This version of the form is not currently in use and is provided for reference only. Download this version of

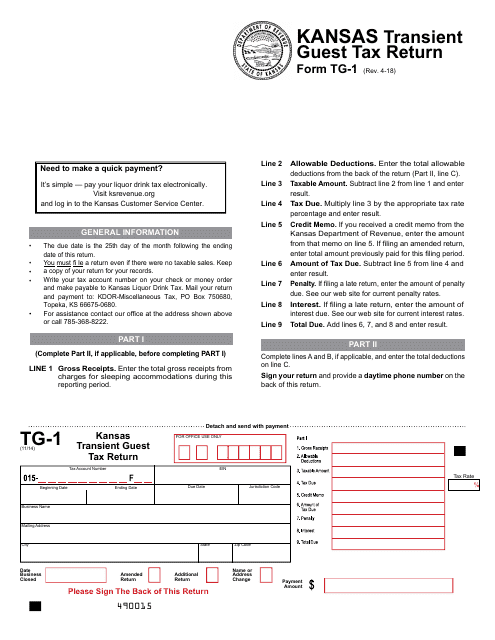

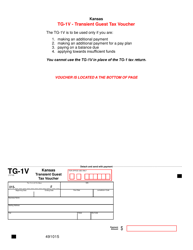

Form TG-1

for the current year.

Form TG-1 Transient Guest Tax Return - Kansas

What Is Form TG-1?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

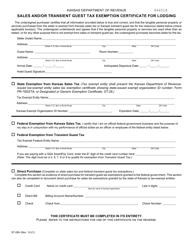

Q: What is Form TG-1?

A: Form TG-1 is the Transient Guest Tax Return form used in Kansas.

Q: What is the purpose of Form TG-1?

A: The purpose of Form TG-1 is to report and pay the transient guest tax owed to the state of Kansas.

Q: Who needs to file Form TG-1?

A: Anyone who operates a transient guest establishment in Kansas is required to file Form TG-1.

Q: What is the transient guest tax?

A: The transient guest tax is a tax imposed on the rental of rooms, lodgings, or accommodations for a period of less than 30 consecutive days.

