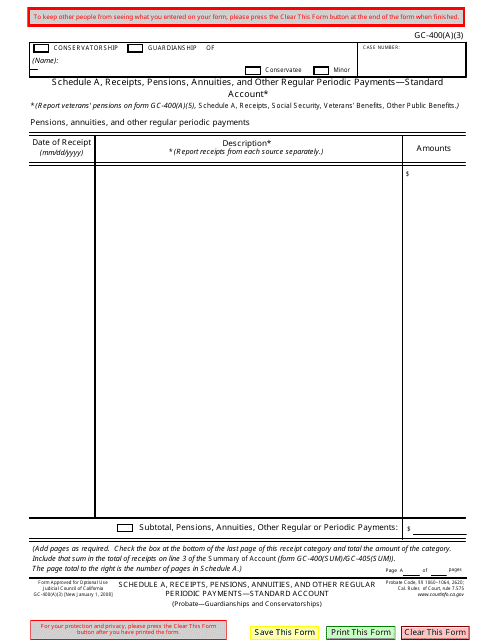

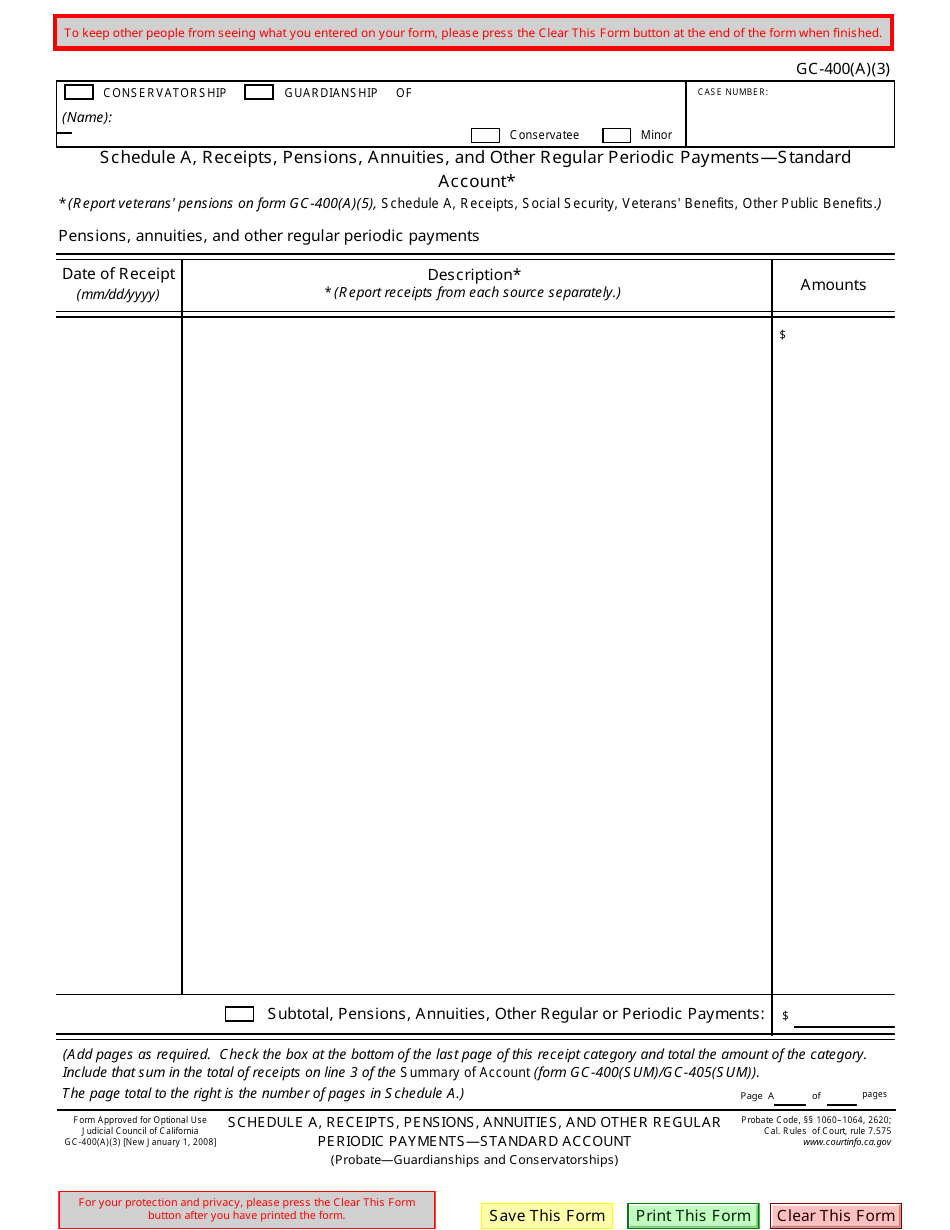

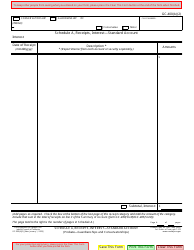

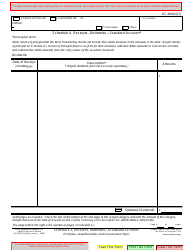

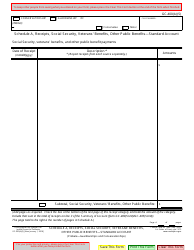

Form GC-400(A)(3) Schedule A Receipts, Pensions, Annuities, and Other Regular Periodic Payments - Standard Account - California

What Is Form GC-400(A)(3) Schedule A?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-400(A)(3)?

A: GC-400(A)(3) is a California Schedule A Receipts form that is used to report pensions, annuities, and other regular periodic payments.

Q: What is the purpose of GC-400(A)(3)?

A: The purpose of GC-400(A)(3) is to provide information about your pension, annuity, and other regular periodic payments.

Q: Who needs to file GC-400(A)(3)?

A: If you receive pensions, annuities, or other regular periodic payments in California, you may need to file GC-400(A)(3).

Q: What should be reported on GC-400(A)(3)?

A: You should report all your pensions, annuities, and other regular periodic payments on GC-400(A)(3).

Q: Is GC-400(A)(3) specific to California residents?

A: Yes, GC-400(A)(3) is specific to California residents who receive pensions, annuities, or other regular periodic payments.

Q: Can I use GC-400(A)(3) for other types of income?

A: No, GC-400(A)(3) is only for reporting pensions, annuities, and other regular periodic payments.

Q: When is the deadline to file GC-400(A)(3)?

A: The deadline to file GC-400(A)(3) is generally April 15th of the following year.

Q: Is there a penalty for late filing of GC-400(A)(3)?

A: Yes, there may be penalties for late filing of GC-400(A)(3), so it is important to file it on time.

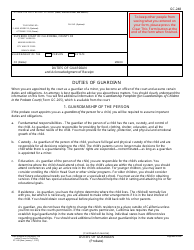

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(A)(3) Schedule A by clicking the link below or browse more documents and templates provided by the California Judicial Branch.