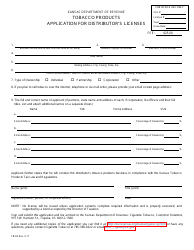

This version of the form is not currently in use and is provided for reference only. Download this version of

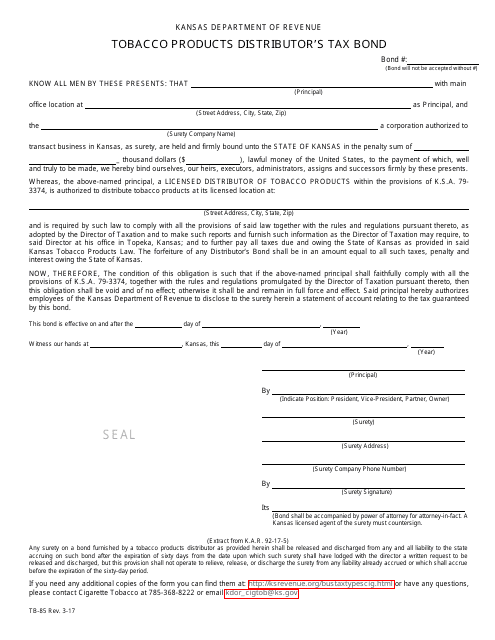

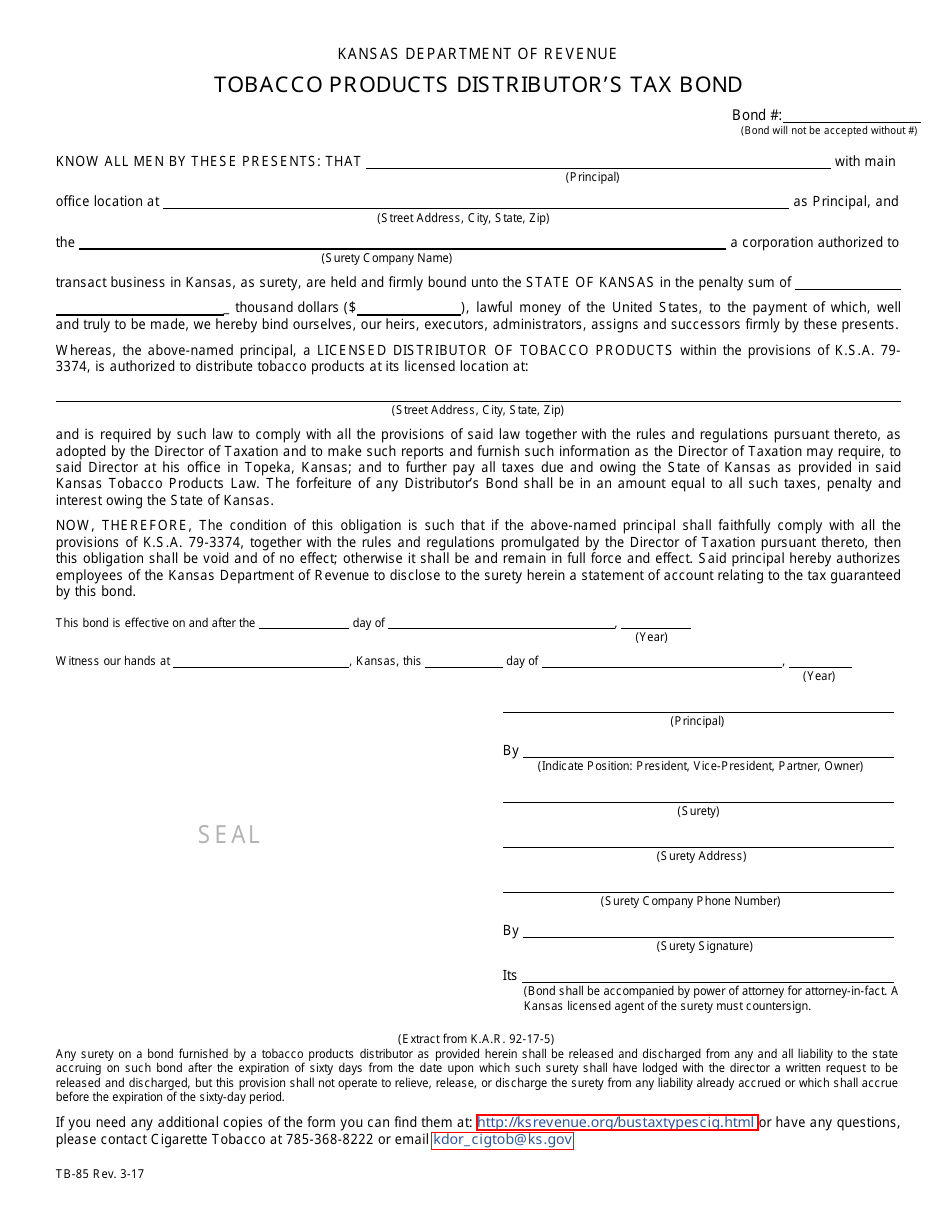

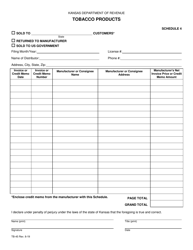

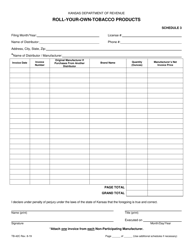

Form TB-85

for the current year.

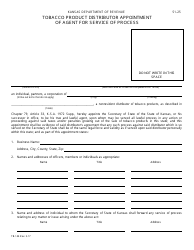

Form TB-85 Tobacco Products Distrbutior's Tax Bond - Kansas

What Is Form TB-85?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

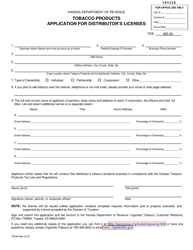

Q: What is Form TB-85?

A: Form TB-85 is a tobacco products distributor's tax bond for the state of Kansas.

Q: What is a tobacco products distributor's tax bond?

A: A tobacco products distributor's tax bond is a type of surety bond that ensures the payment of taxes on tobacco products by distributors.

Q: Who needs to submit Form TB-85?

A: Tobacco products distributors in Kansas need to submit Form TB-85.

Q: Why do I need to submit a tobacco products distributor's tax bond?

A: Submitting a tax bond is a requirement by the state of Kansas to ensure that distributors fulfill their tax obligations on tobacco products.

Q: Are there any fees associated with submitting Form TB-85?

A: Yes, there may be fees associated with submitting Form TB-85. You should contact the Kansas Department of Revenue for more information.

Q: How often do I need to submit Form TB-85?

A: The frequency of submitting Form TB-85 may vary. You should check with the Kansas Department of Revenue for the specific requirements.

Q: What happens if I fail to submit Form TB-85?

A: Failure to submit Form TB-85 may result in penalties and legal consequences. It is important to comply with the requirements set by the state of Kansas.

Q: Is Form TB-85 specific to Kansas?

A: Yes, Form TB-85 is specific to the state of Kansas and its tobacco products tax requirements.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TB-85 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.