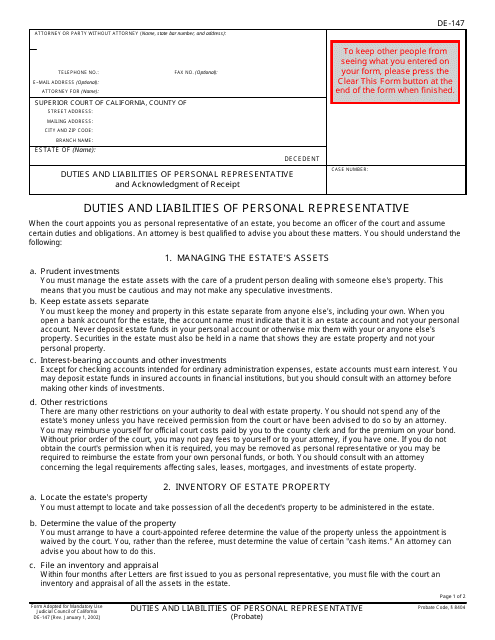

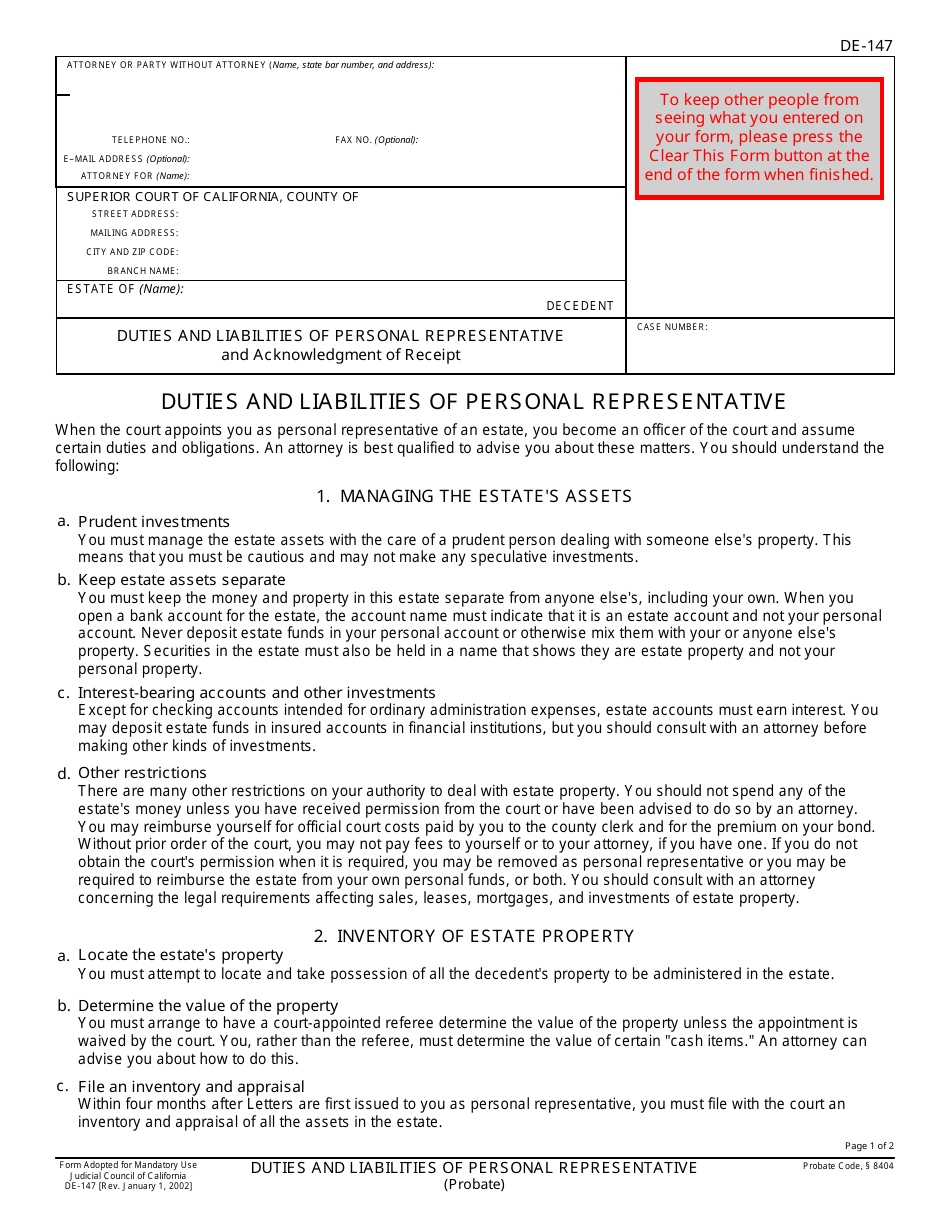

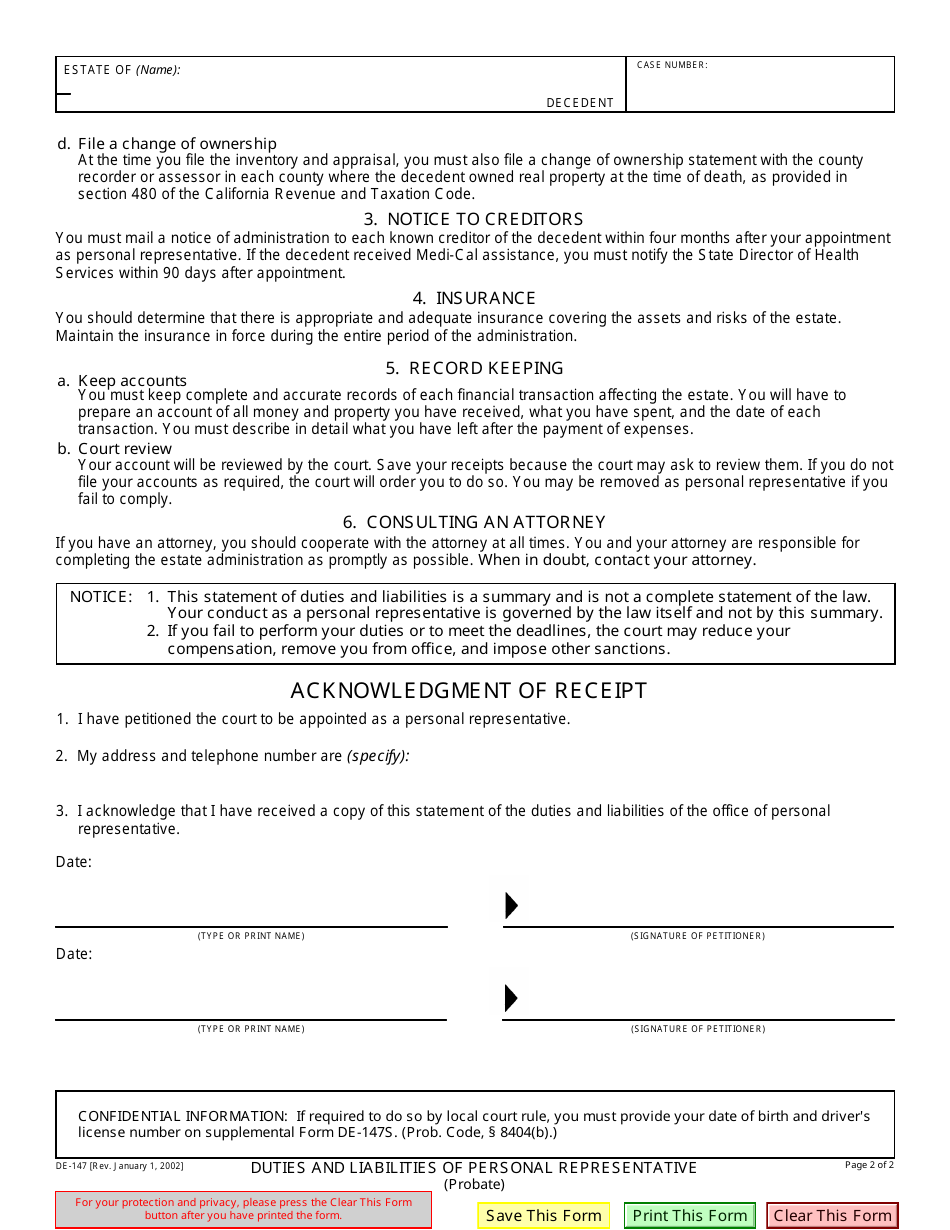

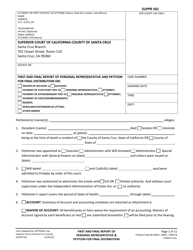

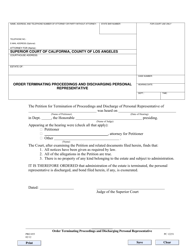

Form DE-147 Duties and Liabilities of Personal Representative - California

What Is Form DE-147?

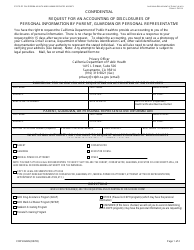

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DE-147?

A: Form DE-147 is used in California to outline the duties and liabilities of a personal representative.

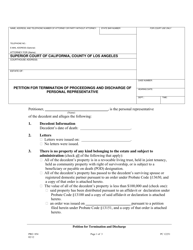

Q: Who is a personal representative?

A: A personal representative is an individual responsible for administering the estate of a deceased person.

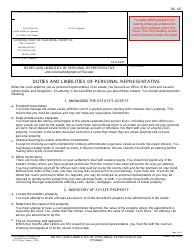

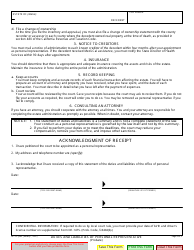

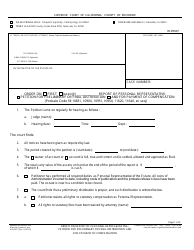

Q: What are the duties of a personal representative?

A: The duties of a personal representative include managing the assets and debts of the estate, distributing the assets to beneficiaries, and filing tax returns for the estate.

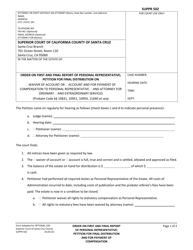

Q: What are the liabilities of a personal representative?

A: Liabilities of a personal representative may include potential legal actions against them if they fail to fulfill their duties in a competent and timely manner.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-147 by clicking the link below or browse more documents and templates provided by the California Superior Court.