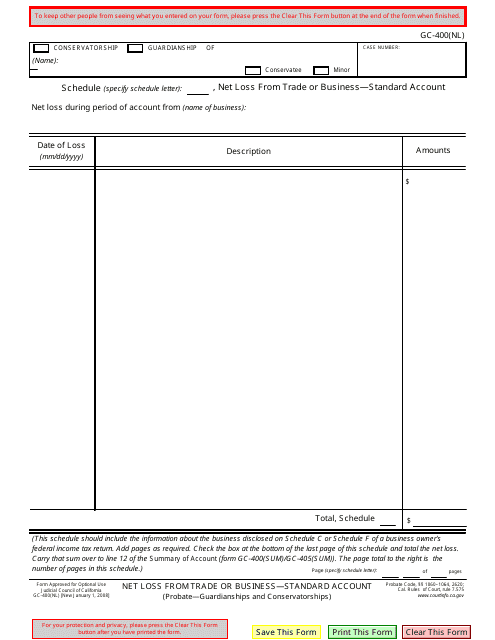

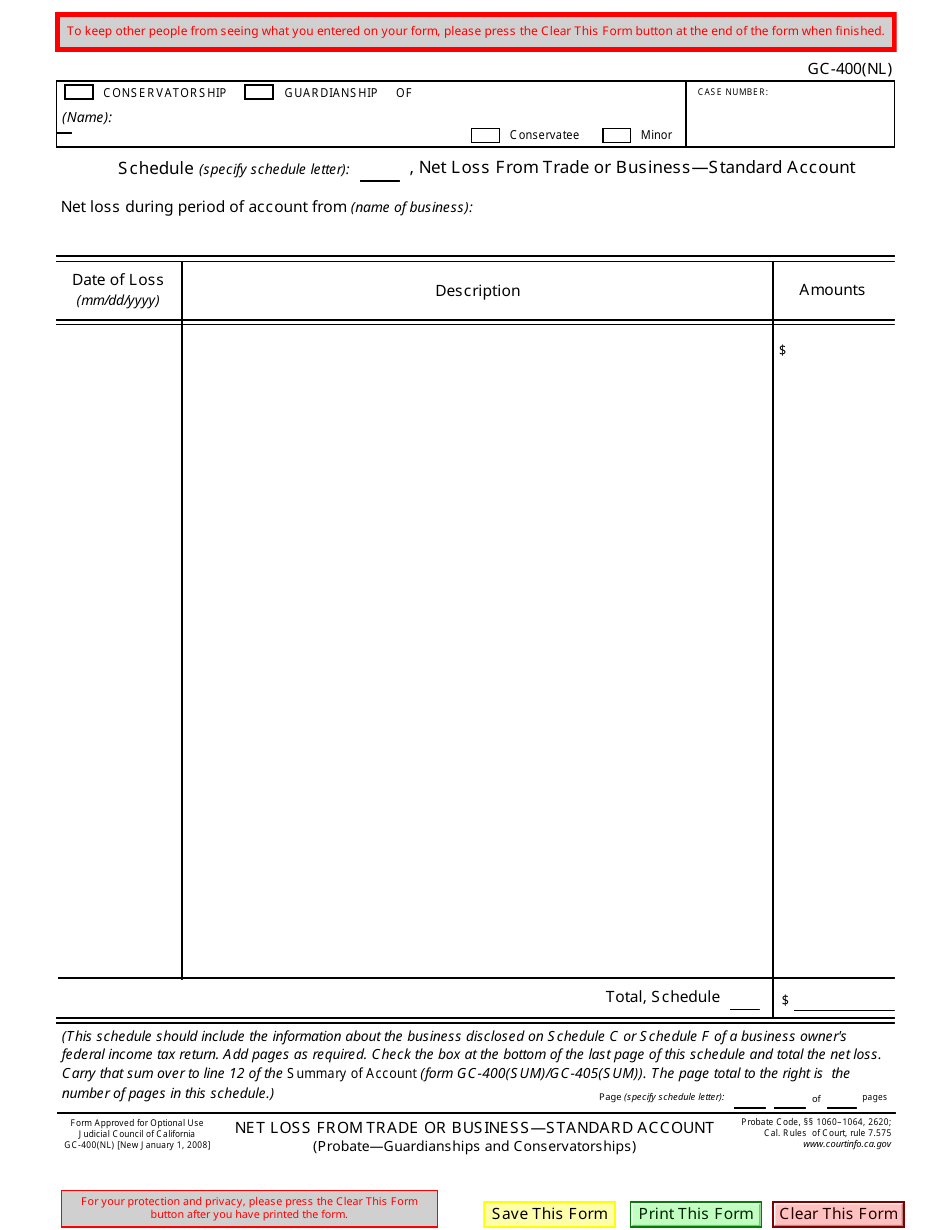

Form GC-400(NL) Net Loss From Trade or Business -standard Account - California

What Is Form GC-400(NL)?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(NL)?

A: GC-400(NL) is a form used by businesses in California to report their net loss from trade or business.

Q: What is a net loss from trade or business?

A: Net loss from trade or business refers to the amount by which total expenses exceed total revenues in a business.

Q: Who needs to file GC-400(NL)?

A: Businesses in California that have experienced a net loss from trade or business during the tax year need to file GC-400(NL).

Q: What is the standard account method?

A: The standard account method is a method of accounting where business transactions are recorded based on the actual cash flows.

Q: What is California?

A: California is a state located on the West Coast of the United States.

Q: Is GC-400(NL) specific to California?

A: Yes, GC-400(NL) is specifically used by businesses in California.

Q: Is there a deadline for filing GC-400(NL)?

A: Yes, the deadline for filing GC-400(NL) is the same as the deadline for filing the California income tax return, which is usually April 15th.

Q: Can I claim a net loss from trade or business as a deduction?

A: Yes, a net loss from trade or business can be used as a deduction to reduce taxable income.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(NL) by clicking the link below or browse more documents and templates provided by the California Judicial Branch.