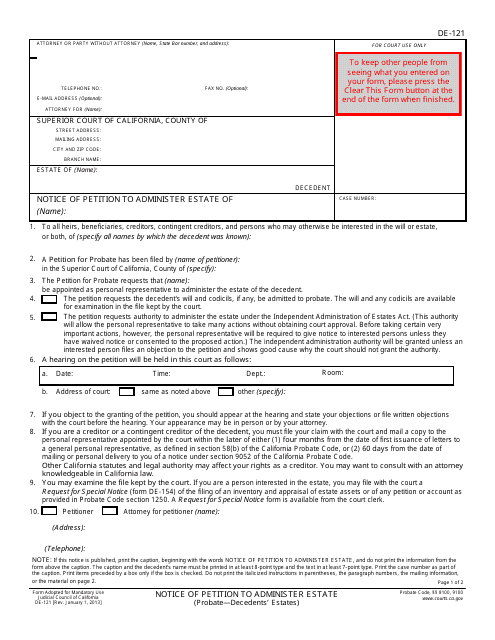

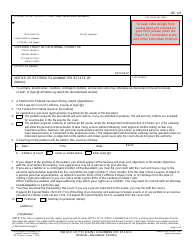

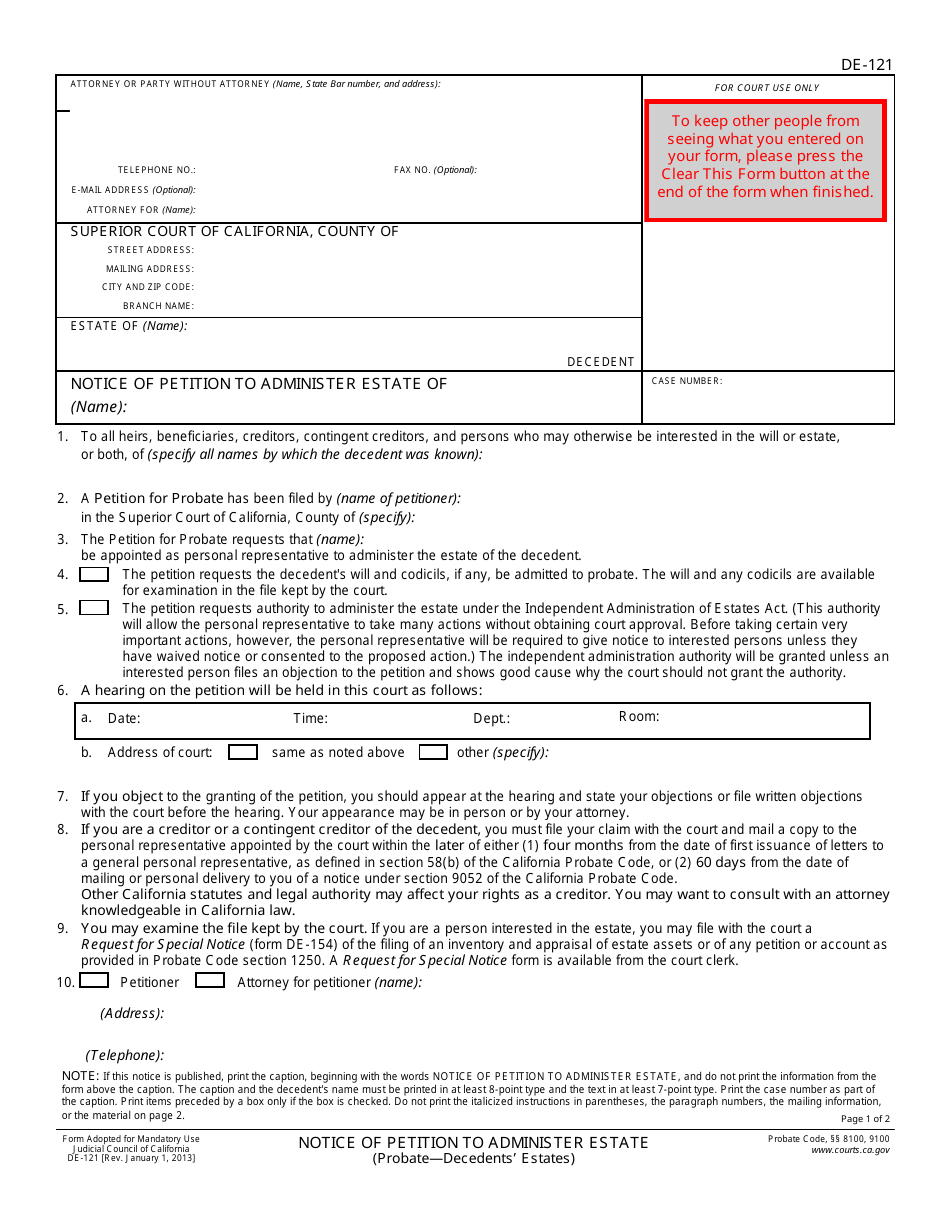

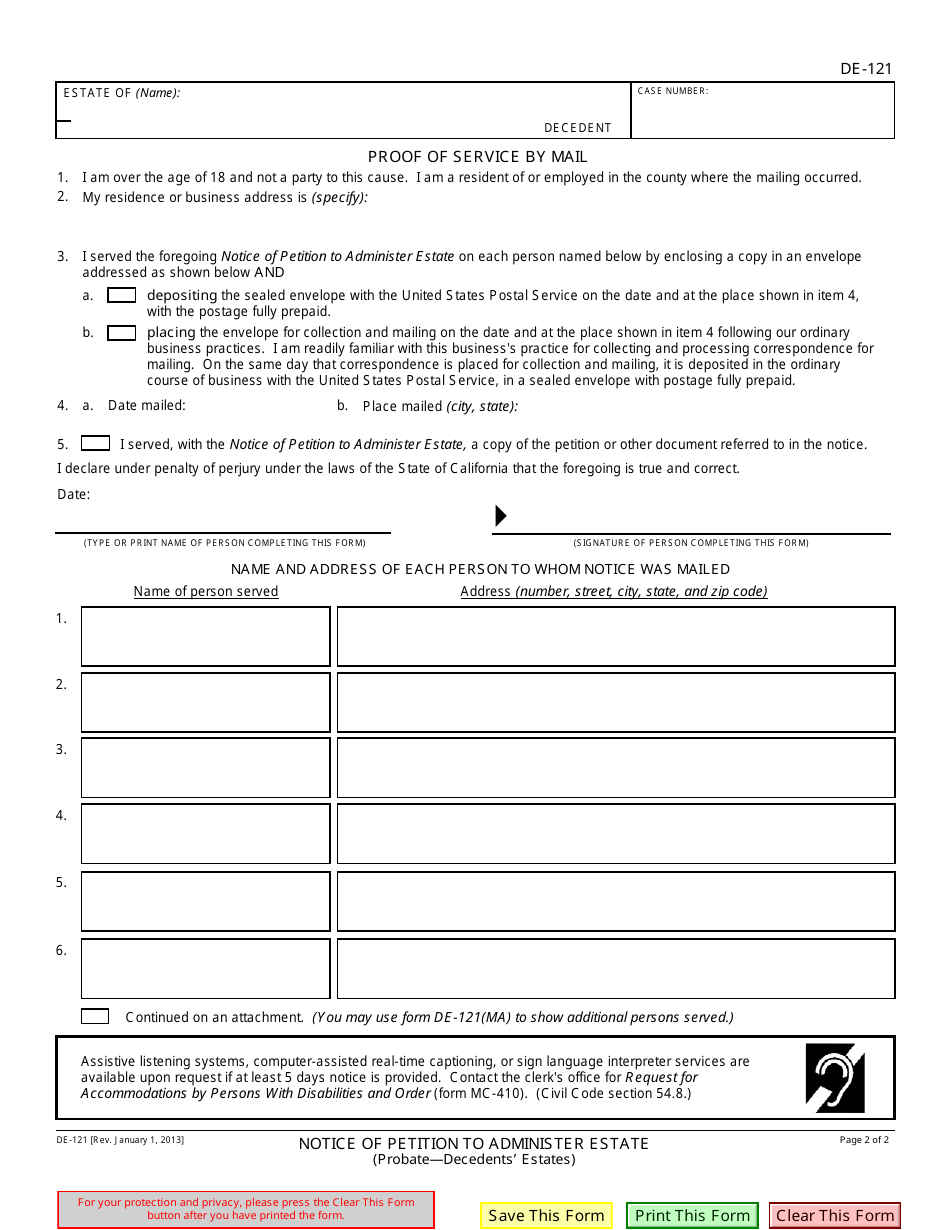

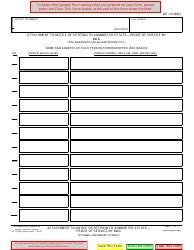

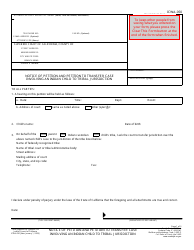

Form DE-121 Notice of Petition to Administer Estate - California

What Is Form DE-121?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE-121?

A: Form DE-121 is the Notice of Petition to Administer Estate in California.

Q: What is the purpose of Form DE-121?

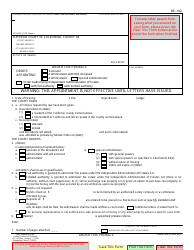

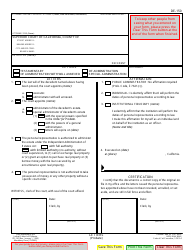

A: The purpose of Form DE-121 is to notify interested parties that a petition has been filed to administer an estate in California.

Q: Who needs to file Form DE-121?

A: The person seeking to administer the estate needs to file Form DE-121.

Q: Are there any fees associated with filing Form DE-121?

A: Yes, there are filing fees associated with filing Form DE-121. The amount of the fees may vary depending on the county where you are filing.

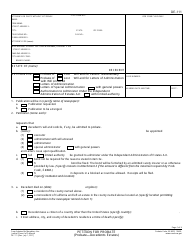

Q: What information is required to be included in Form DE-121?

A: Form DE-121 requires information about the deceased person, the petitioner, the proposed administrator, and any named beneficiaries or creditors.

Q: When should Form DE-121 be filed?

A: Form DE-121 should be filed as soon as possible after the death of the person whose estate is being administered.

Q: What happens after Form DE-121 is filed?

A: After Form DE-121 is filed, a hearing will be scheduled, and interested parties will be notified of the hearing.

Q: What if I need help completing Form DE-121?

A: If you need assistance in completing Form DE-121, you may consider seeking the help of an attorney or a legal document preparation service.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-121 by clicking the link below or browse more documents and templates provided by the California Superior Court.