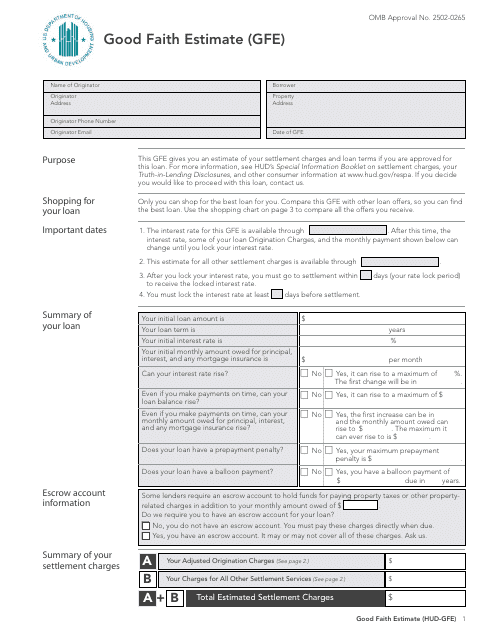

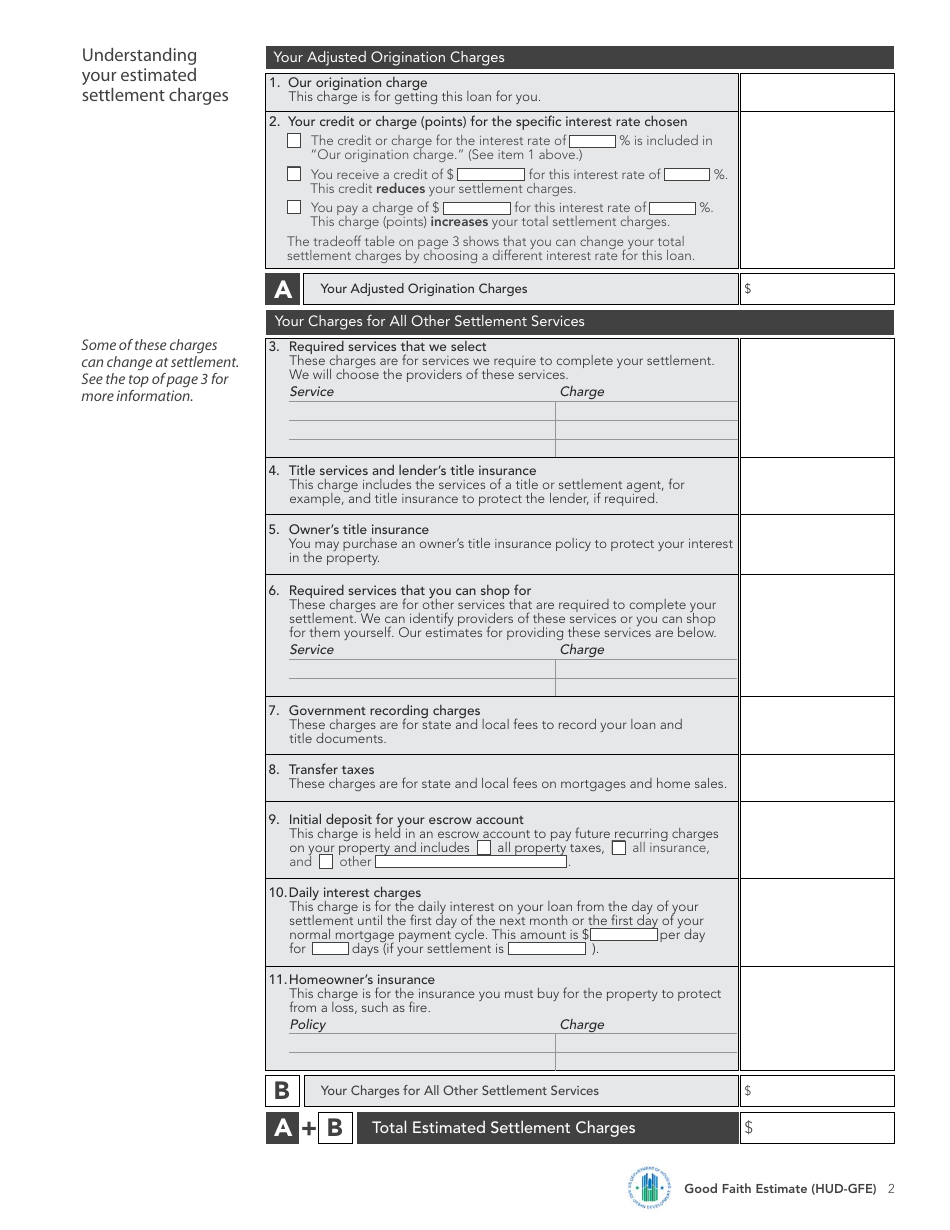

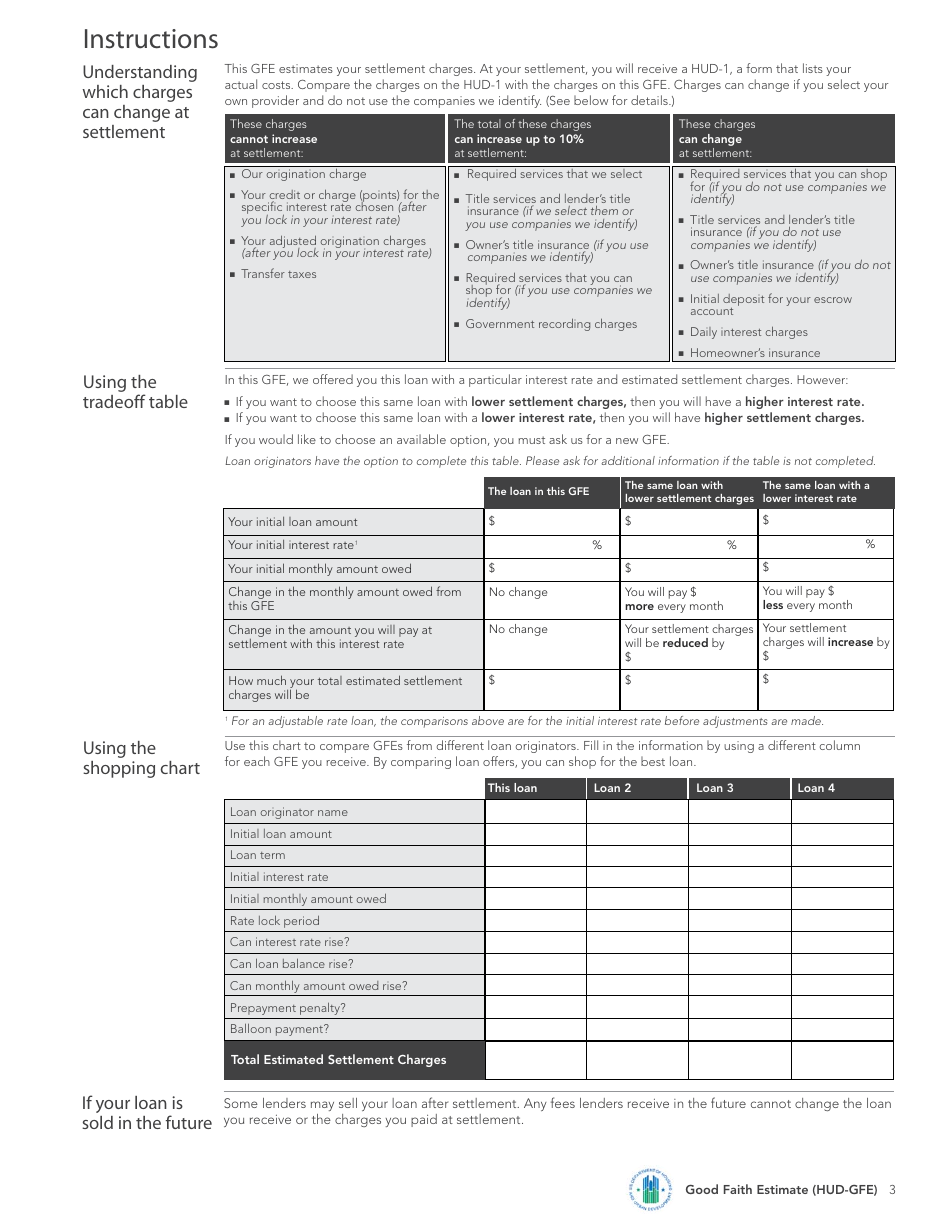

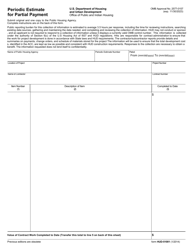

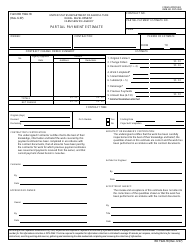

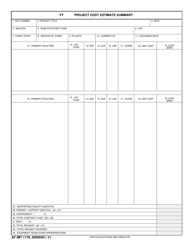

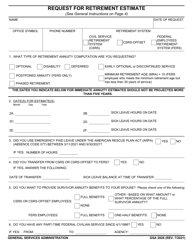

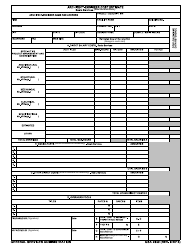

Good Faith Estimate (GFE)

