This version of the form is not currently in use and is provided for reference only. Download this version of

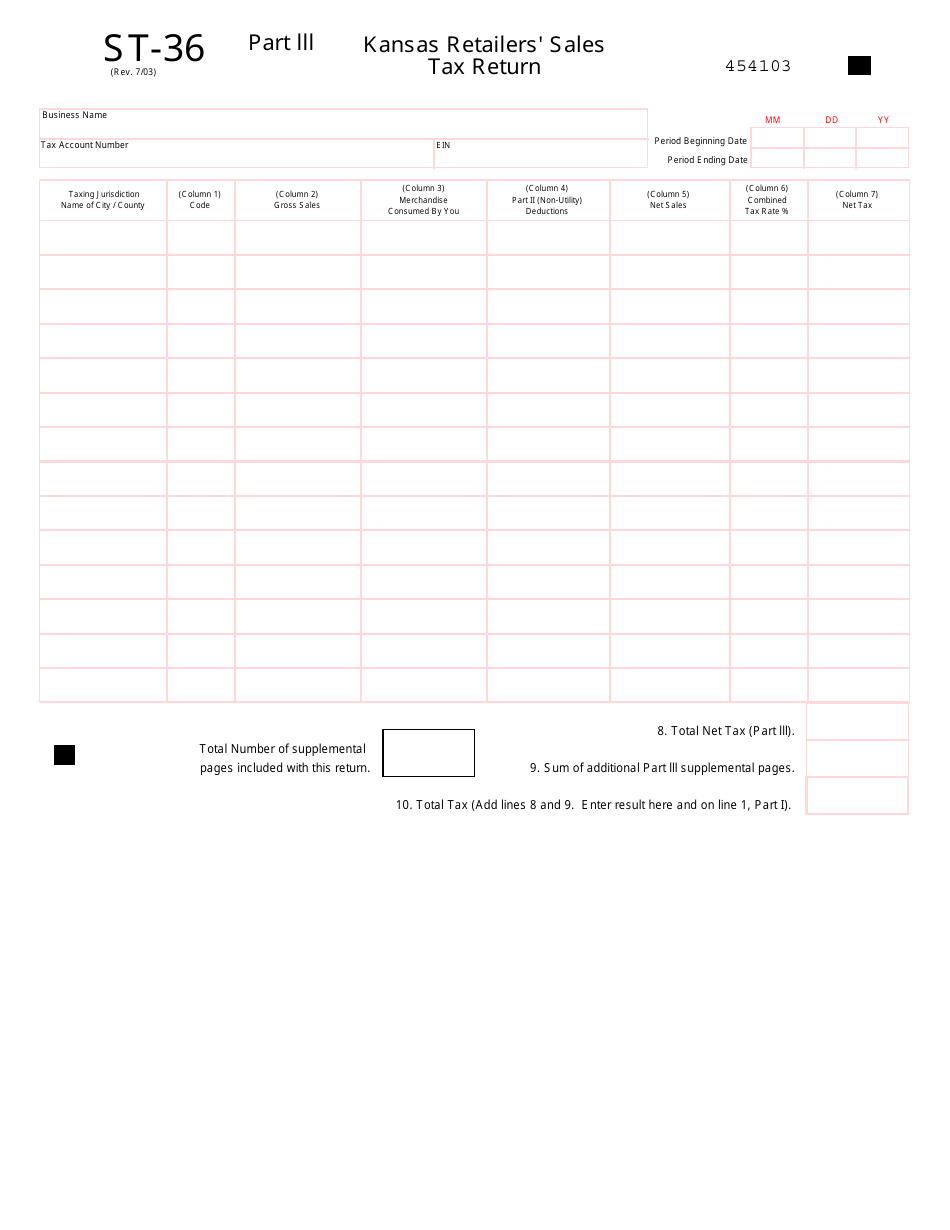

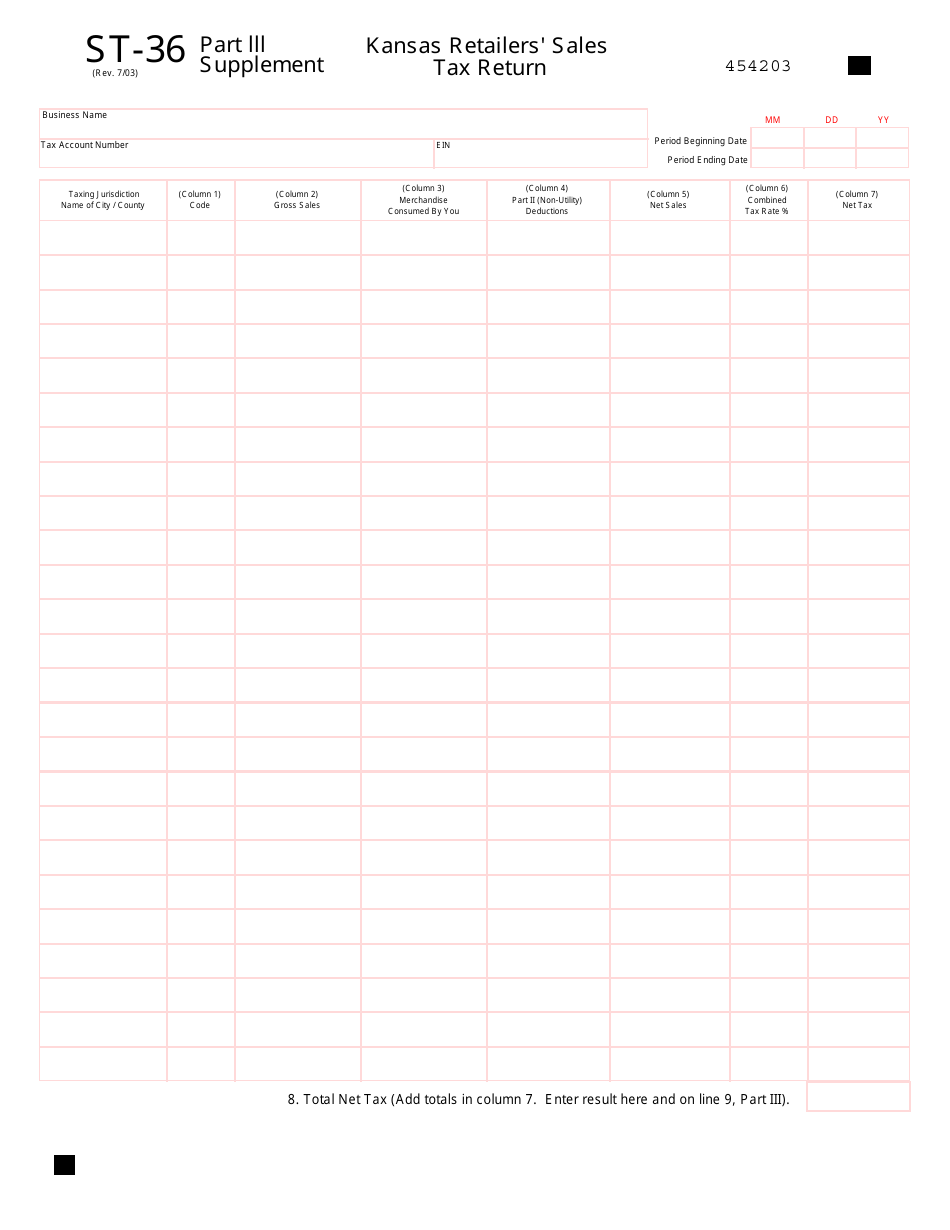

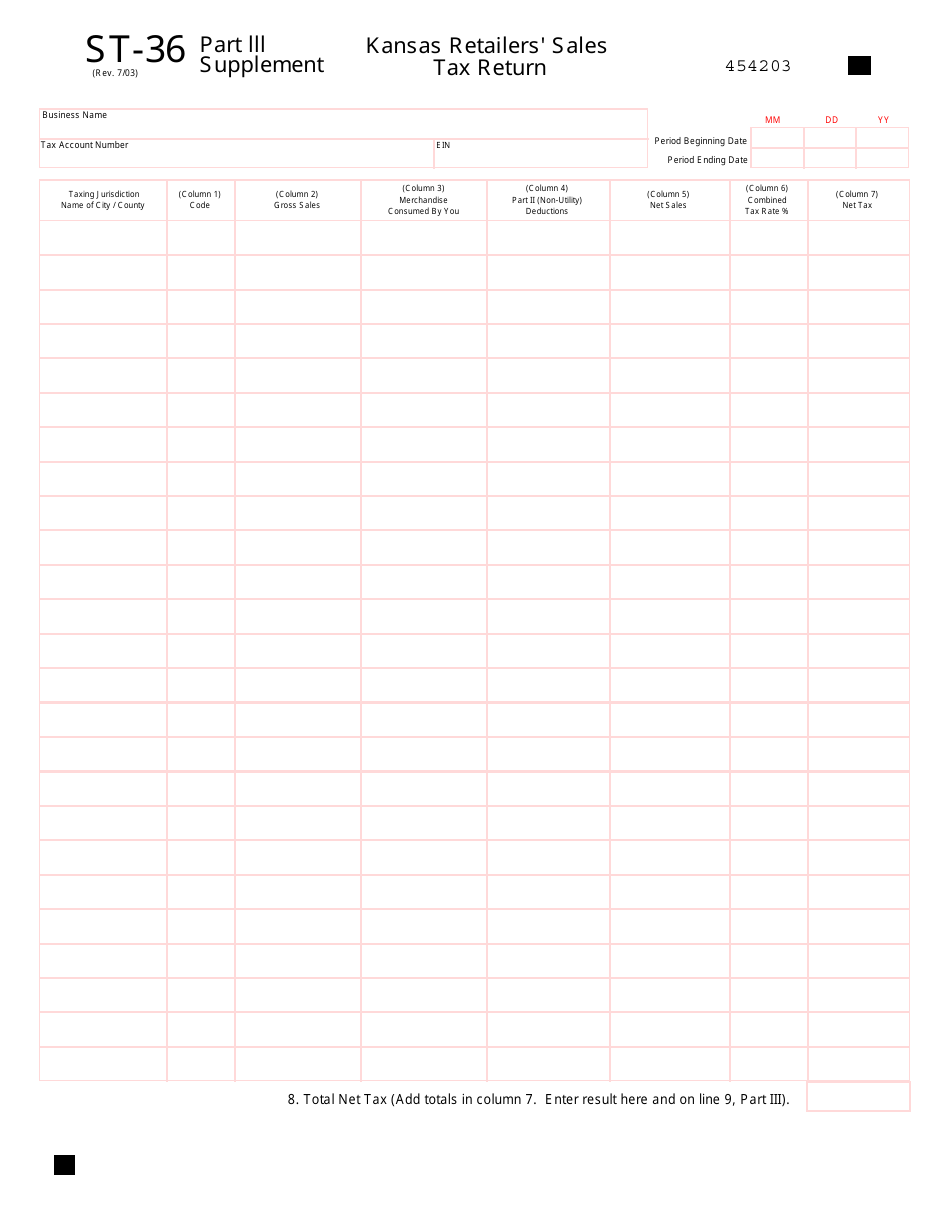

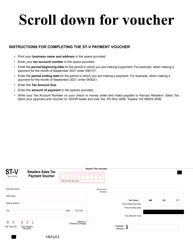

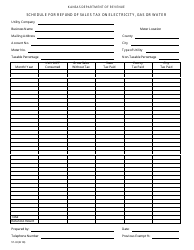

Form ST-36

for the current year.

