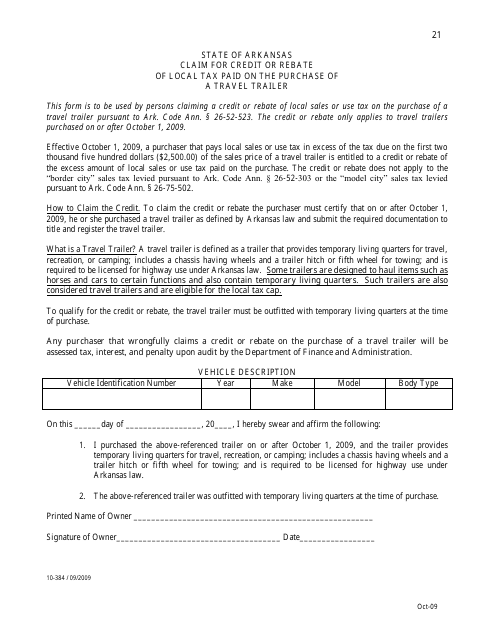

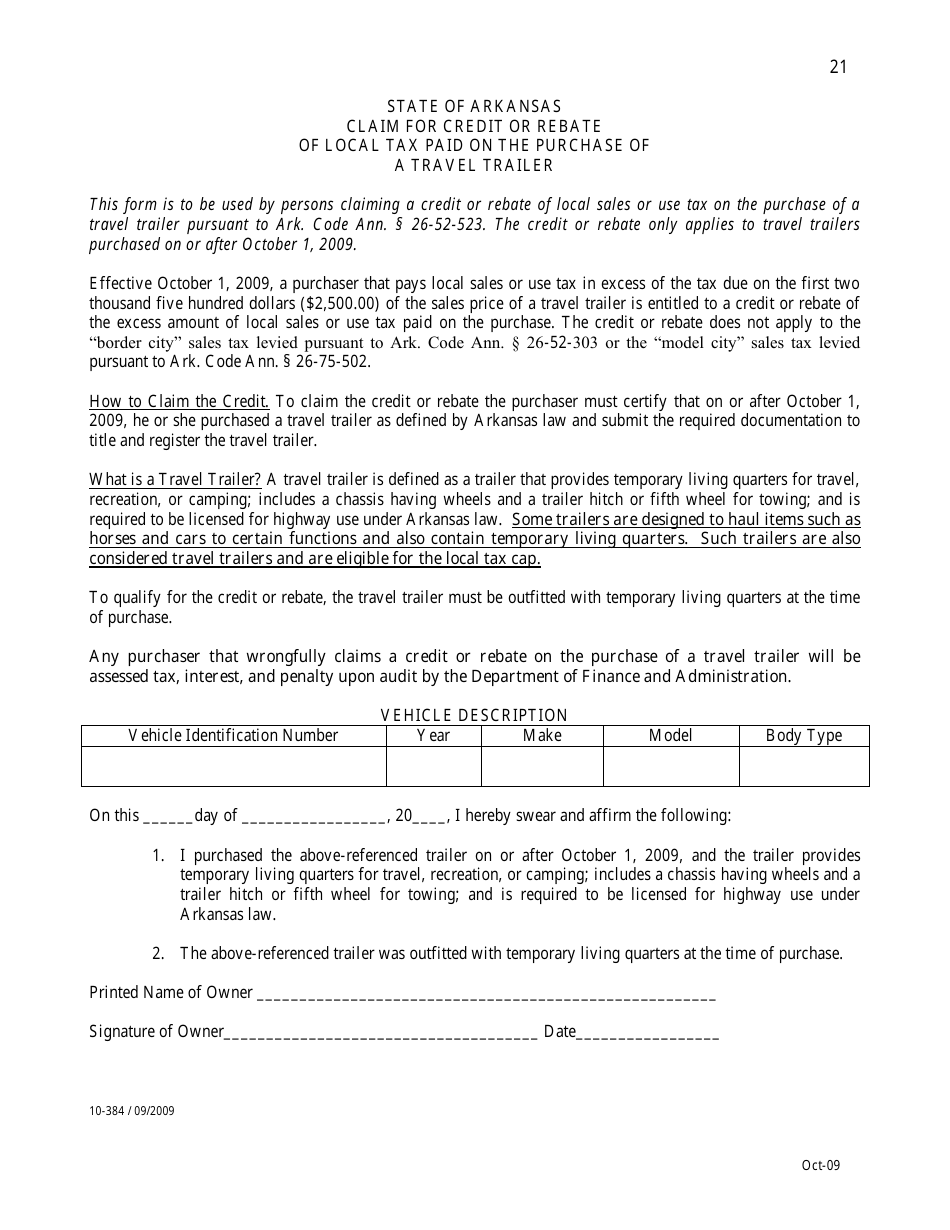

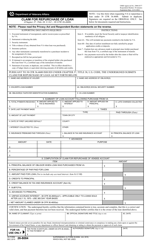

Form 10-384 Claim for Credit or Rebate of Local Tax Paid on the Purchase of a Travel Trailer - Arkansas

What Is Form 10-384?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10-384?

A: Form 10-384 is a claim for credit or rebate of local tax paid on the purchase of a travel trailer in Arkansas.

Q: Who can use Form 10-384?

A: Residents of Arkansas who have paid local tax on the purchase of a travel trailer can use Form 10-384.

Q: What is the purpose of Form 10-384?

A: The purpose of Form 10-384 is to claim a credit or rebate for the local tax paid on the purchase of a travel trailer.

Q: What supporting documentation do I need to include with Form 10-384?

A: You need to include a copy of the bill of sale and proof of payment of the local tax with Form 10-384.

Q: Is there a deadline for filing Form 10-384?

A: Yes, Form 10-384 must be filed within 6 months from the date of purchase of the travel trailer.

Q: How long does it take to process Form 10-384?

A: The processing time for Form 10-384 can vary, but it may take several weeks to receive a response from the Arkansas Department of Finance and Administration.

Q: Can I get a refund for the local tax paid on a used travel trailer?

A: No, Form 10-384 is only applicable for the purchase of a new travel trailer in Arkansas.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 10-384 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.