This version of the form is not currently in use and is provided for reference only. Download this version of

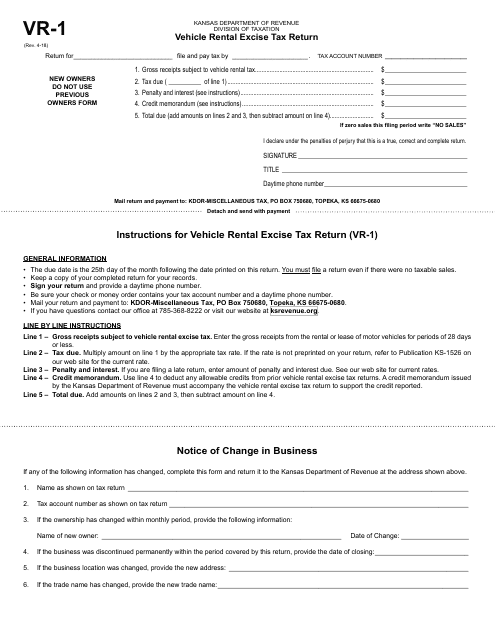

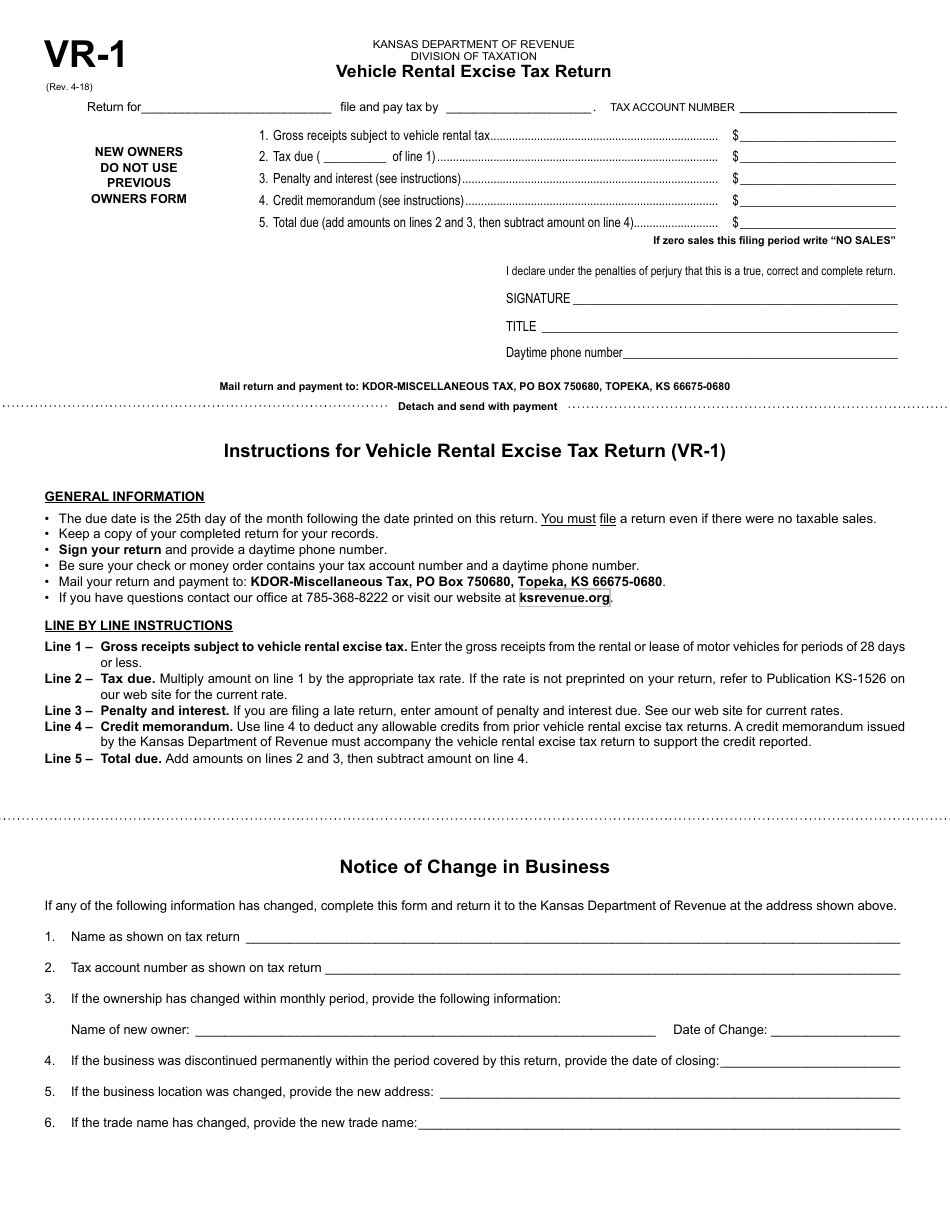

Form VR-1

for the current year.

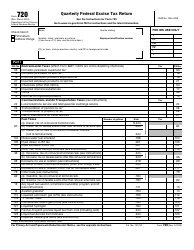

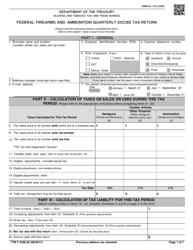

Form VR-1 Vehicle Rental Excise Tax Return - Kansas

What Is Form VR-1?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VR-1?

A: Form VR-1 is the Vehicle Rental Excise Tax Return form used in the state of Kansas.

Q: What is the purpose of Form VR-1?

A: The purpose of Form VR-1 is to report and pay vehicle rental excise tax in Kansas.

Q: Who needs to file Form VR-1?

A: Vehicle rental businesses operating in Kansas need to file Form VR-1.

Q: When is Form VR-1 due?

A: Form VR-1 is due on the 25th day of the month following the end of the reporting period.

Q: What information is required on Form VR-1?

A: Form VR-1 requires you to provide information about your business, rental periods, number of vehicles rented, and the amount of excise tax due.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, penalties may apply for late filing or non-compliance with the vehicle rental excise tax requirements in Kansas.

Q: Who can I contact for more information about Form VR-1?

A: For more information about Form VR-1, you can contact the Kansas Department of Revenue directly.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VR-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.