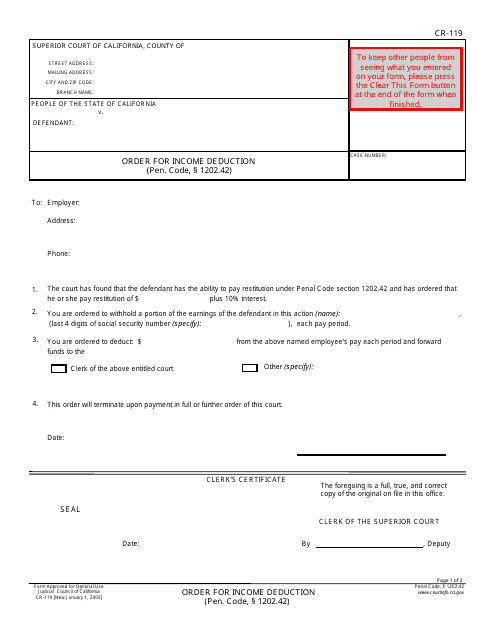

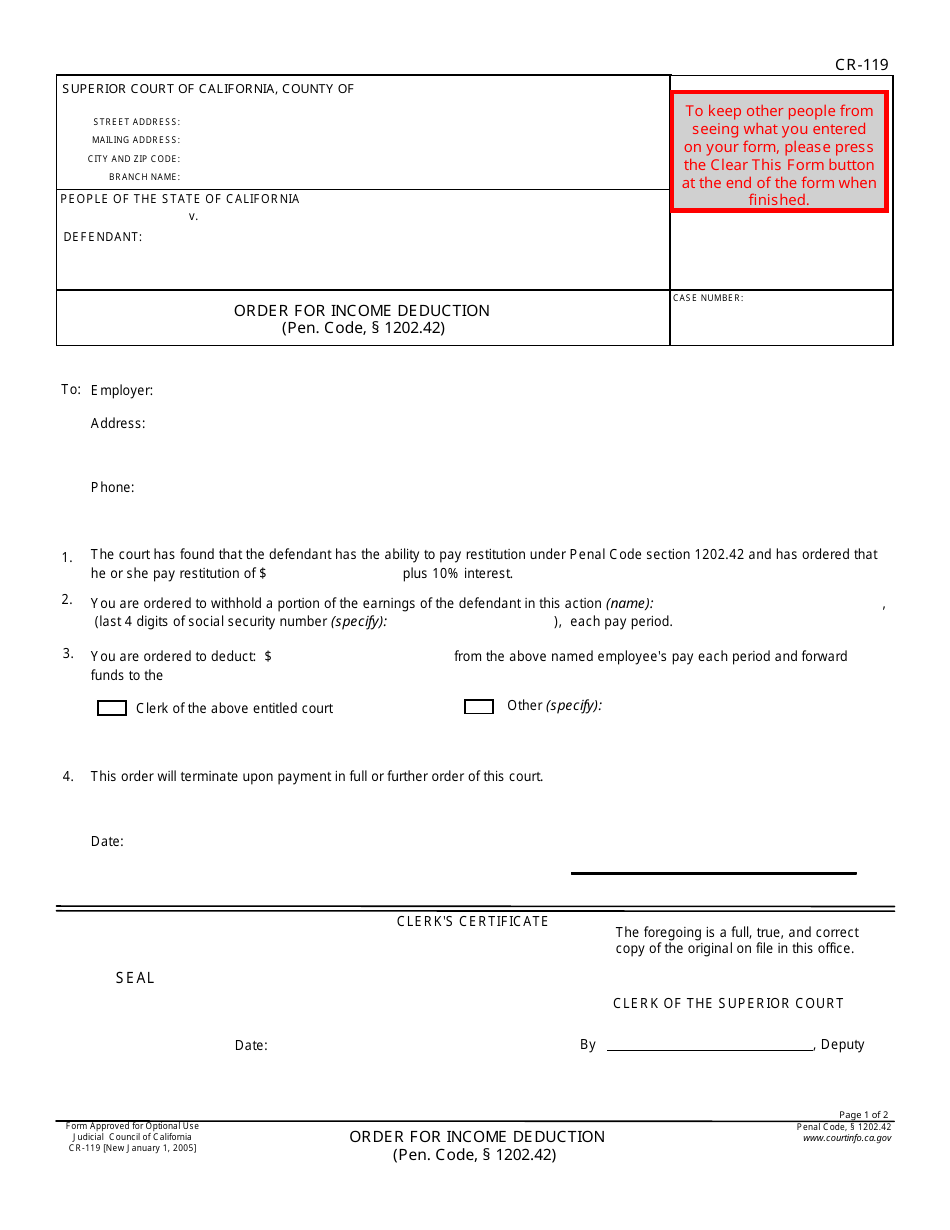

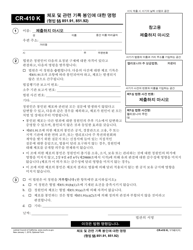

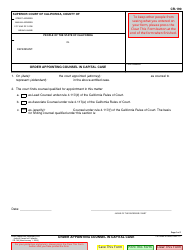

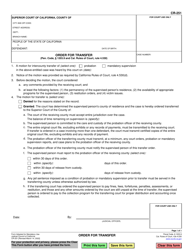

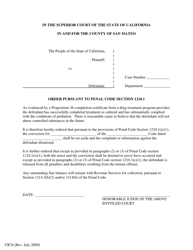

Form CR-119 Order for Income Deduction (Pen. Code, 1202.42) - California

What Is Form CR-119?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-119?

