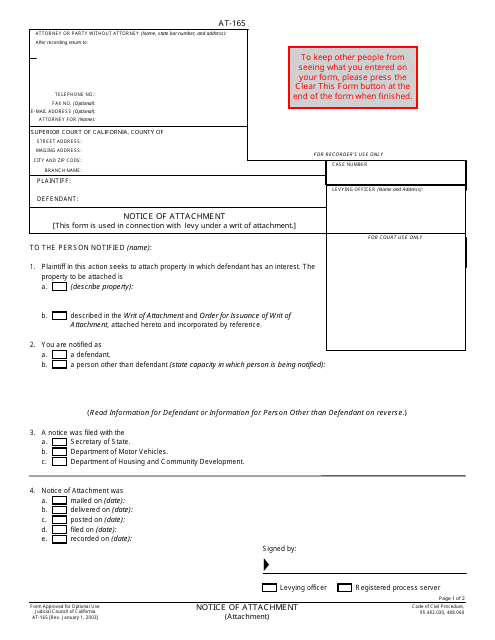

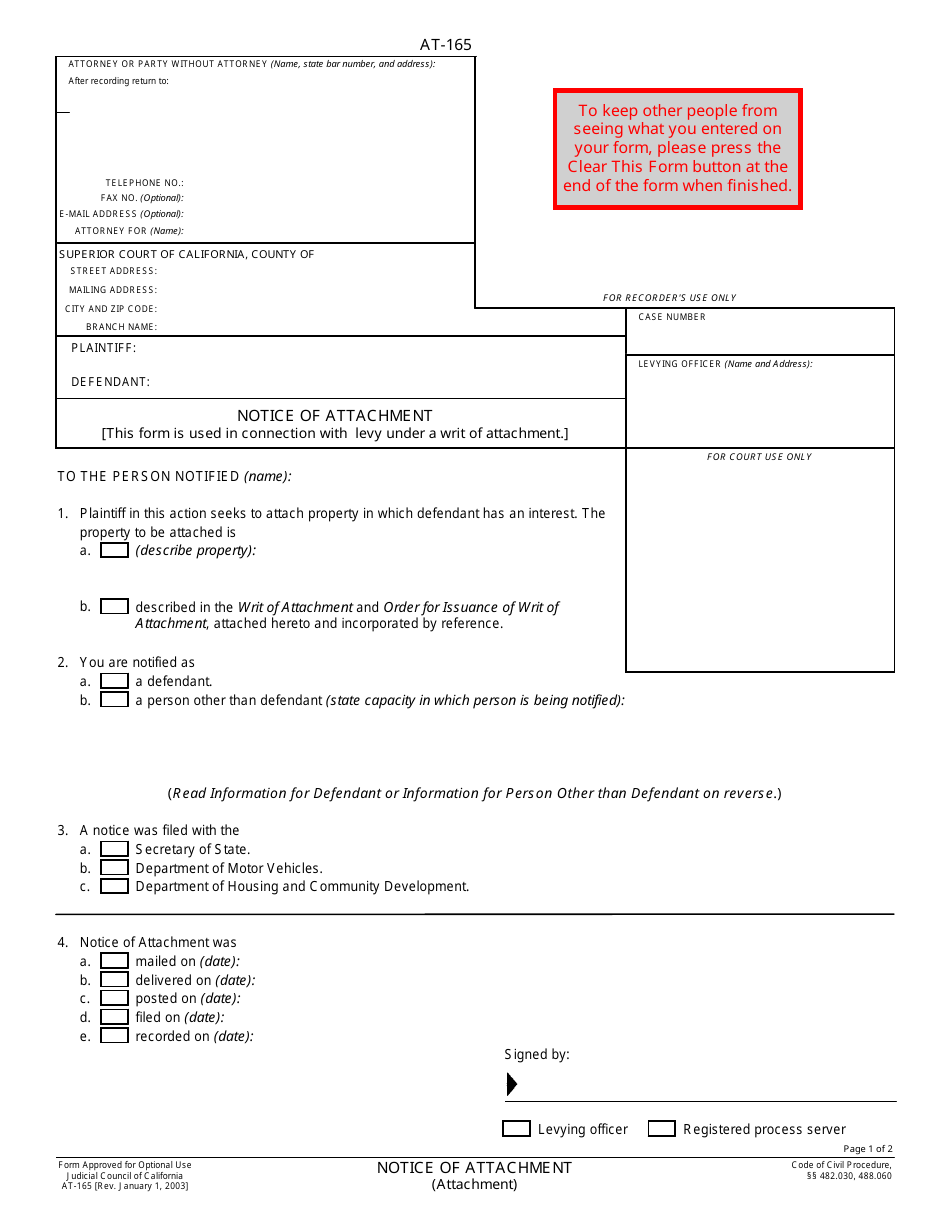

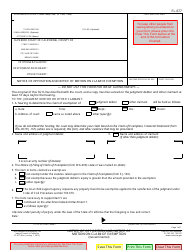

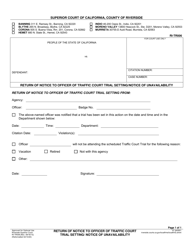

Form AT-165 Notice of Attachment - California

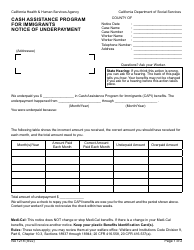

What Is Form AT-165?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AT-165?

