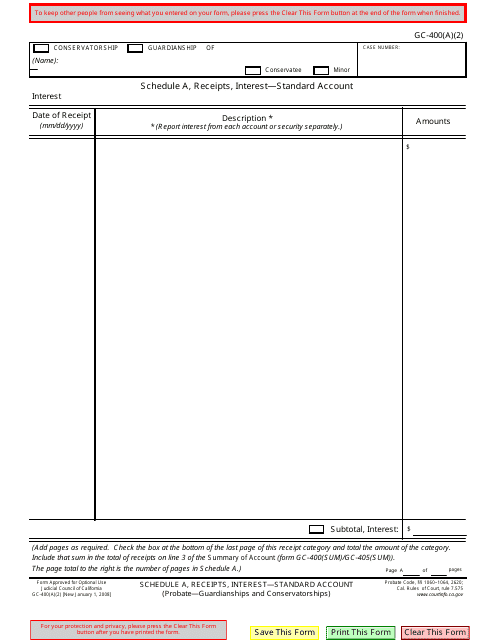

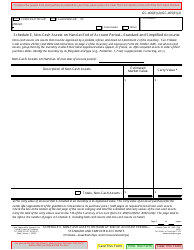

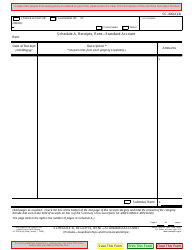

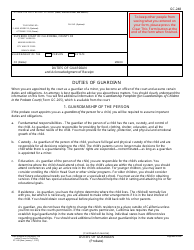

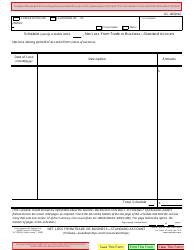

Form GC-400(A)(2) Schedule A Receipts, Interest - Standard Account - California

What Is Form GC-400(A)(2) Schedule A?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

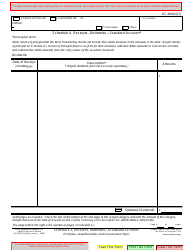

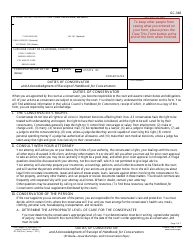

Q: What is GC-400(A)(2)?

A: GC-400(A)(2) is a form used for reporting receipts and interest in California.

Q: What is Schedule A?

A: Schedule A is a section on the GC-400(A)(2) form specifically for reporting receipts and interest.

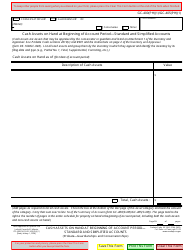

Q: What are receipts?

A: Receipts refer to the money received by an individual or organization.

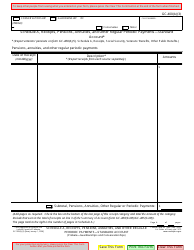

Q: What is interest?

A: Interest is the money paid by a borrower for the use of funds borrowed from a lender.

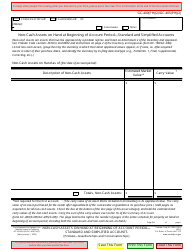

Q: What is a standard account?

A: A standard account refers to a regular non-specialized account that follows standard procedures and rules.

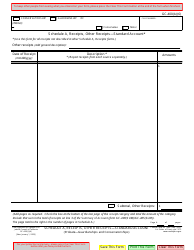

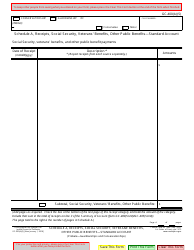

Q: What does 'California' refer to?

A: 'California' in this context refers to the specific jurisdiction for which the GC-400(A)(2) form is designed to be used.

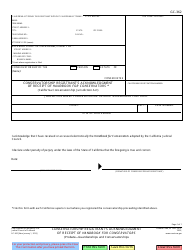

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC-400(A)(2) Schedule A by clicking the link below or browse more documents and templates provided by the California Judicial Branch.