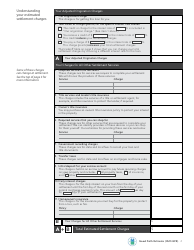

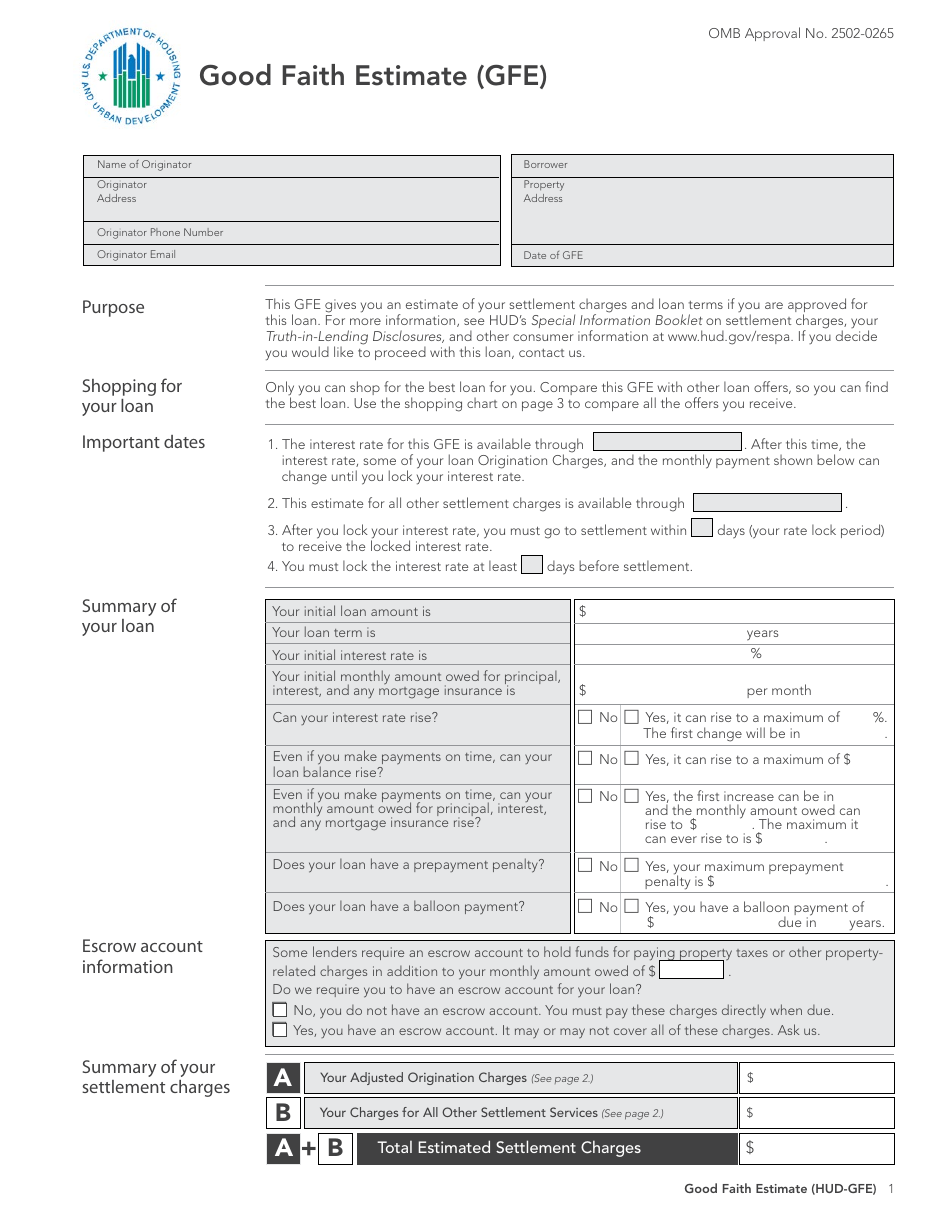

Good Faith Estimate (GFE) is a 3-page legal document that was released by the U.S. Department of Housing and Urban Development and used nation-wide.

FAQ

Q: What is a Good Faith Estimate (GFE)?

A: A Good Faith Estimate (GFE) is a document provided by lenders to borrowers that outlines the estimated costs and fees associated with a mortgage loan.

Q: Why is a Good Faith Estimate important?

A: A Good Faith Estimate is important because it allows borrowers to compare the costs and fees of different lenders, helping them make an informed decision about their mortgage loan.

Q: What information is included in a Good Faith Estimate?

A: A Good Faith Estimate typically includes information about the loan amount, interest rate, closing costs, and other fees associated with the loan.

Q: Is a Good Faith Estimate binding?

A: No, a Good Faith Estimate is not binding. The actual costs and fees may vary from what is stated in the GFE.

Q: What replaced the Good Faith Estimate?

A: The Good Faith Estimate was replaced by the Loan Estimate in October 2015 as part of the TILA-RESPA Integrated Disclosure Rule.

Form Details:

- The latest edition currently provided by the U.S. Department of Housing and Urban Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.