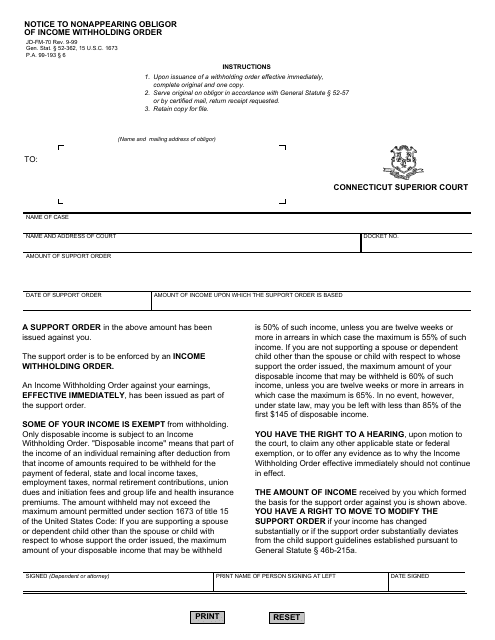

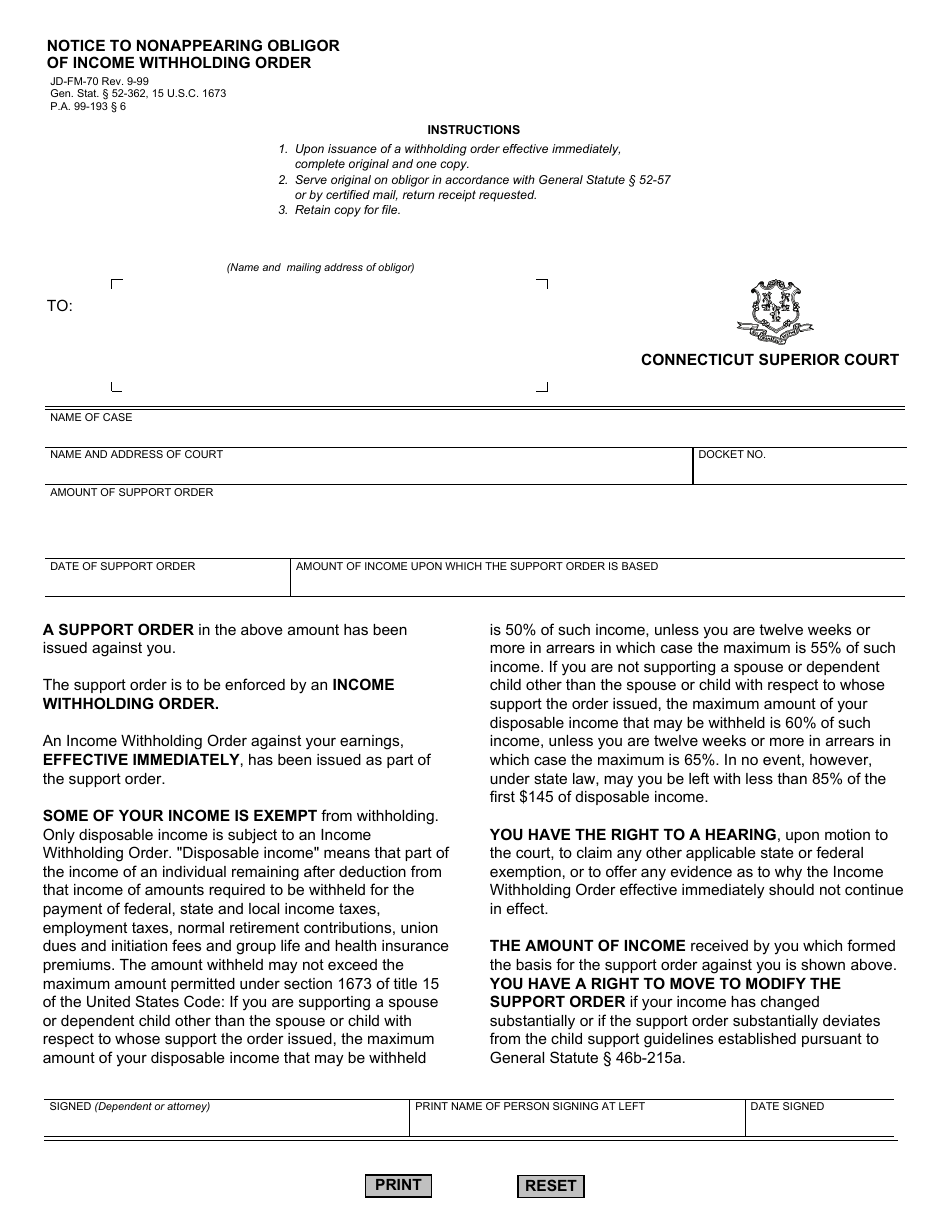

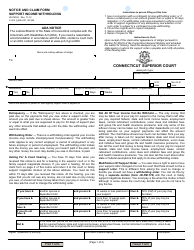

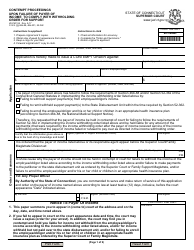

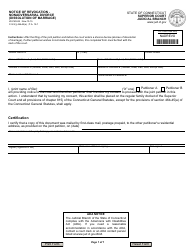

Form JD-FM-70 Notice to Nonappearing Obligor of Income Withholding Order - Connecticut

What Is Form JD-FM-70?

This is a legal form that was released by the Connecticut Superior Court - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form JD-FM-70?

A: Form JD-FM-70 is a Notice to Nonappearing Obligor of Income Withholding Order used in Connecticut.

Q: What is the purpose of Form JD-FM-70?

A: The purpose of Form JD-FM-70 is to notify a nonappearing obligor about an income withholding order.

Q: Who uses Form JD-FM-70?

A: Form JD-FM-70 is used by individuals or agencies seeking to enforce child support orders in Connecticut.

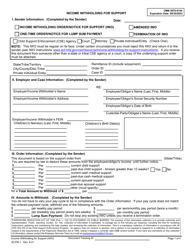

Q: What is an income withholding order?

A: An income withholding order is a legal document that requires an employer to deduct child support payments from an employee's wages.

Q: What information does Form JD-FM-70 contain?

A: Form JD-FM-70 contains information about the obligor, the child support order, and the income withholding order.

Q: Is Form JD-FM-70 specific to Connecticut?

A: Yes, Form JD-FM-70 is specific to Connecticut and may not be used in other states.

Form Details:

- Released on September 1, 1999;

- The latest edition provided by the Connecticut Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JD-FM-70 by clicking the link below or browse more documents and templates provided by the Connecticut Superior Court.