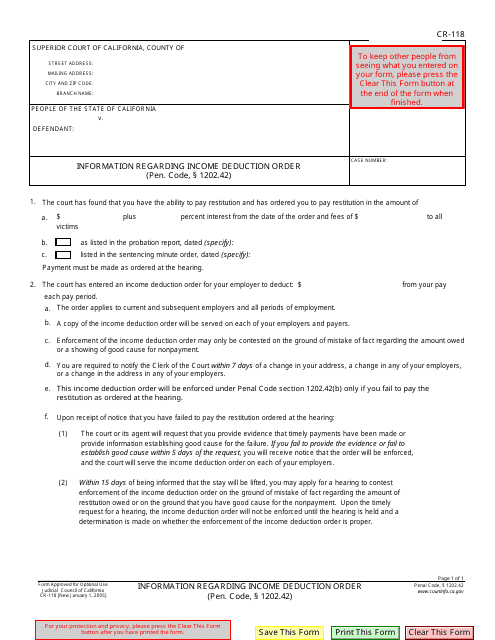

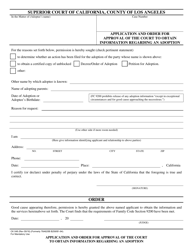

Form CR-118 Information Regarding Income Deduction Order (Pen. Code,1202.42) - California

What Is Form CR-118?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-118?

A: Form CR-118 is a document used in California to gather information about an income deduction order.

Q: What is an income deduction order?

A: An income deduction order is a legal order that requires an employer to withhold a certain amount of an employee's income to be used for the payment of certain debts or obligations.

Q: Who can use Form CR-118?

A: Form CR-118 is typically used by agencies or organizations that are seeking to enforce support orders or collect certain debts.

Q: What is the purpose of Form CR-118?

A: The purpose of Form CR-118 is to gather information about the debtor's employment and income that is necessary for the enforcement of an income deduction order.

Q: Is Form CR-118 specific to California?

A: Yes, Form CR-118 is specific to California and is used in accordance with California Penal Code Section 1202.42.

Q: How should I fill out Form CR-118?

A: The form should be completed with accurate and current information about the debtor's employment and income. It is important to provide all requested details to ensure proper enforcement.

Q: What happens after Form CR-118 is filed?

A: After Form CR-118 is filed, the court or agency will review the information provided and determine the appropriate amount to be withheld from the debtor's income.

Q: Can the debtor challenge an income deduction order?

A: Yes, the debtor has the right to challenge an income deduction order by following the appropriate legal procedures.

Q: What are the consequences of non-compliance with an income deduction order?

A: Non-compliance with an income deduction order can result in penalties, including fines or even imprisonment.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-118 by clicking the link below or browse more documents and templates provided by the California Superior Court.