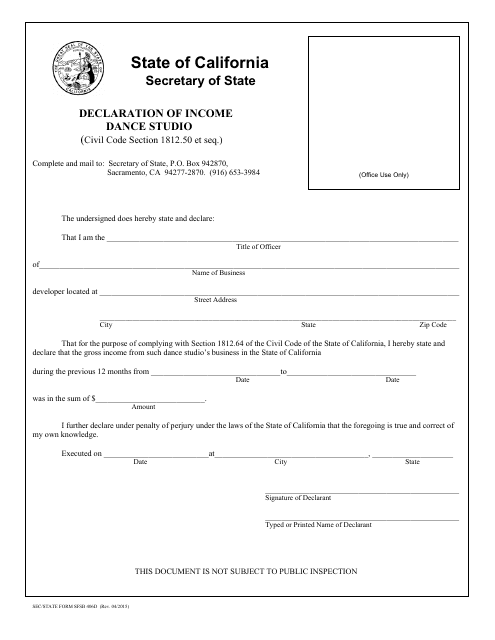

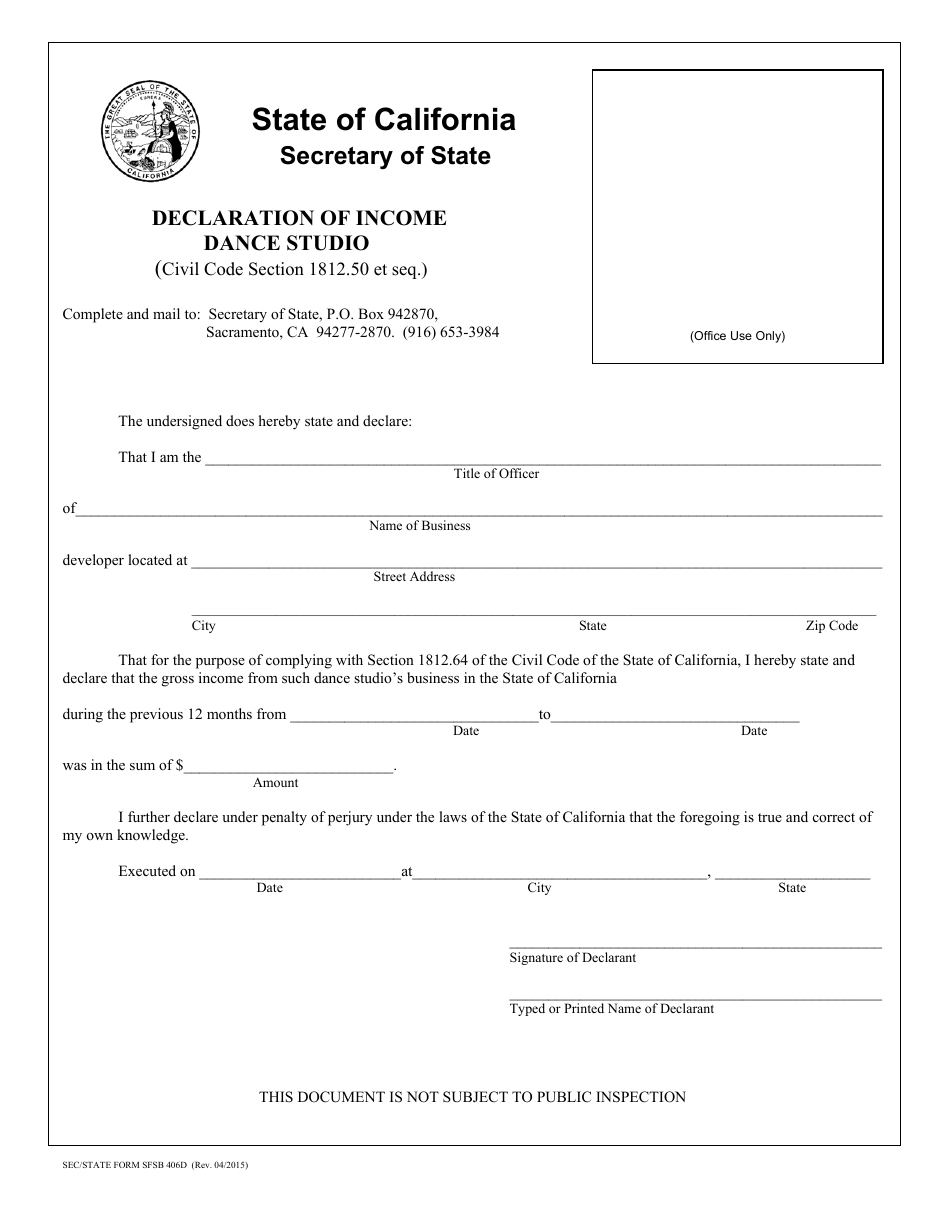

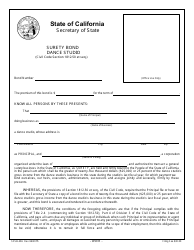

Form SFSB406D Dance Studio Surety Bond - Declaration of Income - California

What Is Form SFSB406D?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFSB406D?

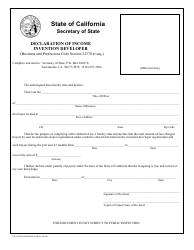

A: Form SFSB406D is a declaration of income form for a dance studio surety bond in California.

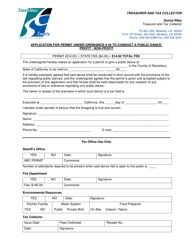

Q: What is a dance studio surety bond?

A: A dance studio surety bond is a type of insurance that provides financial protection to customers in case the dance studio fails to fulfill its obligations.

Q: Who needs to submit Form SFSB406D?

A: Dance studio owners in California who have a surety bond are required to submit Form SFSB406D to declare their income.

Q: What information is required on Form SFSB406D?

A: Form SFSB406D requires information such as the name and address of the dance studio, the surety bond number, the income earned during the reporting period, and the signature of the dance studio owner.

Q: When is Form SFSB406D due?

A: Form SFSB406D is due on or before April 30th of each year.

Q: What happens if I fail to submit Form SFSB406D?

A: Failure to submit Form SFSB406D or providing false information may result in penalties or the cancellation of your dance studio surety bond.

Q: Are there any fees associated with submitting Form SFSB406D?

A: There are no fees associated with submitting Form SFSB406D.

Q: Who should I contact for more information about Form SFSB406D?

A: For more information about Form SFSB406D, you can contact the California Department of Industrial Relations (DIR) or your local DIR office.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFSB406D by clicking the link below or browse more documents and templates provided by the California Secretary of State.