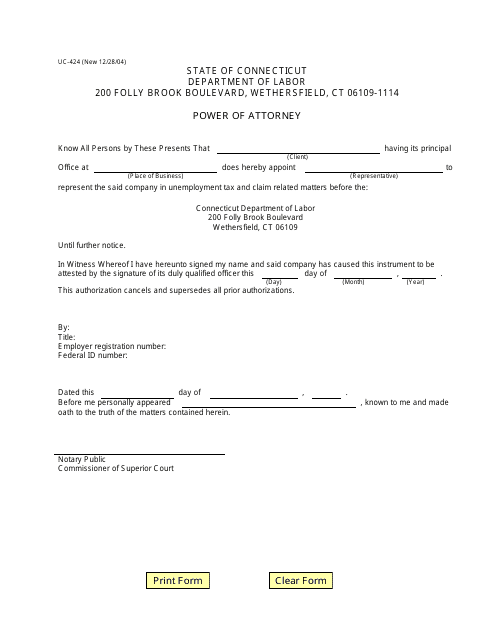

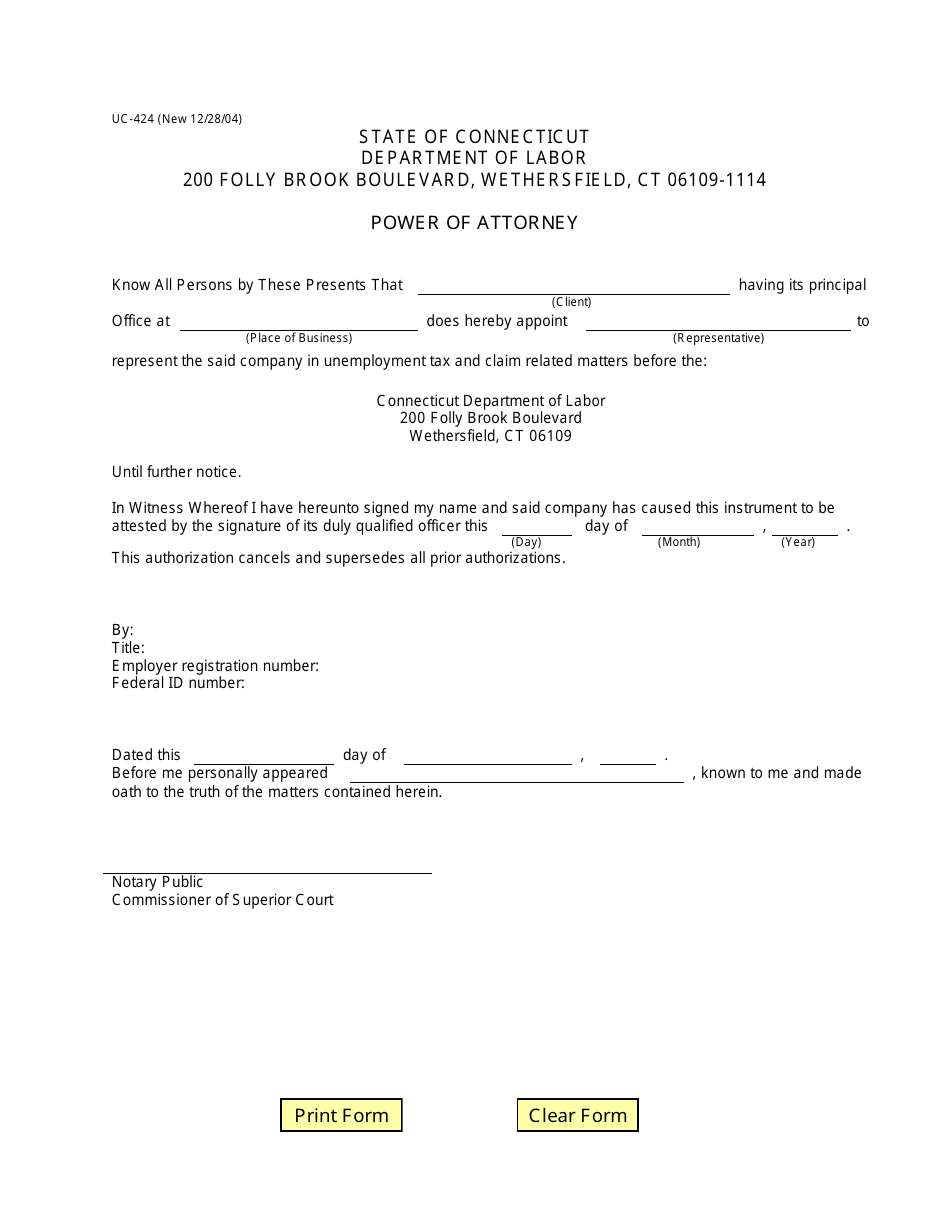

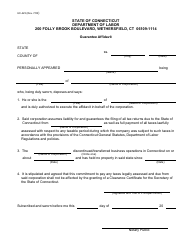

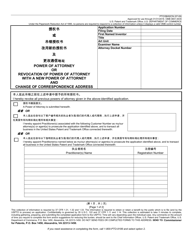

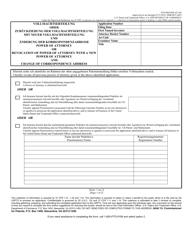

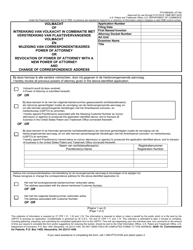

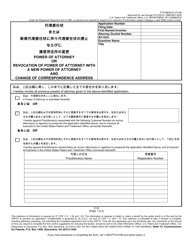

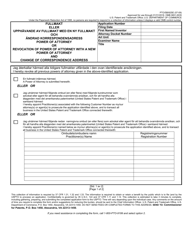

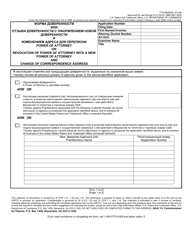

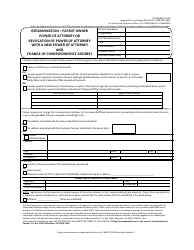

Form UC-424 Power of Attorney - Connecticut

What Is Form UC-424?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

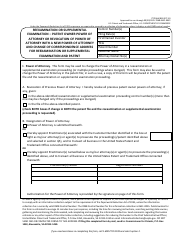

Q: What is Form UC-424?

A: Form UC-424 is a Power of Attorney form used in Connecticut.

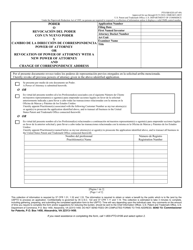

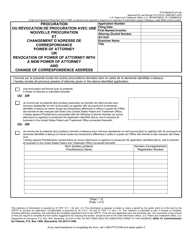

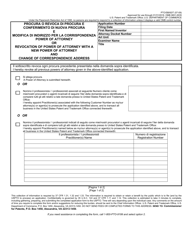

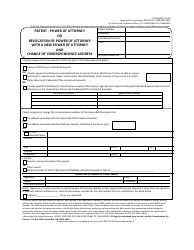

Q: What is the purpose of Form UC-424?

A: The purpose of Form UC-424 is to appoint a power of attorney to act on behalf of the declarant in tax matters.

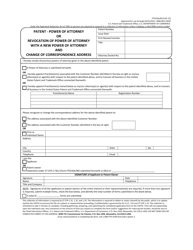

Q: Who should use Form UC-424?

