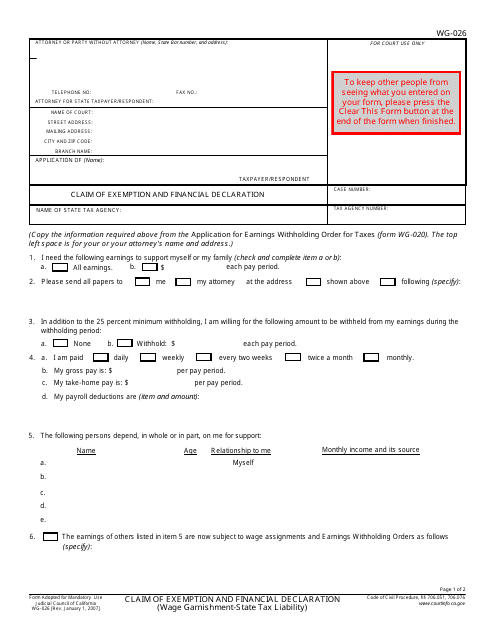

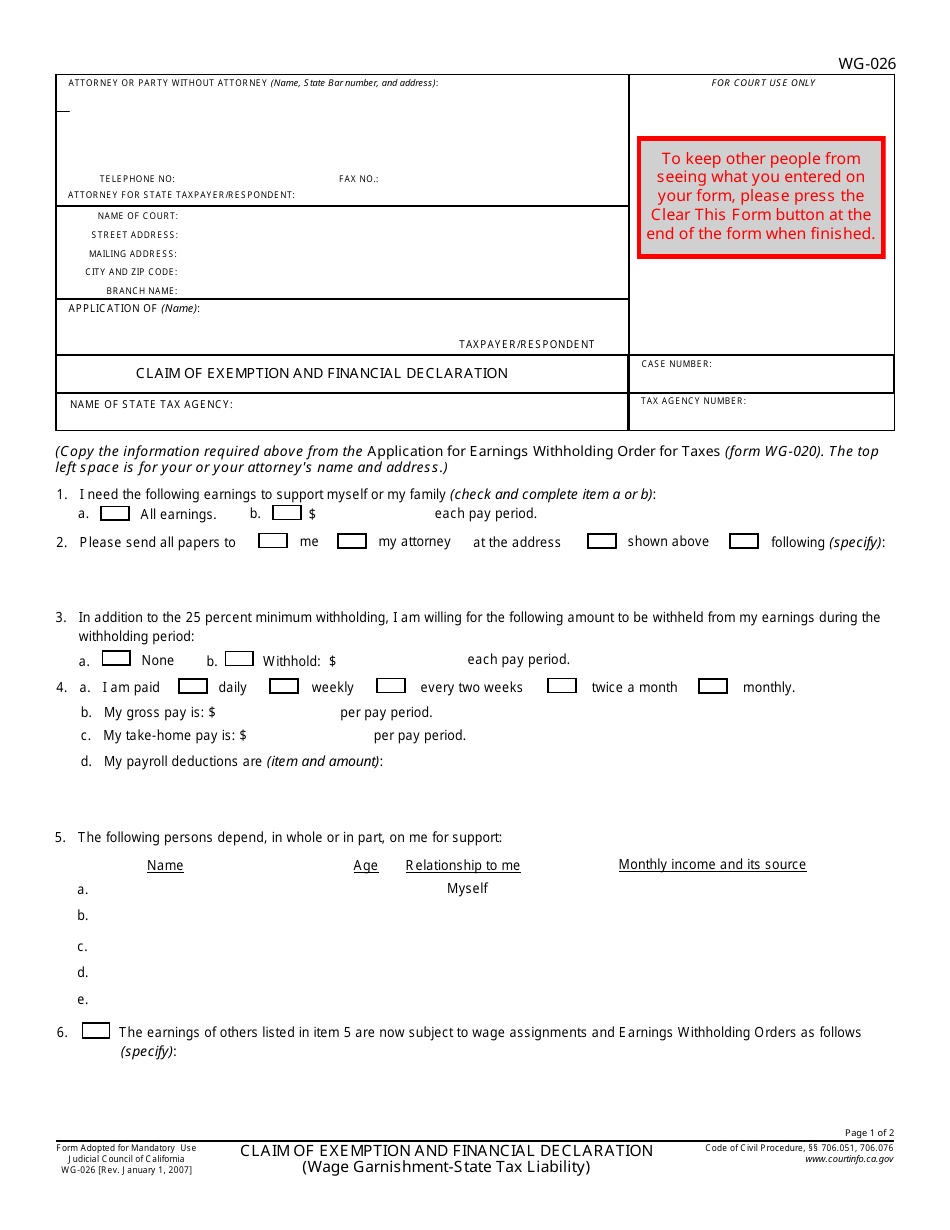

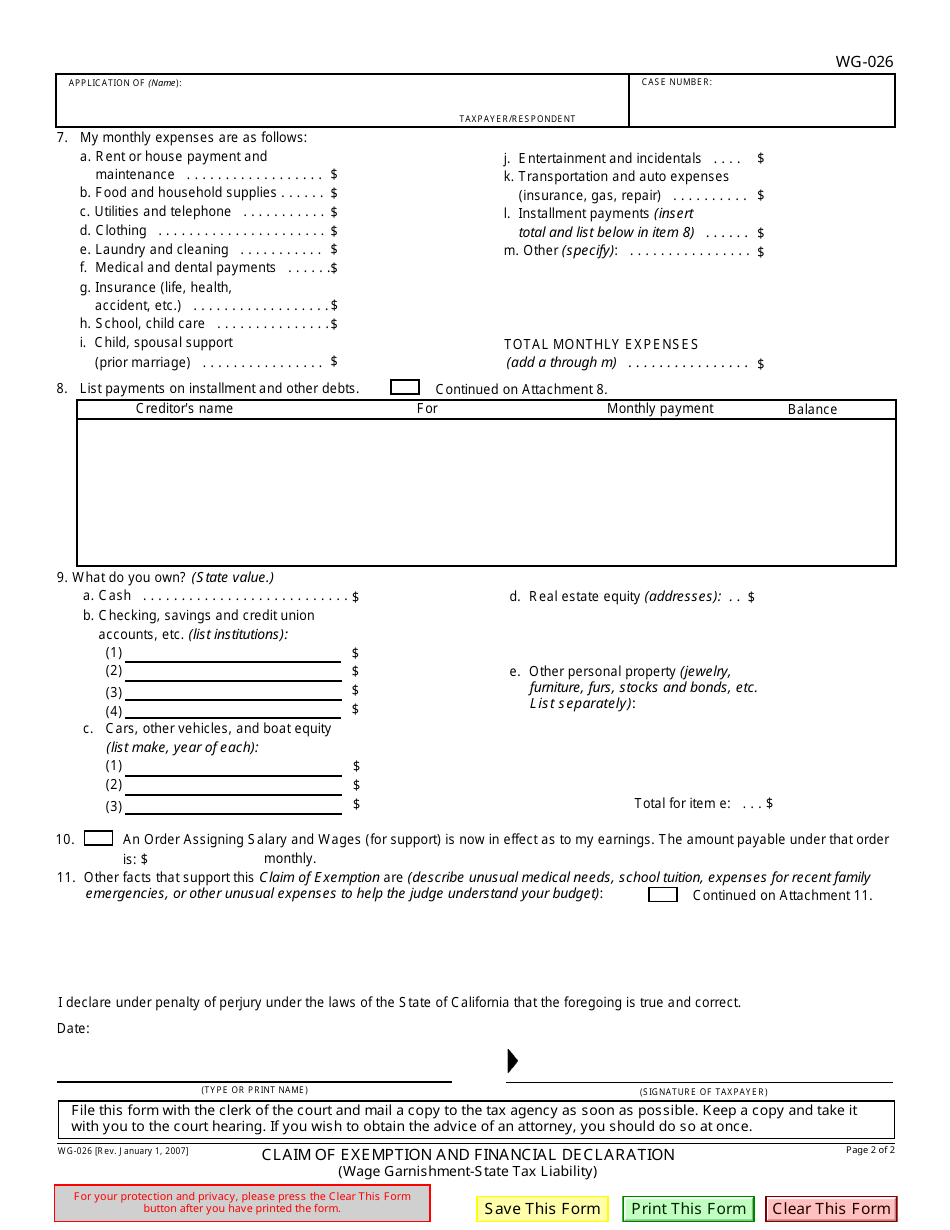

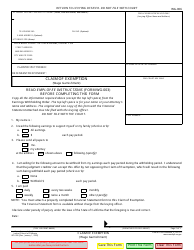

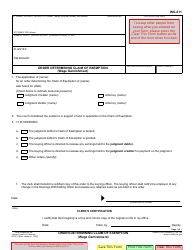

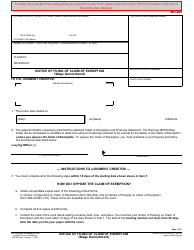

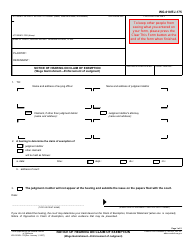

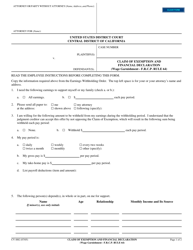

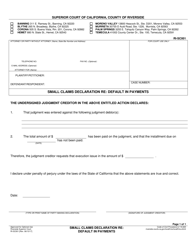

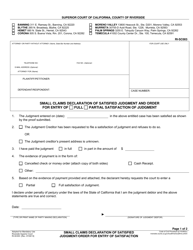

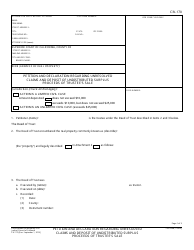

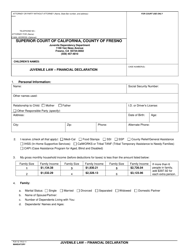

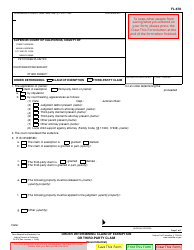

Form WG-026 Claim of Exemption and Financial Declaration (State Tax Liability) - California

What Is Form WG-026?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WG-026?

A: Form WG-026 is a Claim of Exemption and Financial Declaration form specifically for state tax liability in California.

Q: When is Form WG-026 used?

