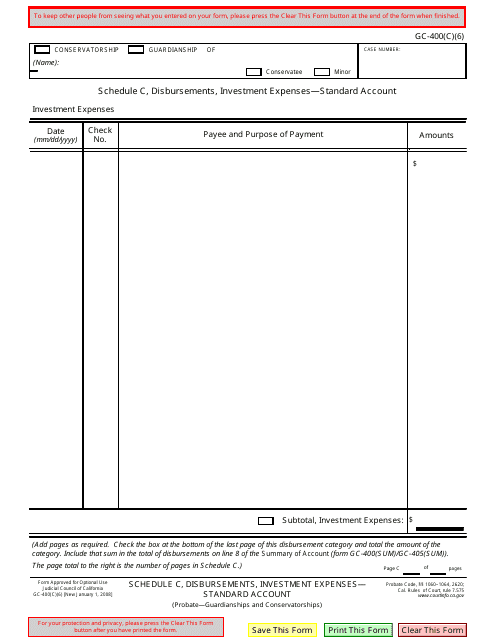

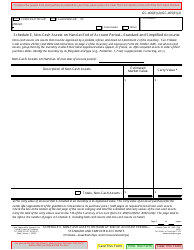

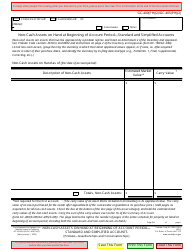

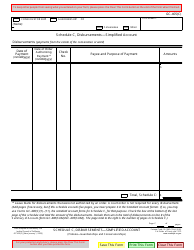

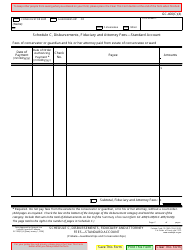

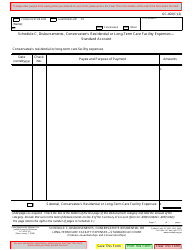

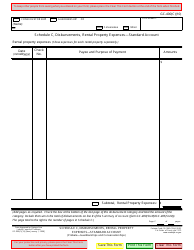

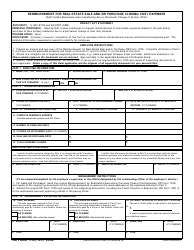

Form GC-400(C)(6) Schedule C Disbursements, Investment Expenses - Standard Account - California

What Is Form GC-400(C)(6) Schedule C?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(C)(6) Schedule C?

A: GC-400(C)(6) Schedule C is a form used for reporting disbursements and investment expenses related to a standard account in California.

Q: What are disbursements?

A: Disbursements refer to payments made for various expenses related to the account.

Q: What are investment expenses?

A: Investment expenses are costs associated with managing investments in the standard account.

Q: What is a standard account?

A: A standard account refers to a regular investment account without any specialized features.

Q: What does the form GC-400(C)(6) Schedule C for?

A: The form GC-400(C)(6) Schedule C is used to report disbursements and investment expenses for a standard account in California.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(C)(6) Schedule C by clicking the link below or browse more documents and templates provided by the California Judicial Branch.