A: Form UC-424 should be used by individuals or businesses who want to appoint someone else to handle their tax matters in Connecticut.

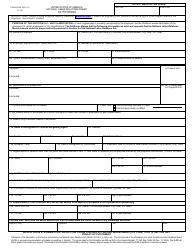

Q: What information is required on Form UC-424?

A: Form UC-424 requires information such as the declarant's name, social security number, and the name and contact information of the appointed power of attorney.

Q: Is there a filing fee for Form UC-424?

A: No, there is no filing fee for Form UC-424. It is a free form.

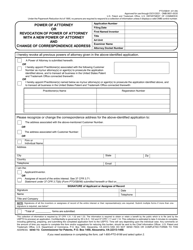

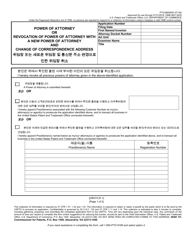

Q: Can I revoke a power of attorney appointed through Form UC-424?

A: Yes, you can revoke a power of attorney appointed through Form UC-424 by completing a Revocation of Power of Attorney form.

Form Details:

- Released on December 28, 2004;

- The latest edition provided by the Connecticut Department of Labor;

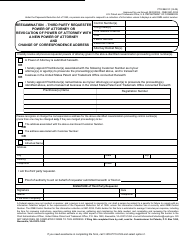

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UC-424 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.