A: Form WG-026 is used when someone wants to claim exemption from state tax liability in California and provide a financial declaration.

Q: Who can use Form WG-026?

A: Any individual or business who wants to claim exemption from state tax liability in California and provide a financial declaration can use Form WG-026.

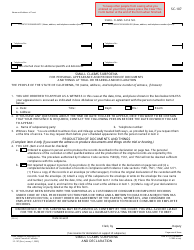

Q: Is there a deadline to submit Form WG-026?

A: Yes, there is a deadline to submit Form WG-026. It must be submitted within a specific timeframe mentioned on the form or as directed by the California FTB.

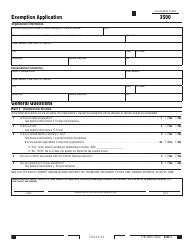

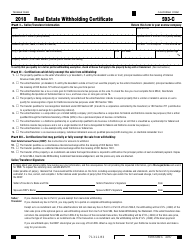

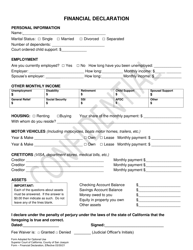

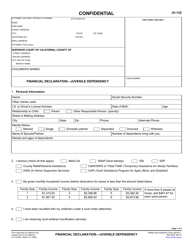

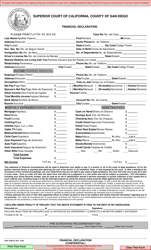

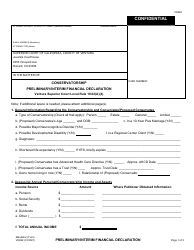

Q: What information is required in Form WG-026?

A: Form WG-026 requires information such as personal details, income information, asset information, and details about the claimed exemption.

Q: Are there any fees to submit Form WG-026?

A: No, there are no fees associated with submitting Form WG-026.

Q: What should I do after submitting Form WG-026?

A: After submitting Form WG-026, it is important to keep a copy for your records and follow any instructions or further actions mentioned by the California FTB.

Q: What happens after submitting Form WG-026?

A: After submitting Form WG-026, the California FTB will review the form and any supporting documents provided to determine the validity of the claimed exemption.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WG-026 by clicking the link below or browse more documents and templates provided by the California Judicial Branch.