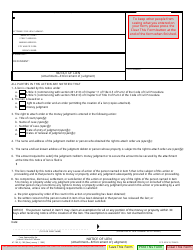

This version of the form is not currently in use and is provided for reference only. Download this version of

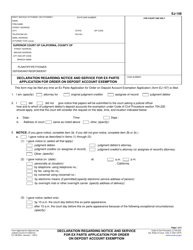

Form EJ-150

for the current year.

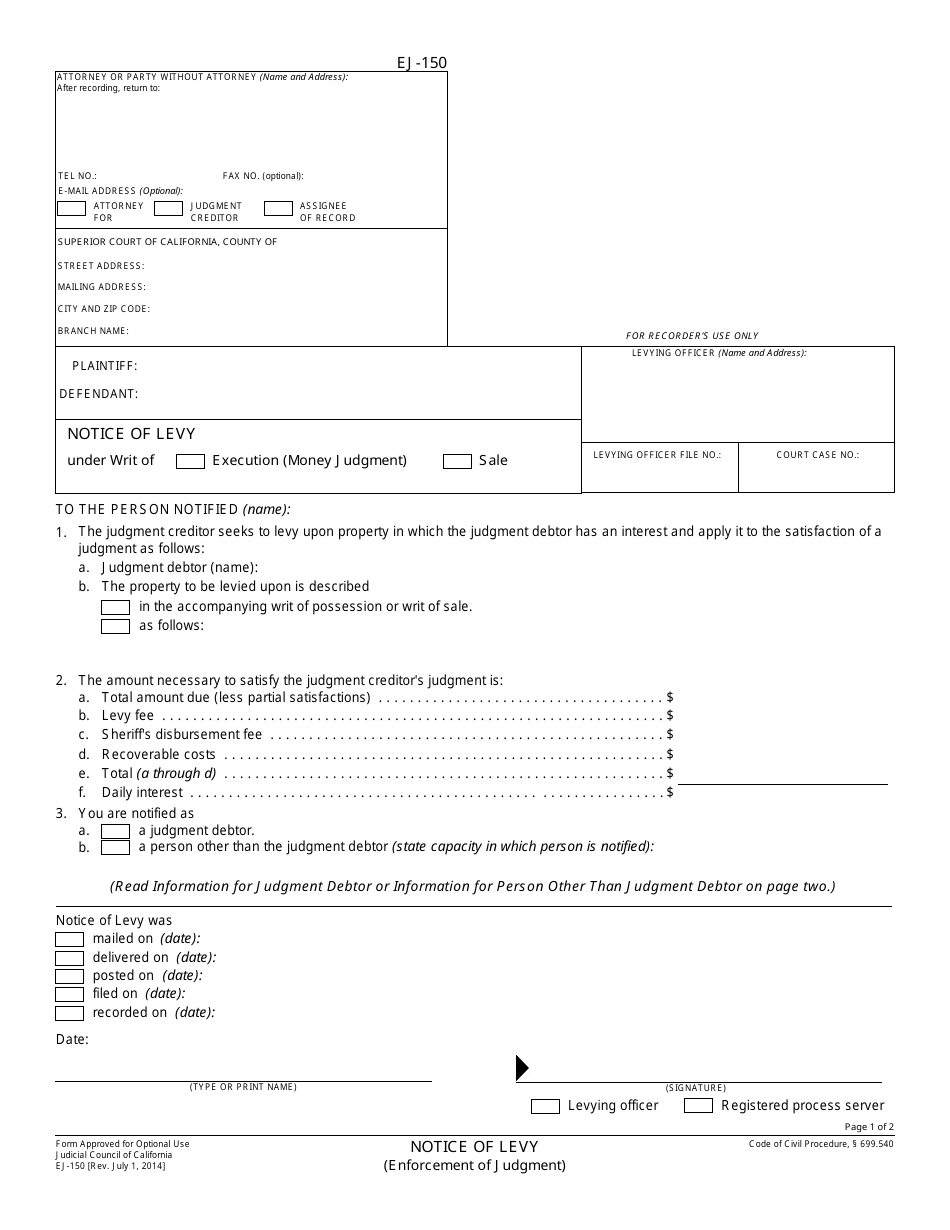

Form EJ-150 Notice of Levy - California

What Is Form EJ-150?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

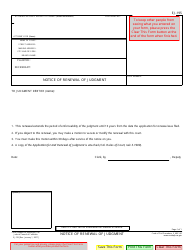

Q: What is Form EJ-150?

A: Form EJ-150 is a Notice of Levy used in California.

Q: What is a Notice of Levy?

A: A Notice of Levy is a legal document that allows a creditor to seize property or assets to satisfy a debt.

Q: Who uses Form EJ-150?

A: Form EJ-150 is used by creditors in California to notify debtors of their intention to levy their property.

Q: What information is included in Form EJ-150?

A: Form EJ-150 includes information about the creditor, debtor, the amount owed, and details of the property to be seized.

