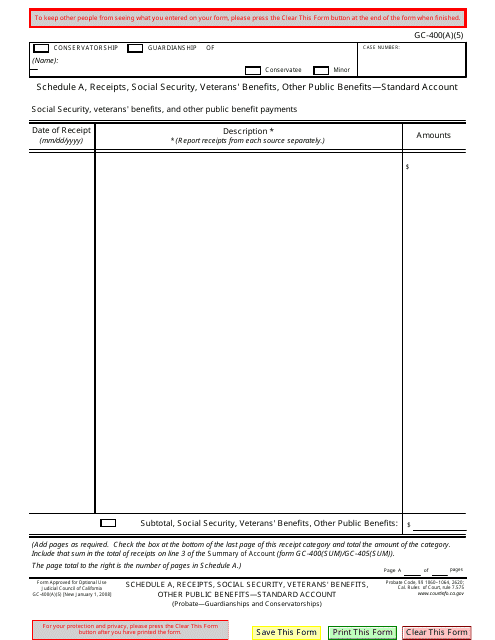

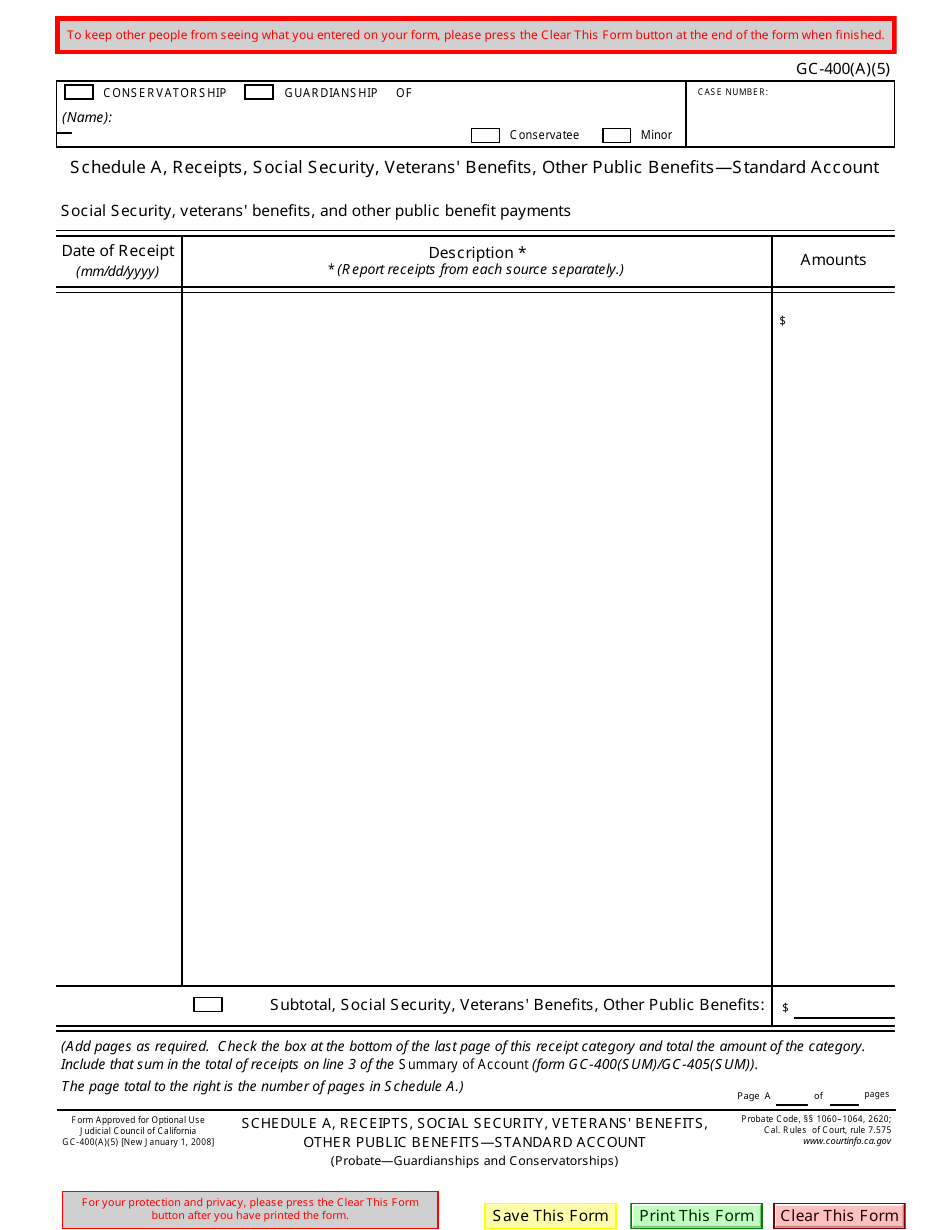

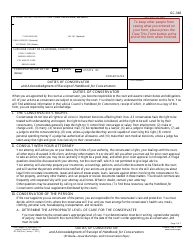

Form GC-400(A)(5) Schedule A Receipts, Social Security, Veterans' Benefits, Other Public Benefits - Standard Account - California

What Is Form GC-400(A)(5) Schedule A?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(A)(5) Schedule A Receipts?

A: GC-400(A)(5) Schedule A Receipts is a form used in California for reporting income, specifically for Social Security, Veterans' Benefits, and Other Public Benefits.

Q: What type of income is reported on GC-400(A)(5) Schedule A Receipts?

A: GC-400(A)(5) Schedule A Receipts is used to report income from Social Security, Veterans' Benefits, and Other Public Benefits.

Q: What is a Standard Account?

A: Standard Account refers to a regular checking or savings account in which funds are deposited and accessed by the account holder.

Q: What is a California GC-400(A)(5) Schedule A Receipts used for?

A: GC-400(A)(5) Schedule A Receipts is used in California to report income from Social Security, Veterans' Benefits, and Other Public Benefits for the purpose of determining eligibility for certain assistance programs.

Q: What is considered as Other Public Benefits?

A: Other Public Benefits include any additional income or benefits received from public sources, such as unemployment benefits, disability benefits, or welfare benefits.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(A)(5) Schedule A by clicking the link below or browse more documents and templates provided by the California Judicial Branch.