A: Form CR-119 is an Order for Income Deduction (Pen. Code, 1202.42) in California.

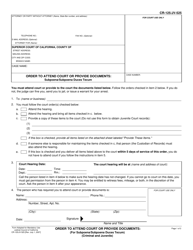

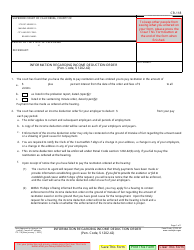

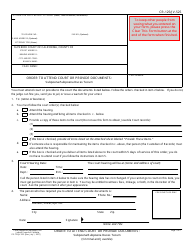

Q: What is the purpose of Form CR-119?

A: The purpose of Form CR-119 is to authorize income deduction for the payment of fines, fees, and restitution ordered by the court.

Q: What does Pen. Code, 1202.42 refer to?

A: Pen. Code, 1202.42 is the California Penal Code section that allows the court to issue an income deduction order.

Q: Who can file Form CR-119?

A: Form CR-119 can be filed by the court, the probation department, or the district attorney's office.

Q: What information is required on Form CR-119?

A: Form CR-119 requires the individual's personal information, employer information, and details about the fines, fees, or restitution to be deducted.

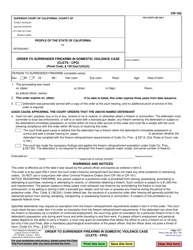

Q: Can the income deduction order be stopped or modified?

A: Yes, the income deduction order can be stopped or modified by the court upon request and appropriate circumstances.

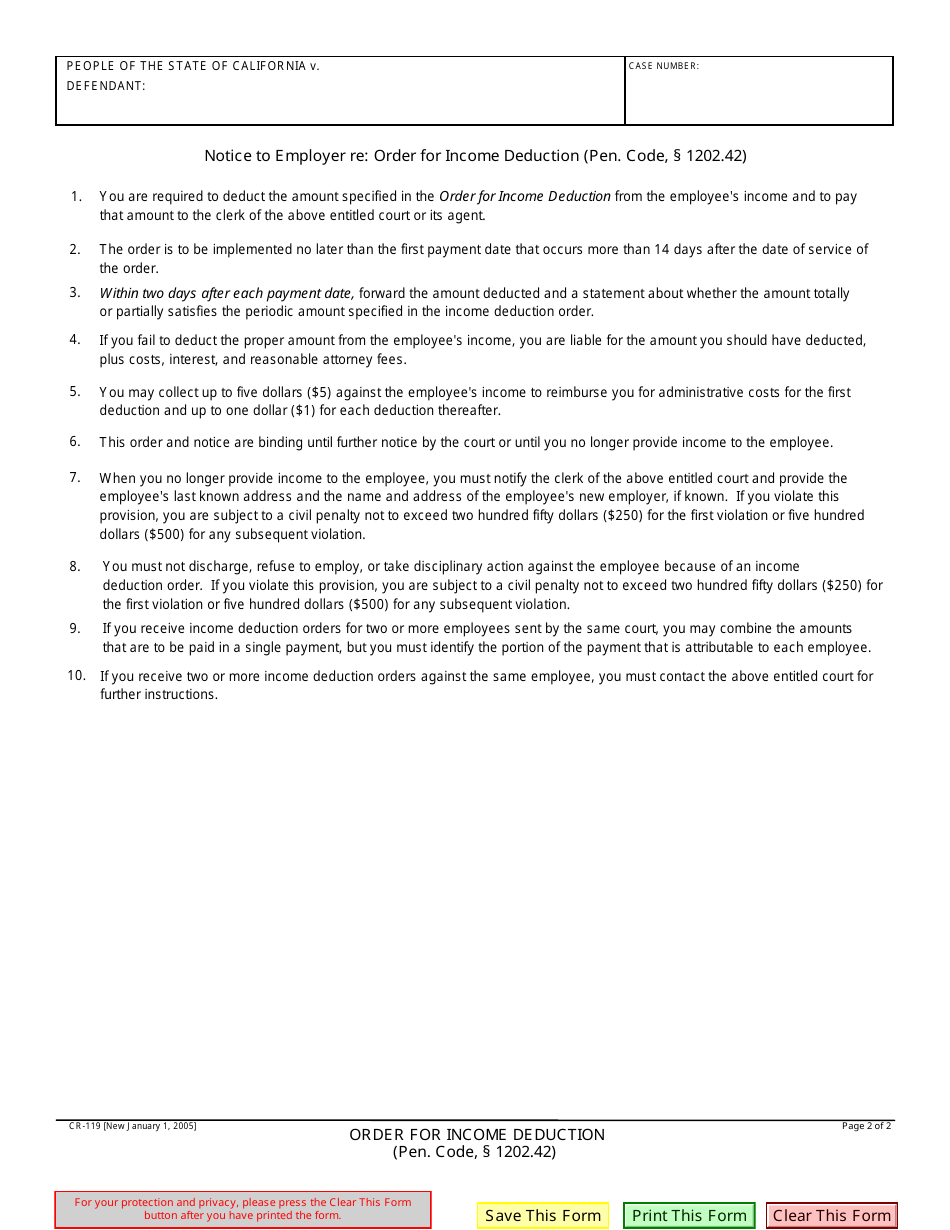

Q: What happens if the individual changes jobs?

A: If the individual changes jobs, they need to inform the court and provide their new employer's information.

Q: Is Form CR-119 specific to California only?

A: Yes, Form CR-119 is specific to California and is not applicable in other states.

Q: Is there a fee to file Form CR-119?

A: There is no fee to file Form CR-119.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-119 by clicking the link below or browse more documents and templates provided by the California Superior Court.