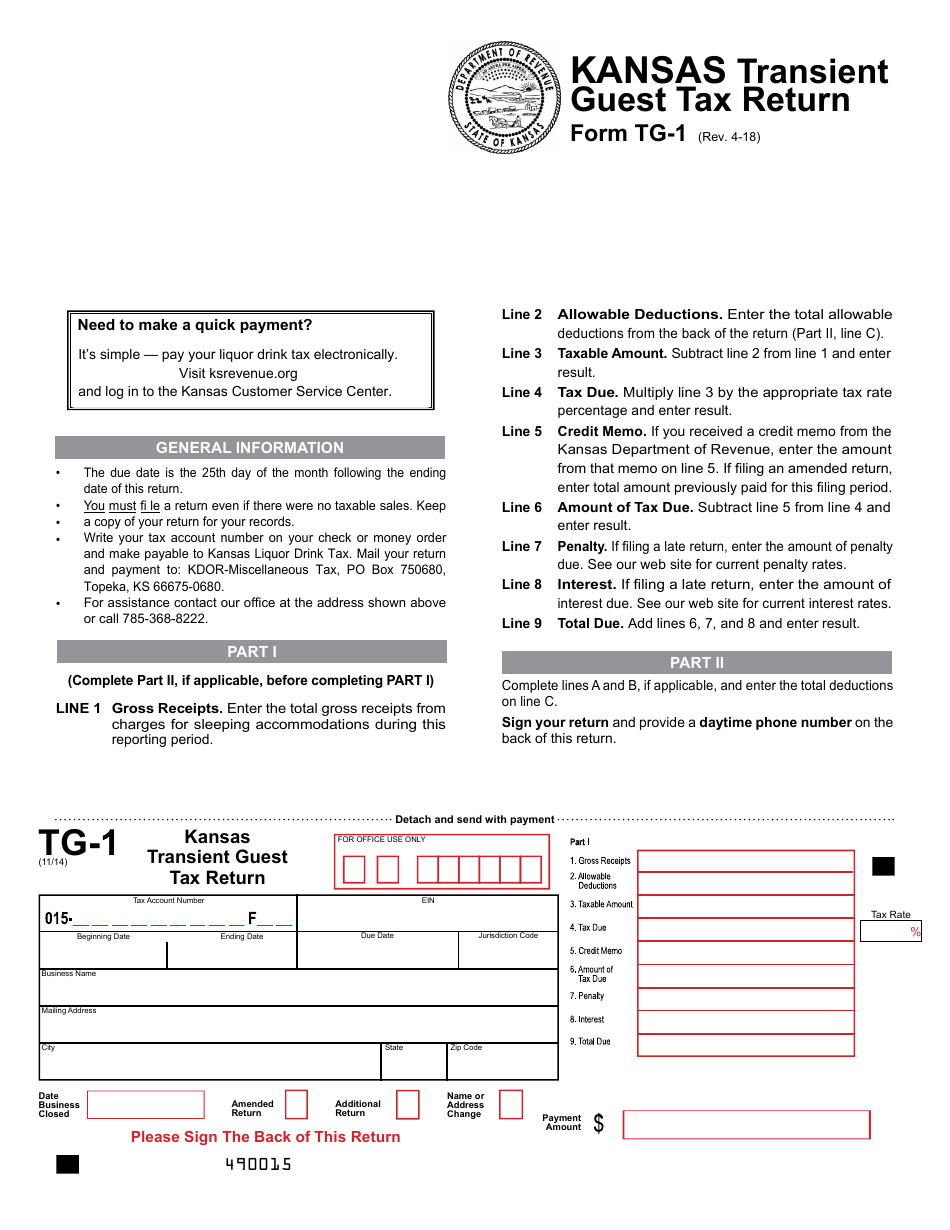

Q: When is Form TG-1 due?

A: Form TG-1 is due on or before the 25th day of the month following the end of the reporting period.

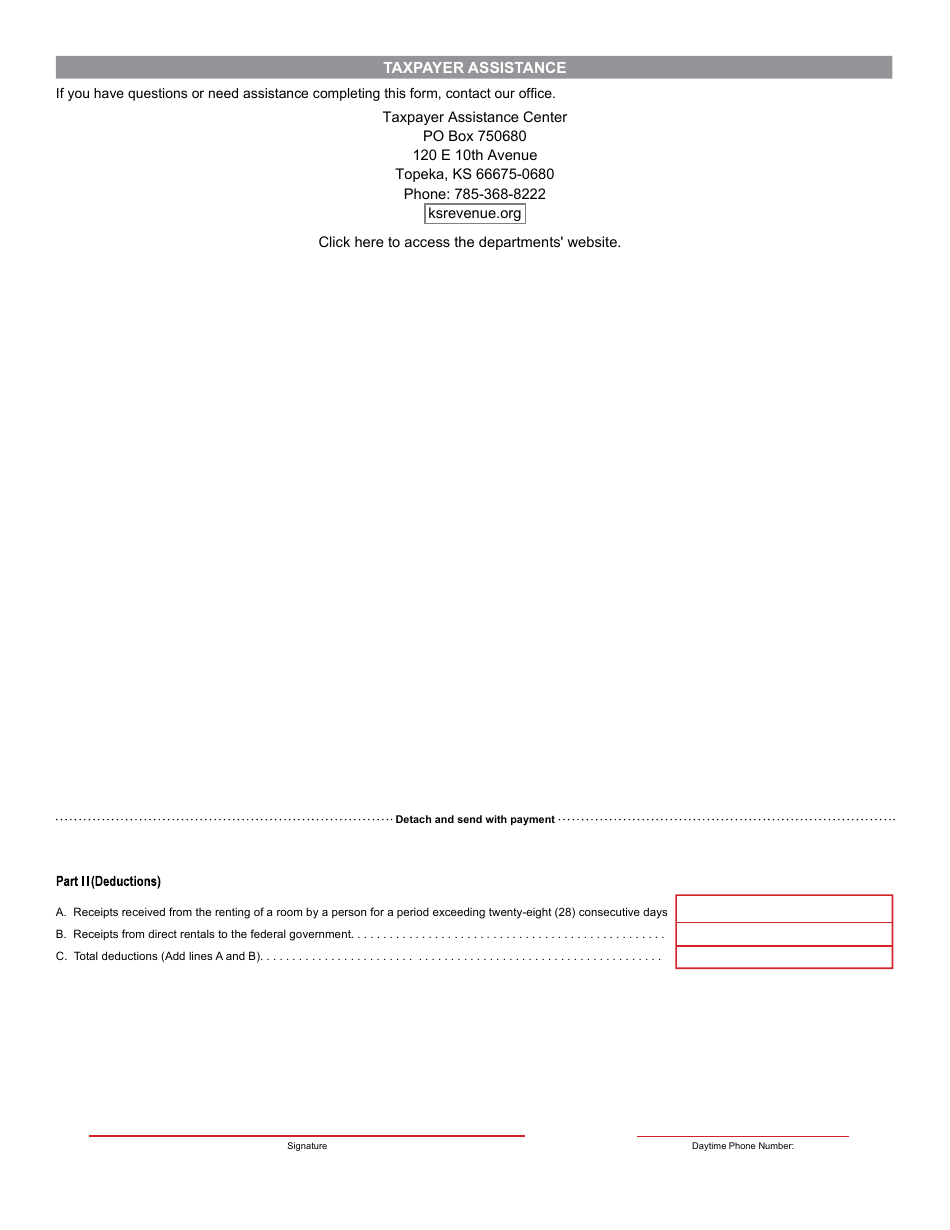

Q: How do I file Form TG-1?

A: Form TG-1 can be filed electronically or by mail. The instructions for filing are included with the form.

Q: What happens if I don't file Form TG-1?

A: Failure to file Form TG-1 or pay the transient guest tax can result in penalties and interest charges.

Q: Can I amend Form TG-1?

A: Yes, you can file an amended Form TG-1 if you need to correct any errors or make changes to your original filing.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TG-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.