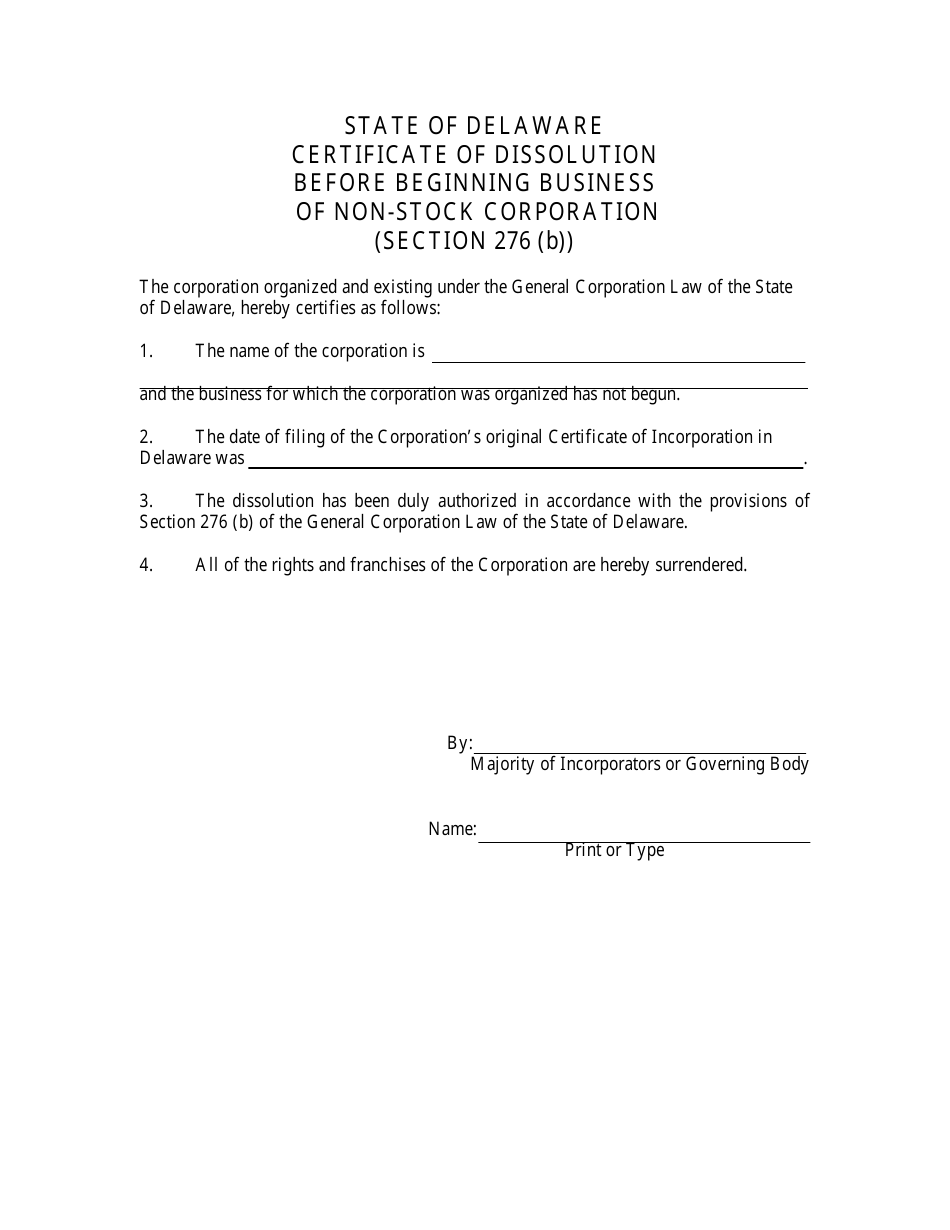

Certificate of Dissolution Before Beginning Business for Non-stock Corporation - Delaware

Certificate of Dissolution Before Beginning Business for Non-stock Corporation is a legal document that was released by the Delaware Department of State - a government authority operating within Delaware.

FAQ

Q: What is a Certificate of Dissolution?

A: A Certificate of Dissolution is a legal document that officially terminates the existence of a non-stock corporation.

Q: When is a Certificate of Dissolution required?

A: A Certificate of Dissolution is required when a non-stock corporation wants to cease its operations and dissolve.

Q: What is a non-stock corporation?

A: A non-stock corporation is a type of corporation that does not issue shares of stock or distribute profits to its members.

Q: Why would a non-stock corporation need to dissolve?