A: Form AT-165 is a Notice of Attachment form used in California.

Q: What is the purpose of Form AT-165?

A: The purpose of Form AT-165 is to notify the debtor's employer or other third-party to withhold wages or funds due to the debtor and remit them to the creditor.

Q: Who uses Form AT-165?

A: Creditors in California use Form AT-165 to notify the debtor's employer or other third-party about the attachment of wages or funds.

Q: What information is required on Form AT-165?

A: Form AT-165 requires information such as the debtor's name, address, employer's name and address, and the amount to be withheld.

Q: What should I do with Form AT-165 once completed?

A: Once completed, Form AT-165 should be filed with the court clerk's office and served on the debtor's employer or other third-party.

Q: Is there a fee for filing Form AT-165?

A: There may be a filing fee associated with submitting Form AT-165, depending on the court's fee schedule.

Q: Can I use Form AT-165 in states other than California?

A: No, Form AT-165 is specific to California and cannot be used in other states.

Q: What happens after Form AT-165 is filed?

A: After Form AT-165 is filed and served, the debtor's employer or other third-party is required to withhold the specified amount and remit it to the creditor until further notice.

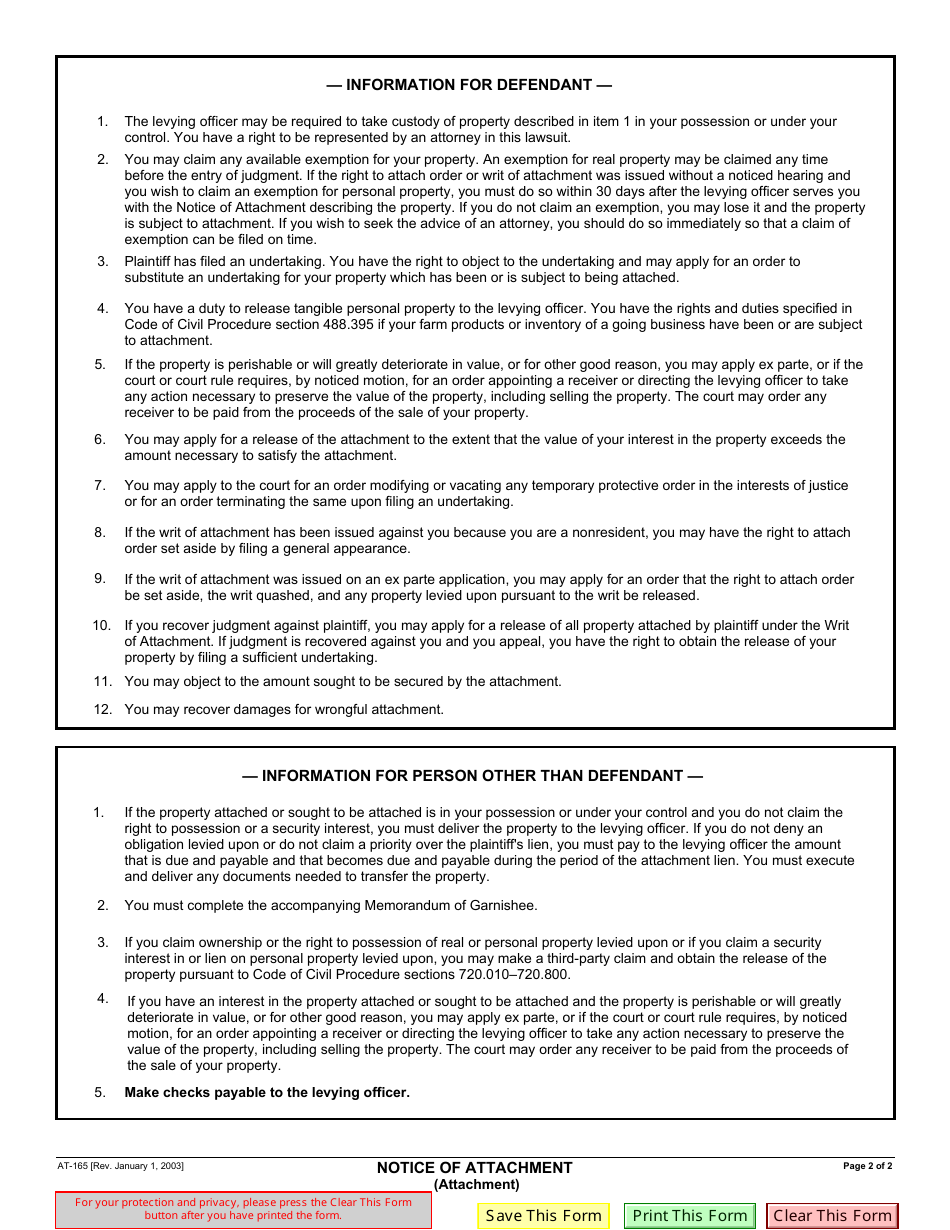

Q: Can the debtor object to the attachment after Form AT-165 is filed?

A: Yes, the debtor has the right to object to the attachment by filing a claim of exemption or requesting a hearing with the court.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AT-165 by clicking the link below or browse more documents and templates provided by the California Superior Court.