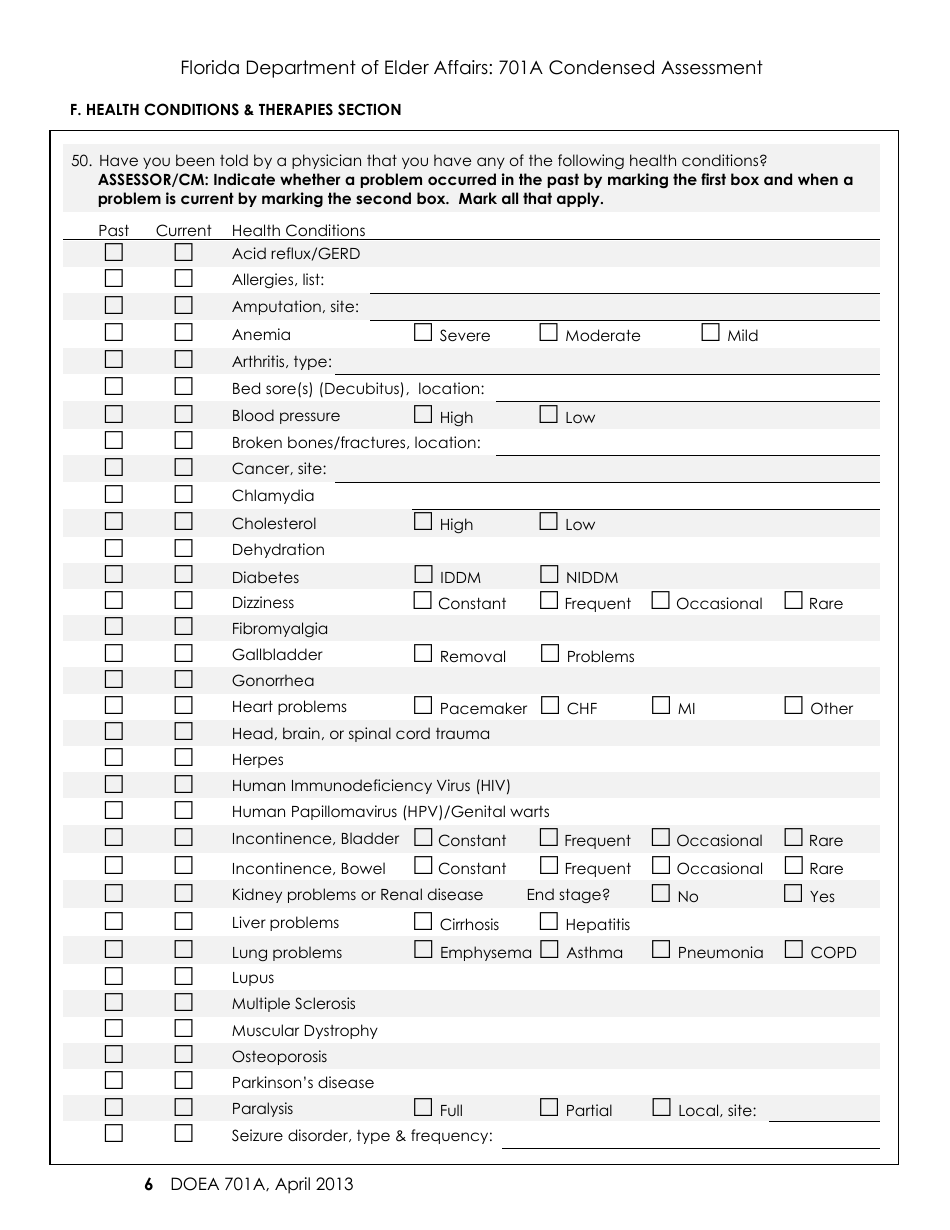

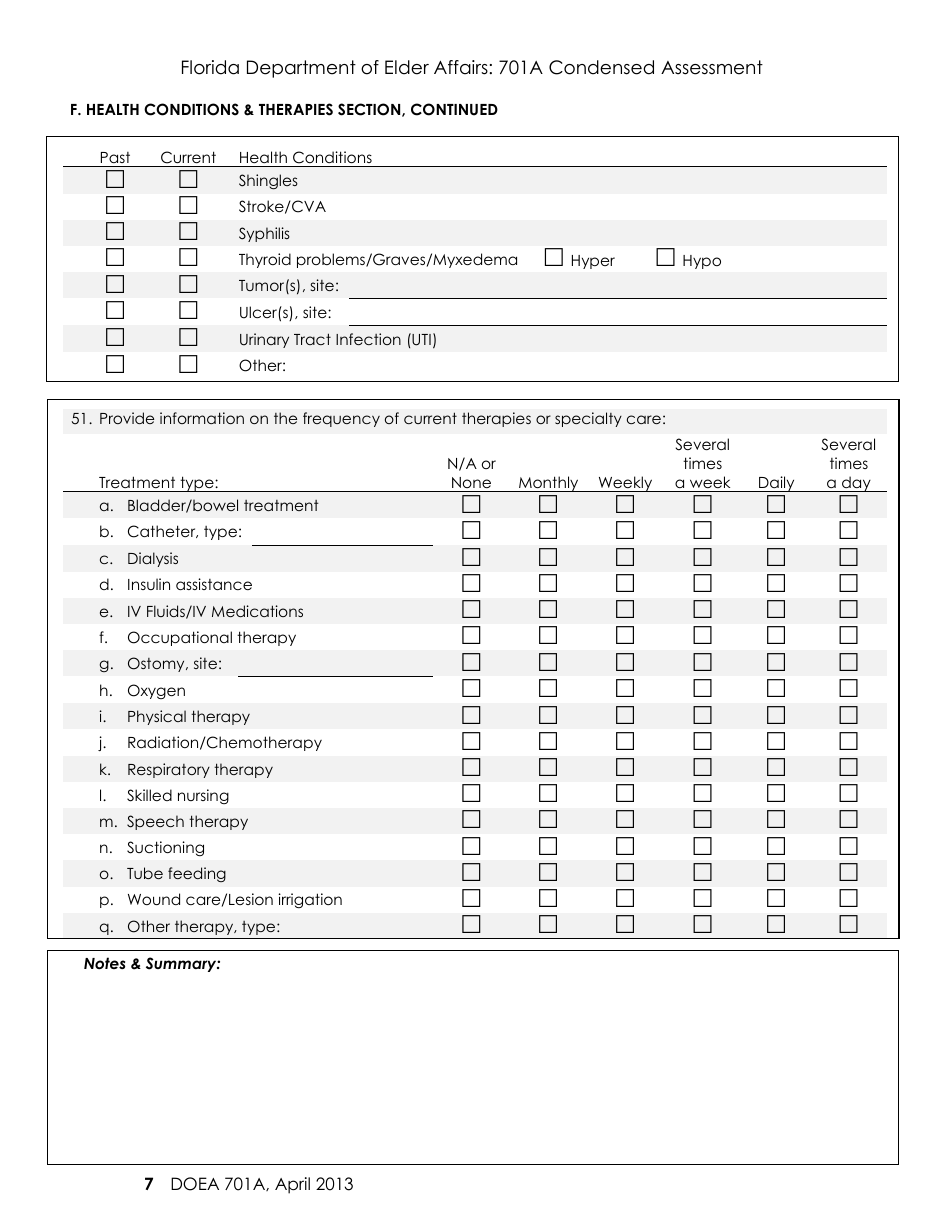

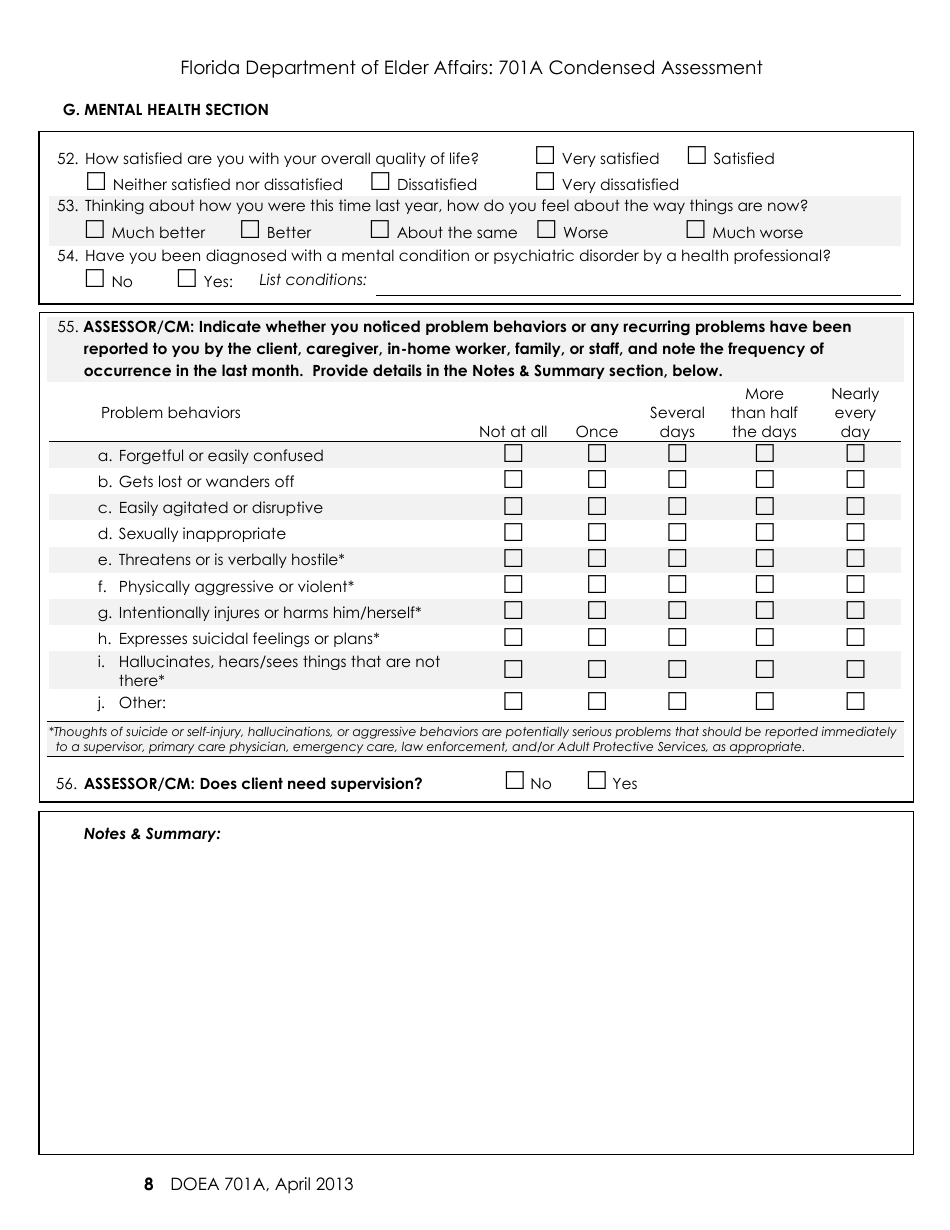

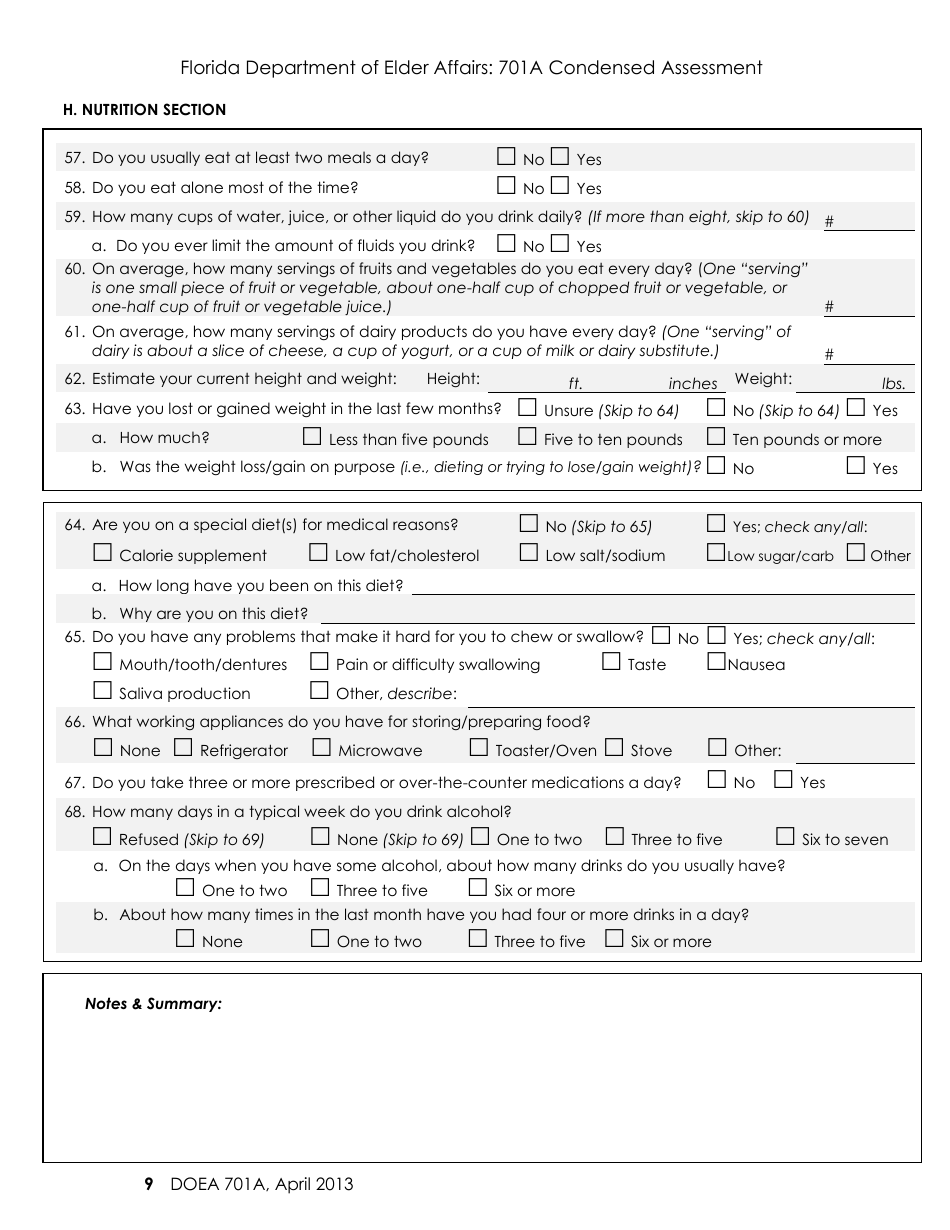

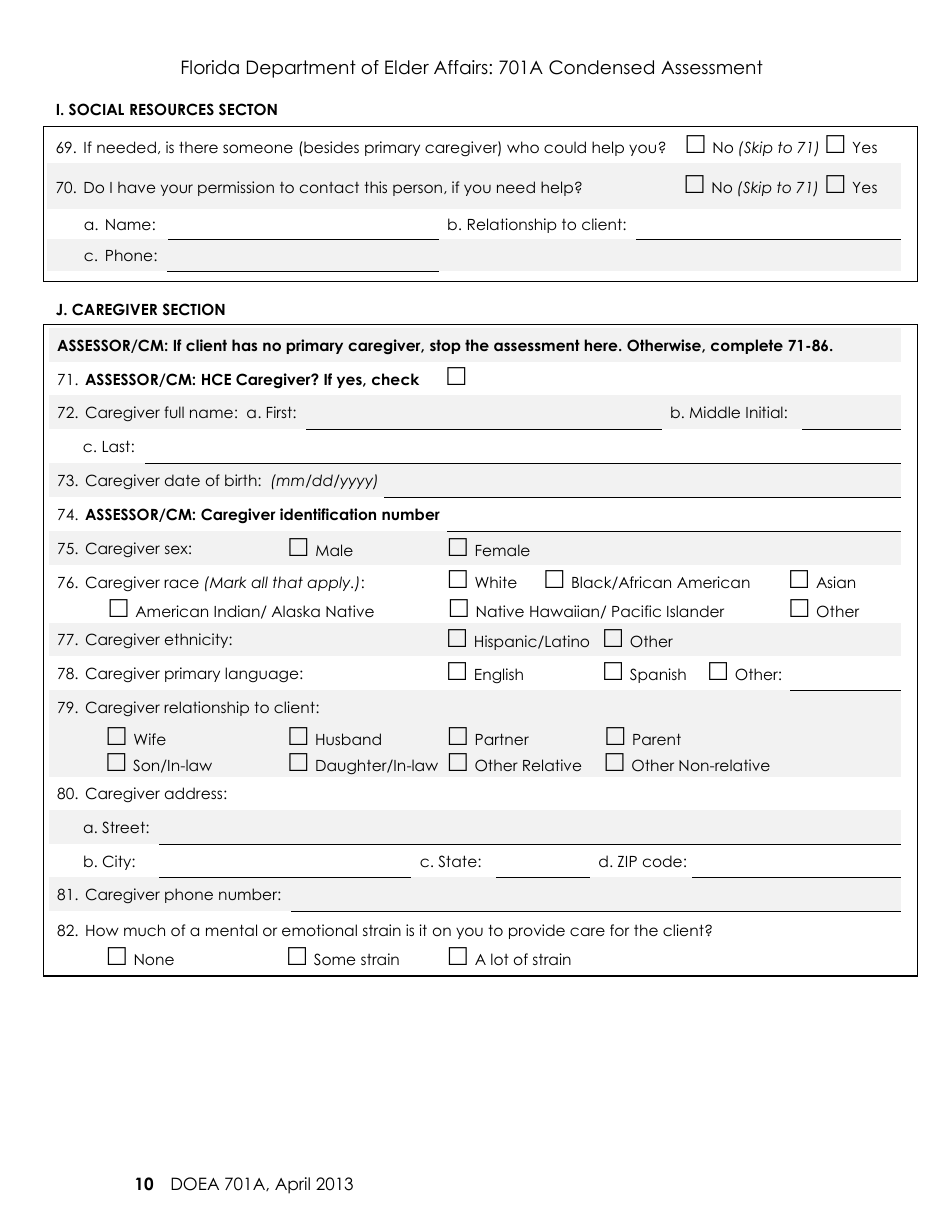

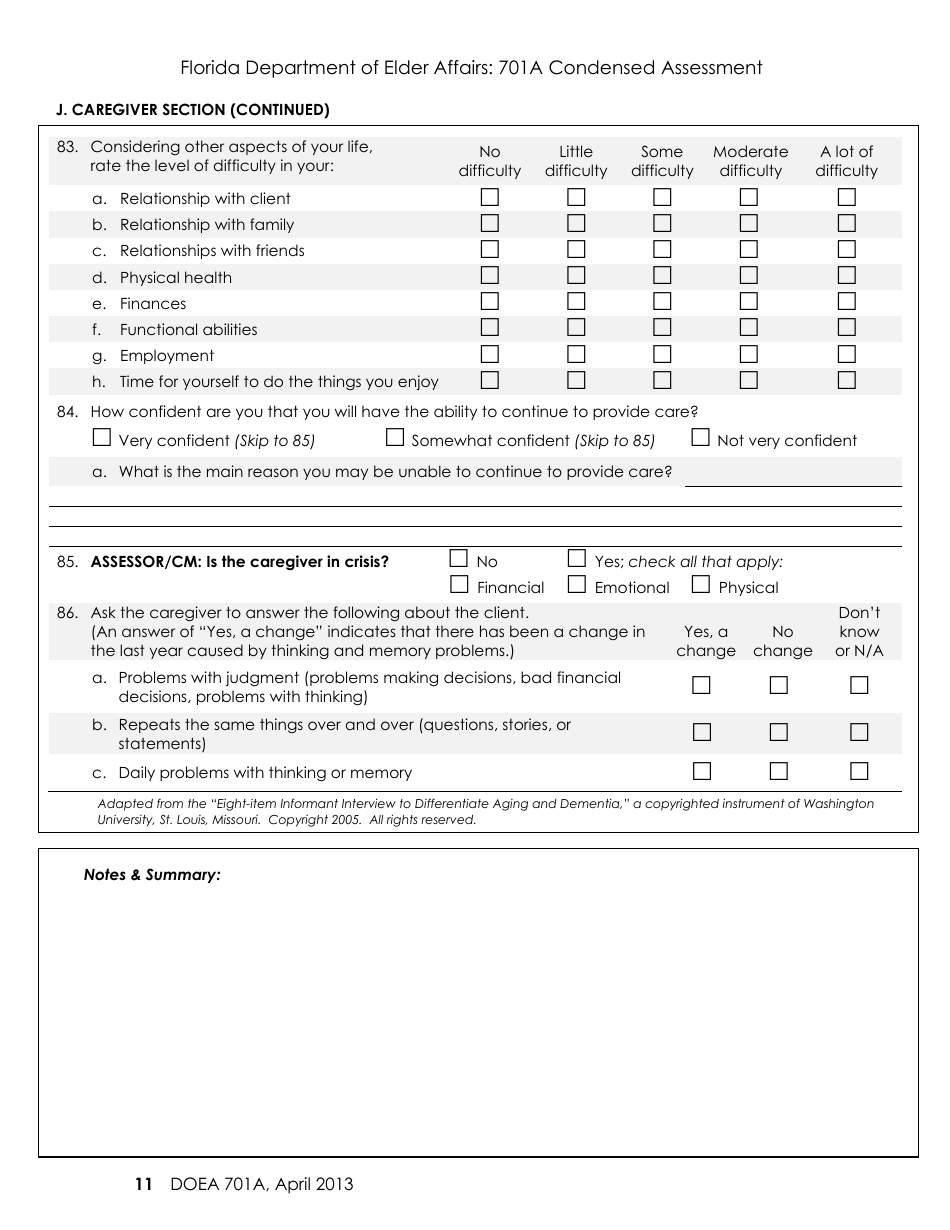

Form 701A Condensed Assessment - Florida

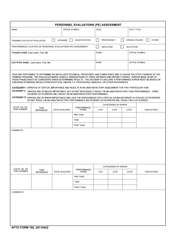

What Is Form 701A?