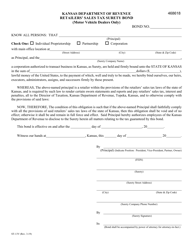

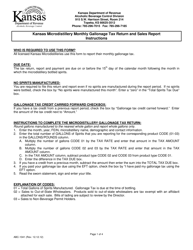

Form ST-36 Kansas Retailers' Sales Tax Return - Kansas

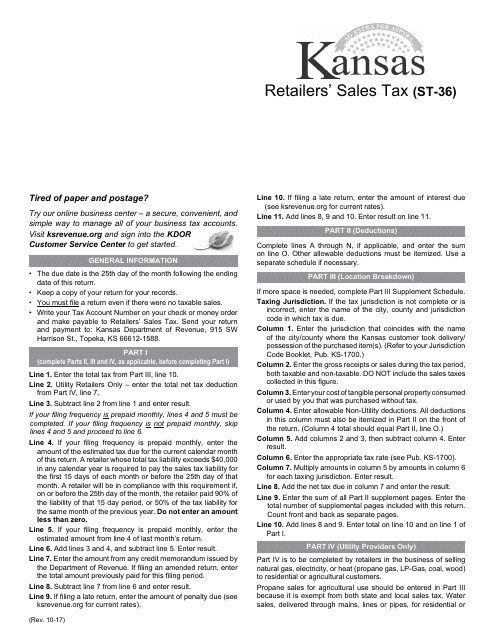

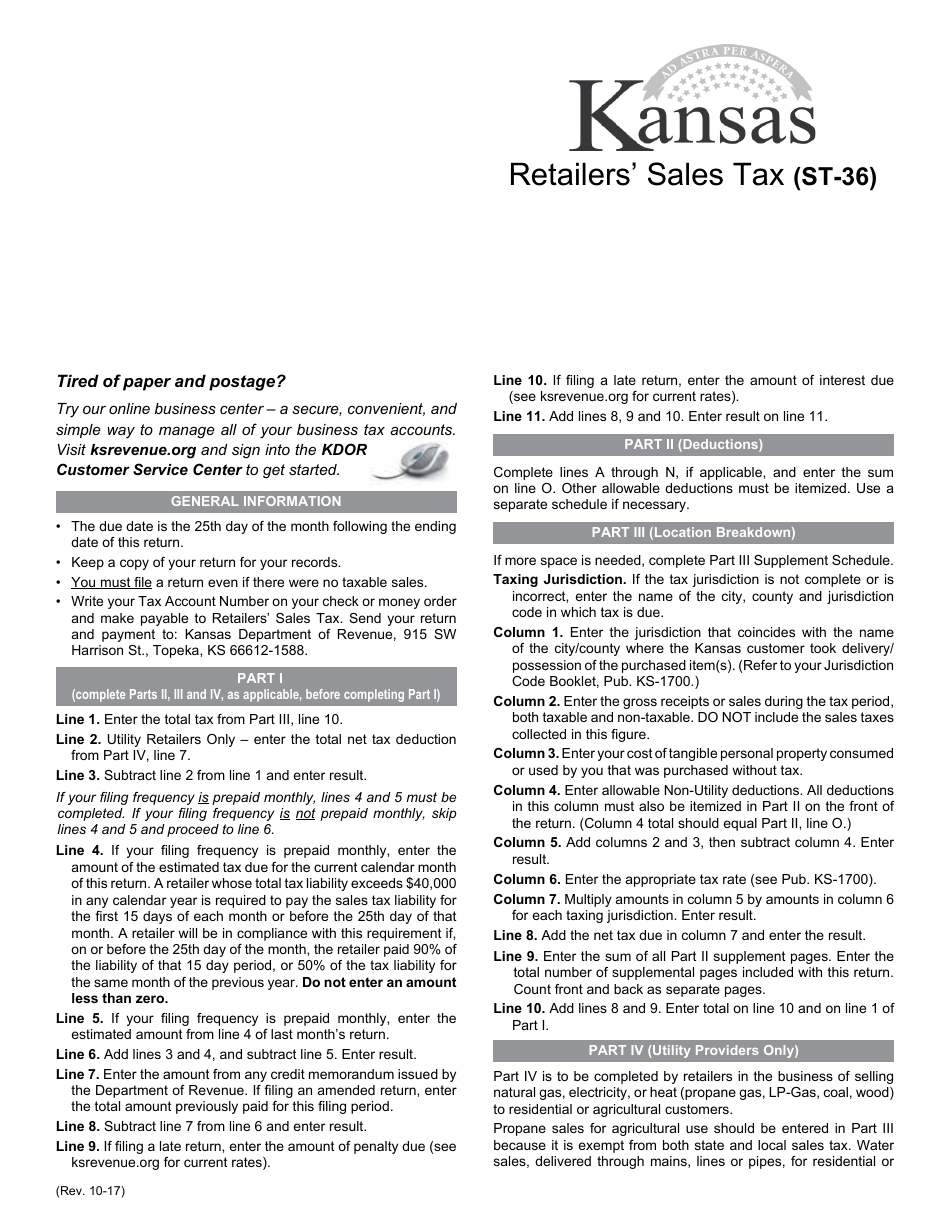

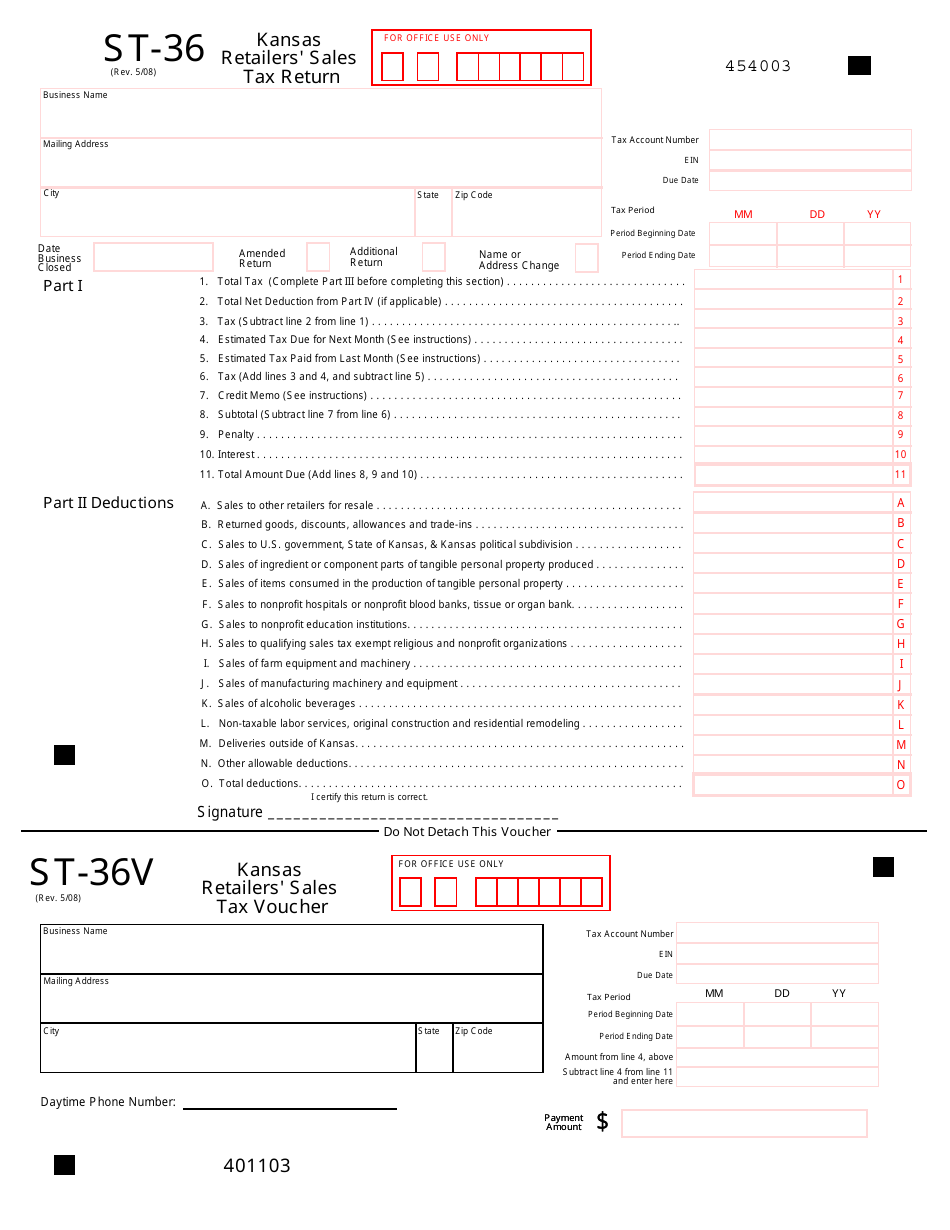

What Is Form ST-36?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-36?

A: Form ST-36 is the Kansas Retailers' Sales Tax Return.

Q: Who needs to file Form ST-36?

A: Kansas retailers who collect sales tax must file Form ST-36.

Q: What is the purpose of Form ST-36?

A: Form ST-36 is used to report and remit sales tax collected by retailers in Kansas.

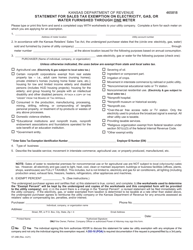

Q: When is Form ST-36 due?

A: Form ST-36 is due on the 25th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form ST-36?

A: Yes, there are penalties for late filing, including interest on the unpaid tax.

Q: What should I do if I have questions about Form ST-36?

A: You can contact the Kansas Department of Revenue for assistance with Form ST-36.

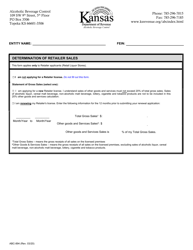

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-36 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.