A: A non-stock corporation may need to dissolve if it is no longer able to operate, has fulfilled its purpose, or has decided to cease all activities.

Q: How do I obtain a Certificate of Dissolution for a non-stock corporation in Delaware?

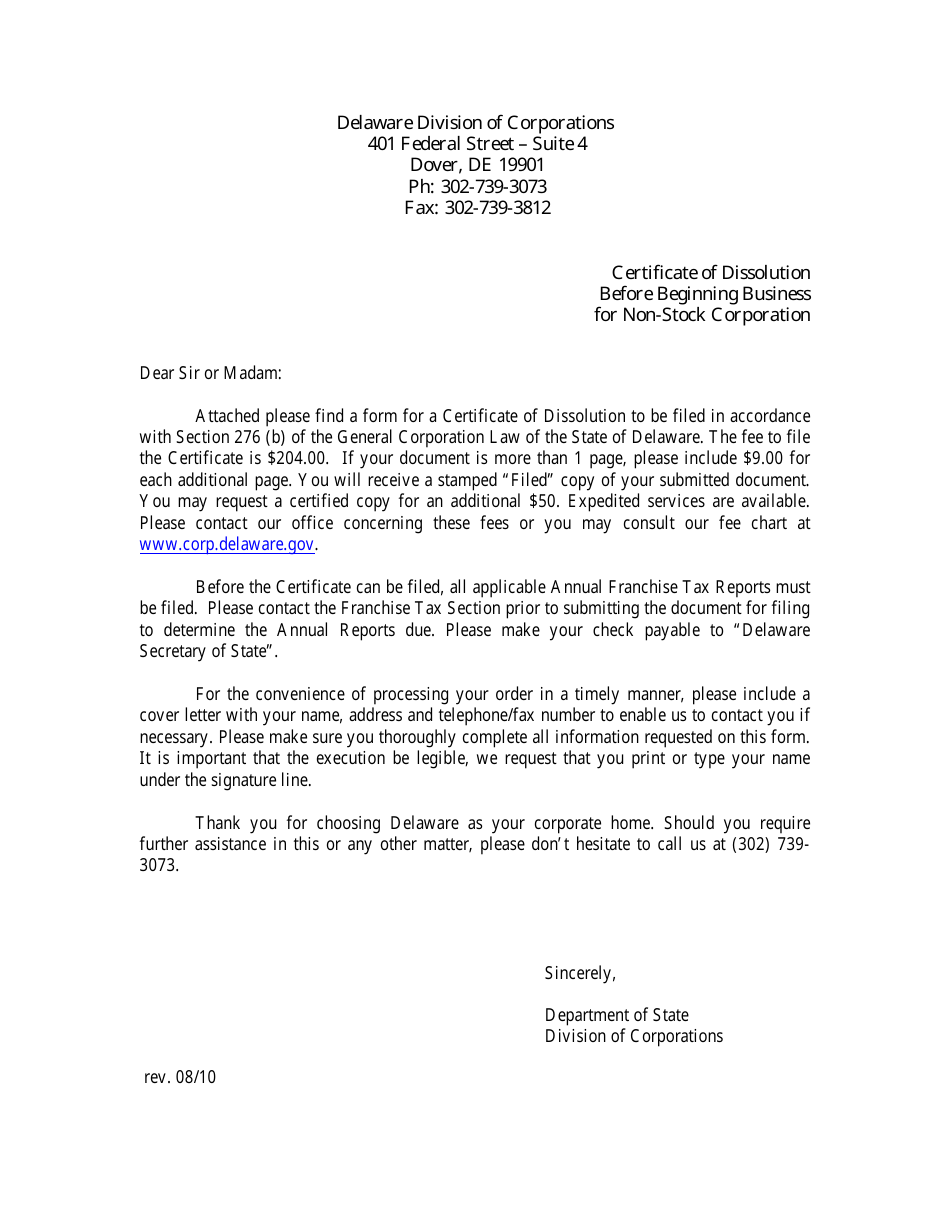

A: To obtain a Certificate of Dissolution in Delaware, you must file a completed Certificate of Dissolution with the Delaware Division of Corporations and pay the associated fees.