This is a legal form that was released by the Florida Department of Elder Affairs - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 701A?

A: Form 701A is a condensed assessment form used in Florida.

Q: Who uses Form 701A?

A: Form 701A is used by certain entities in Florida for assessment purposes.

Q: What does Form 701A assess?

A: Form 701A assesses various aspects of an entity's operations in Florida.

Q: Is Form 701A a mandatory form?

A: Yes, certain entities in Florida are required to submit Form 701A.

Q: What is the purpose of Form 701A?

A: The purpose of Form 701A is to gather information about an entity's operations in Florida for assessment purposes.

Q: Are there any filing deadlines for Form 701A?

A: Yes, specific filing deadlines may apply for Form 701A. It is important to check with the relevant Florida government agency or department for the applicable deadlines.

Q: What happens if I fail to submit Form 701A?

A: Failing to submit Form 701A or submitting it late may result in penalties or other consequences as determined by the relevant Florida government agency or department.

Q: What information is required on Form 701A?

A: Form 701A typically requires information about the entity's operations, such as revenue, expenses, assets, and other relevant details.

Q: Can I request an extension for filing Form 701A?

A: It depends on the specific requirements of the relevant Florida government agency or department. Extensions may be available in certain circumstances, but it is advisable to check with the agency or department for the extension request procedures and requirements.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Florida Department of Elder Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 701A by clicking the link below or browse more documents and templates provided by the Florida Department of Elder Affairs.