This version of the form is not currently in use and is provided for reference only. Download this version of

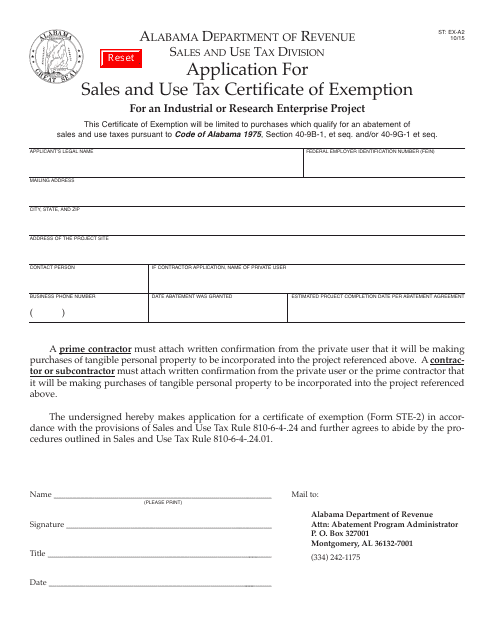

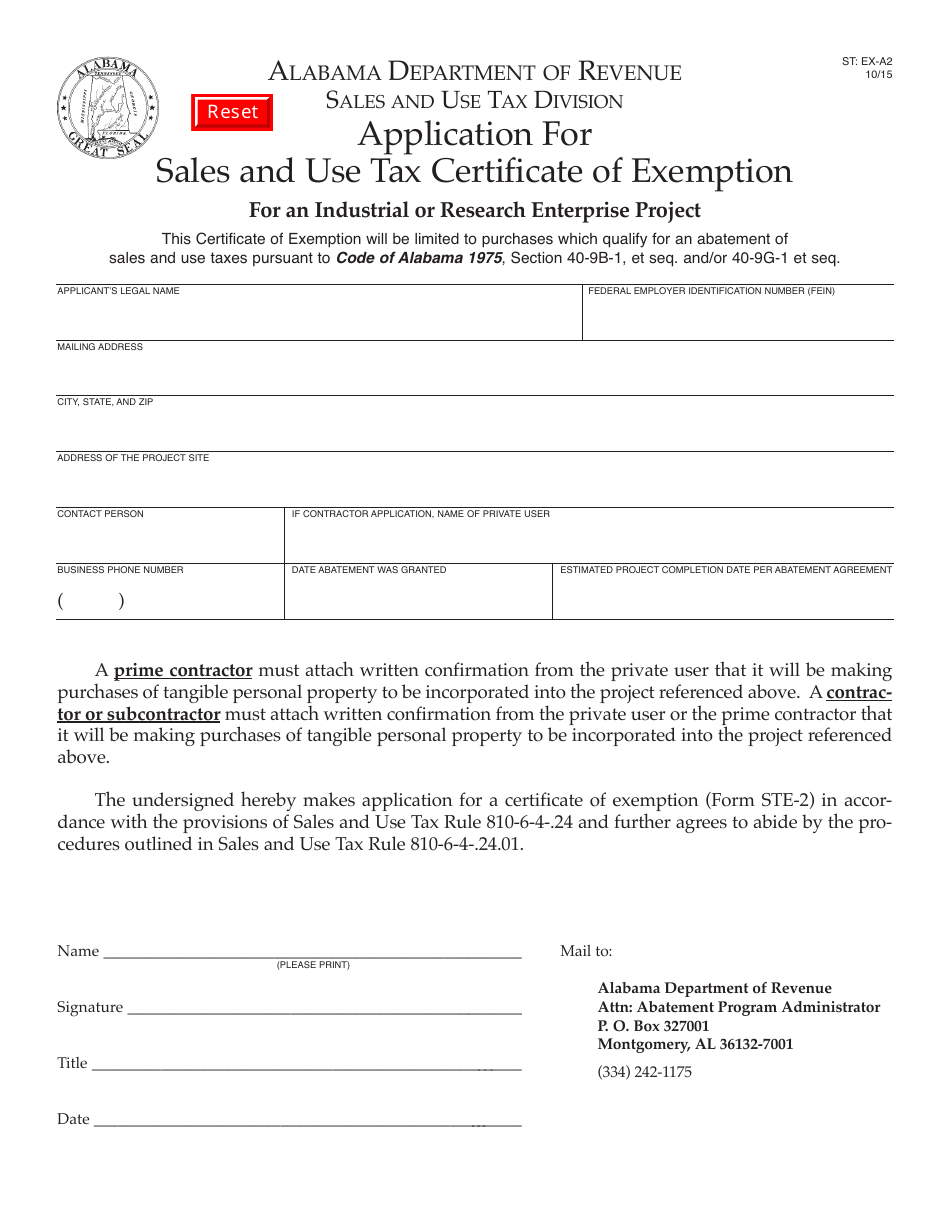

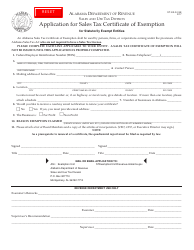

Form ST: EX-A2

for the current year.

Form ST: EX-A2 Application for Sales and Use Tax Certificate of Exemption for an Industrial or Research Enterprise Project - Alabama

What Is Form ST: EX-A2?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST: EX-A2?

A: Form ST: EX-A2 is an application for Sales and Use Tax Certificate of Exemption for an Industrial or Research Enterprise Project in Alabama.

Q: Who can use Form ST: EX-A2?

A: Industrial or research enterprise projects in Alabama can use Form ST: EX-A2 to apply for Sales and Use Tax Certificate of Exemption.

Q: What is the purpose of Form ST: EX-A2?

A: The purpose of Form ST: EX-A2 is to request a certificate of exemption from sales and use tax for industrial or research enterprise projects in Alabama.

Q: Are there any fees associated with filing Form ST: EX-A2?

A: No, there are no fees associated with filing Form ST: EX-A2.

Q: What information is required on Form ST: EX-A2?

A: Form ST: EX-A2 requires information about the applicant, project details, and a description of the project.

Q: How long does it take to process Form ST: EX-A2?

A: The processing time for Form ST: EX-A2 may vary, but it typically takes several weeks to receive a response.

Q: Are there any additional supporting documents required with Form ST: EX-A2?

A: Yes, additional supporting documents such as project plans, contracts, and financial statements may be required.

Q: What should I do if I have questions about Form ST: EX-A2?

A: If you have questions about Form ST: EX-A2, you can contact the Alabama Department of Revenue for assistance.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST: EX-A2 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.