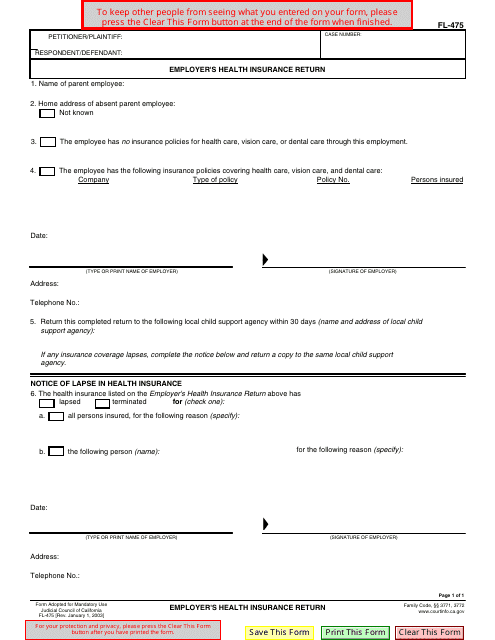

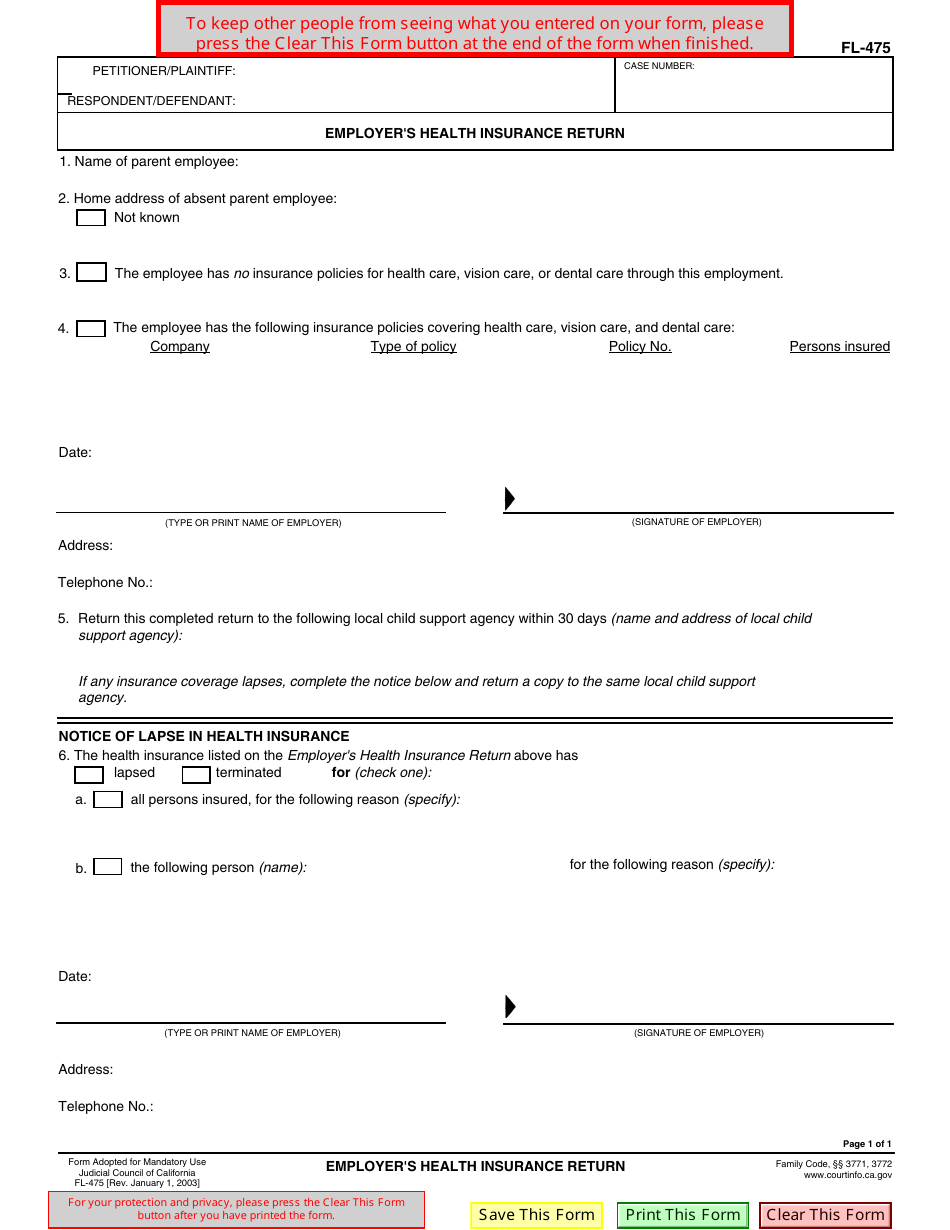

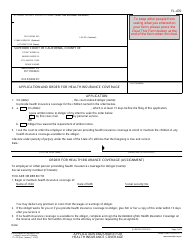

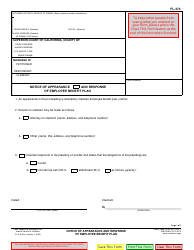

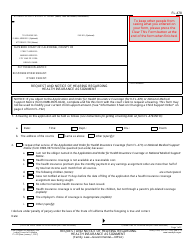

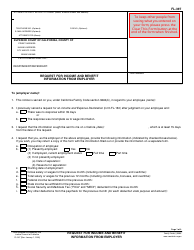

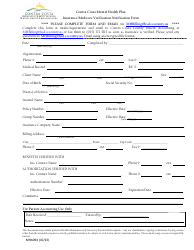

Form FL-475 Employer's Health Insurance Return - California

What Is Form FL-475?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FL-475?

A: Form FL-475 is the Employer's Health Insurance Return in California.

Q: Who needs to file Form FL-475?

A: Employers in California who provide health insurance to their employees are required to file Form FL-475.

Q: What information is required on Form FL-475?

A: Form FL-475 requires employers to provide information about the health insurance coverage offered to their employees, including the number of employees covered and the premiums paid.

Q: When is Form FL-475 due?

A: Form FL-475 is typically due by April 15th of each year.

Q: Are there any penalties for not filing Form FL-475?

A: Yes, there can be penalties for not filing Form FL-475 or for filing it late. It is important to comply with the filing requirements to avoid these penalties.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FL-475 by clicking the link below or browse more documents and templates provided by the California Judicial Branch.