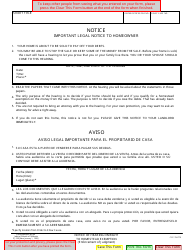

Q: How is Form EJ-150 delivered to the debtor?

A: Form EJ-150 is typically delivered to the debtor in person or by certified mail.

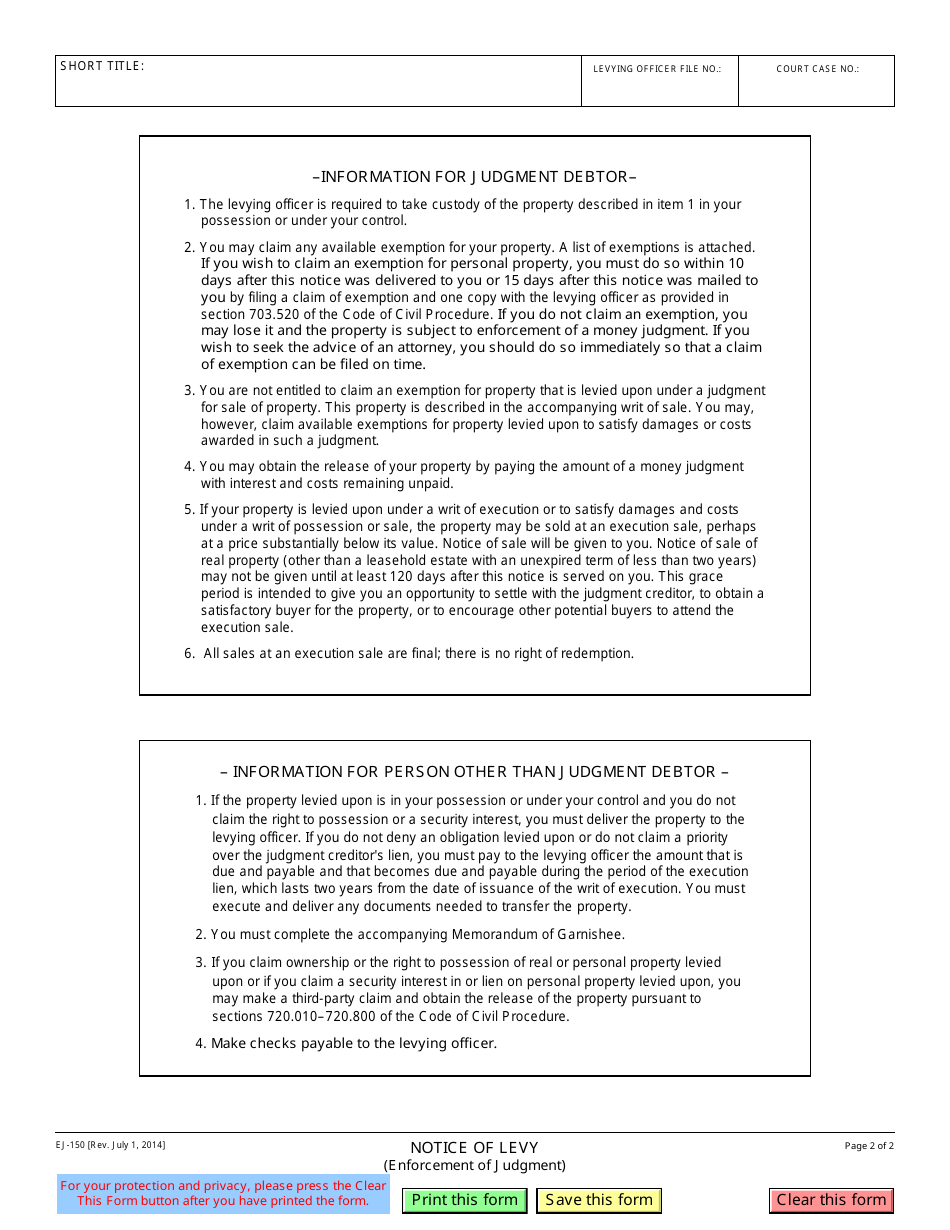

Q: What should the debtor do upon receiving Form EJ-150?

A: The debtor should carefully review the form and seek legal advice if necessary. They may have options to prevent the seizure of their property.

Q: Can the debtor challenge a Notice of Levy?

A: Yes, the debtor can challenge a Notice of Levy by filing a claim of exemption or requesting a hearing.

Q: What happens if the debtor does not respond to Form EJ-150?

A: If the debtor does not respond to Form EJ-150, the creditor may proceed with the seizure of the specified property.

Q: Can a Notice of Levy be removed?

A: A Notice of Levy can be removed if the debt is paid in full or if the debtor successfully challenges the seizure.

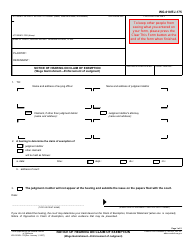

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EJ-150 by clicking the link below or browse more documents and templates provided by the California Superior Court.