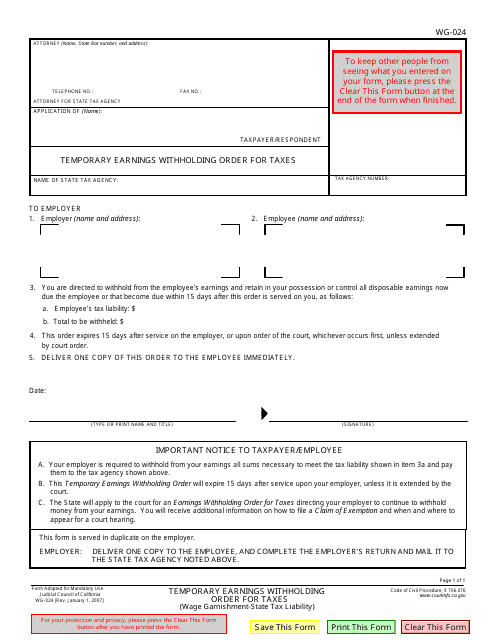

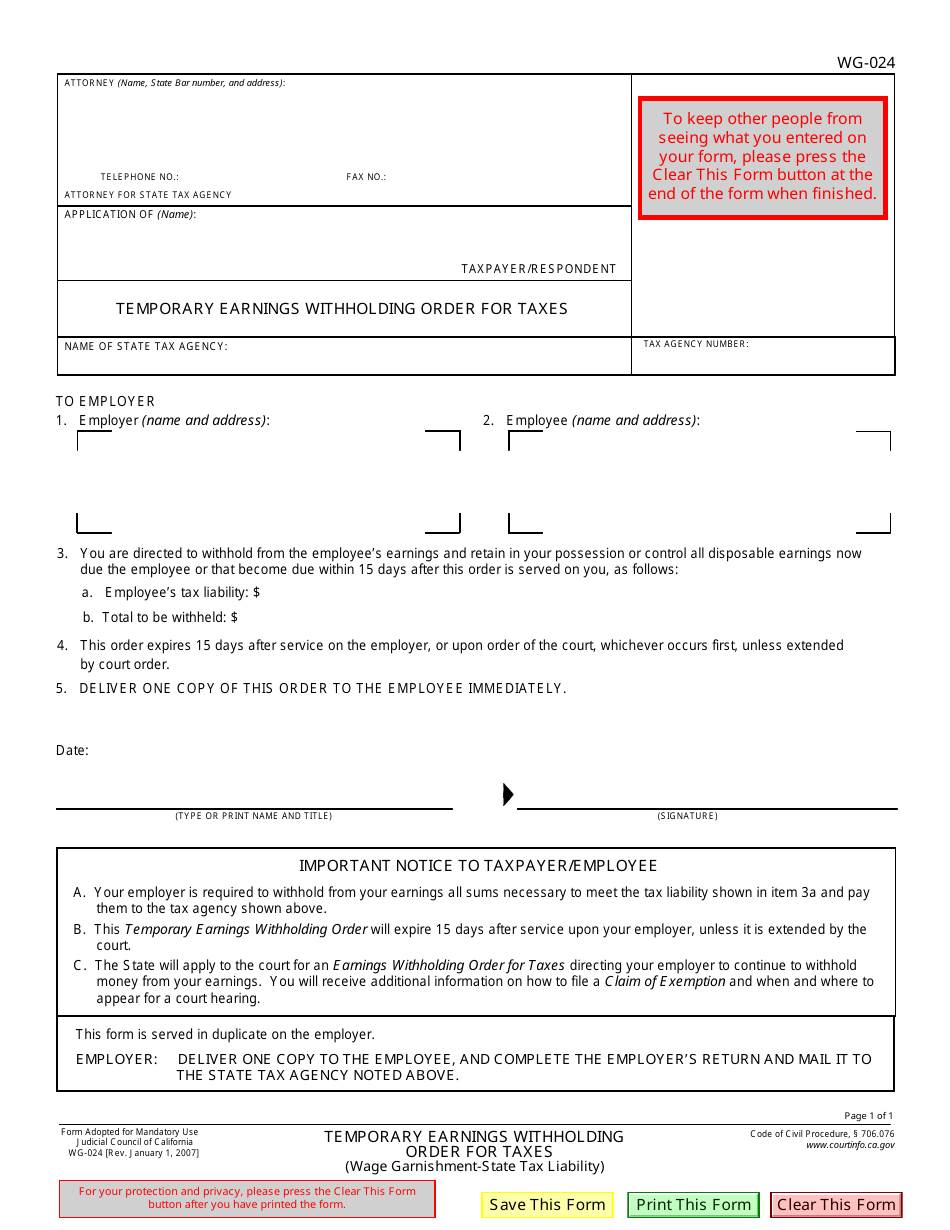

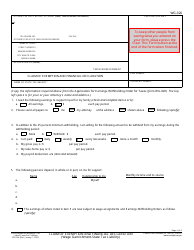

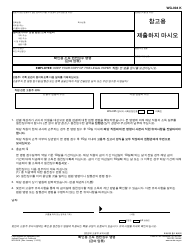

Form WG-024 Temporary Earnings Withholding Order for Taxes - California

What Is Form WG-024?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WG-024?

A: Form WG-024 is the Temporary Earnings Withholding Order for Taxes in California.

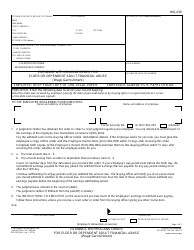

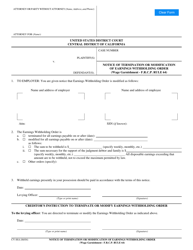

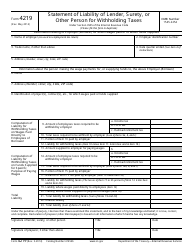

Q: Why would I need to fill out Form WG-024?

A: You would need to fill out Form WG-024 if you owe taxes to the state of California and want them to be automatically deducted from your wages.

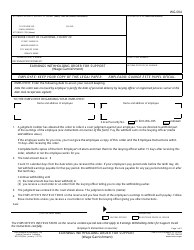

Q: Do I need to complete Form WG-024 every year?

A: No, Form WG-024 is only required if you owe taxes and want to have them withheld from your wages. If your tax situation changes, you may need to update the form.

Q: Can my employer refuse to withhold taxes using Form WG-024?

A: No, if you properly complete and submit Form WG-024, your employer is legally obligated to withhold the specified amount from your wages for taxes.

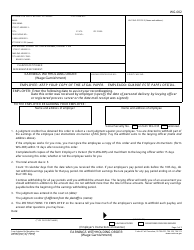

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WG-024 by clicking the link below or browse more documents and templates provided by the California Judicial Branch.