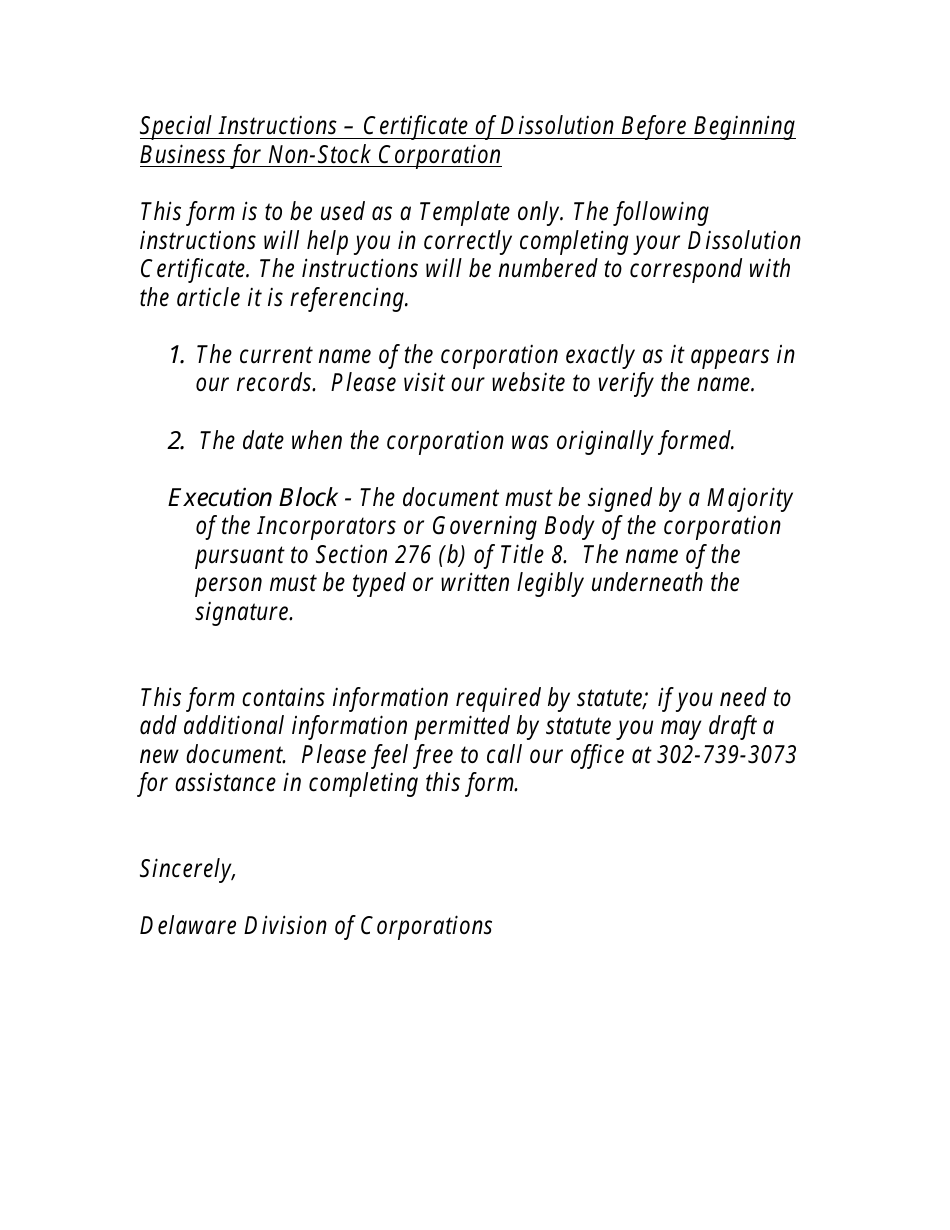

Q: What information is required on the Certificate of Dissolution?

A: The Certificate of Dissolution typically requires information such as the corporation's name, date of dissolution, reason for dissolution, and signatures of authorized individuals.

Q: Are there any additional requirements for dissolution of a non-stock corporation?

A: Depending on the jurisdiction, there may be additional requirements such as settling outstanding debts, filing final tax returns, and notifying creditors and members of the corporation's dissolution.

Q: What happens after a non-stock corporation is dissolved?

A: After dissolution, the non-stock corporation ceases to exist as a legal entity and cannot engage in any further business activities. Its assets are typically distributed to creditors and members according to the corporation's bylaws or applicable laws.

Q: Can a dissolved non-stock corporation be reinstated?

A: In some cases, a dissolved non-stock corporation may be reinstated if certain conditions are met, such as filing necessary documents and paying outstanding fees. However, this process varies by jurisdiction.

Q: Is legal assistance recommended for the dissolution process?

A: While legal assistance is not required, it is recommended to consult with an attorney or a business professional to ensure that all legal requirements are met and the dissolution process is conducted properly.

Form Details:

- Released on August 1, 2010;

- The latest edition currently provided by the Delaware Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State.