This version of the form is not currently in use and is provided for reference only. Download this version of

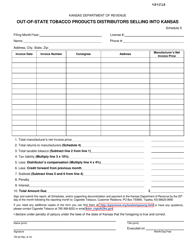

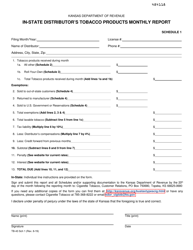

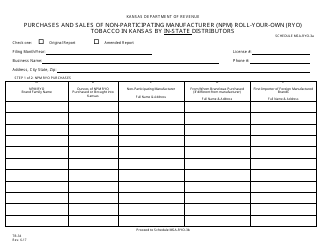

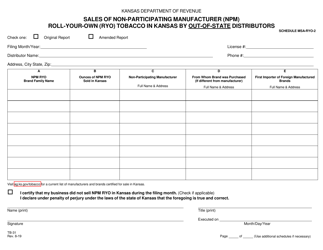

Form TB-42C

for the current year.

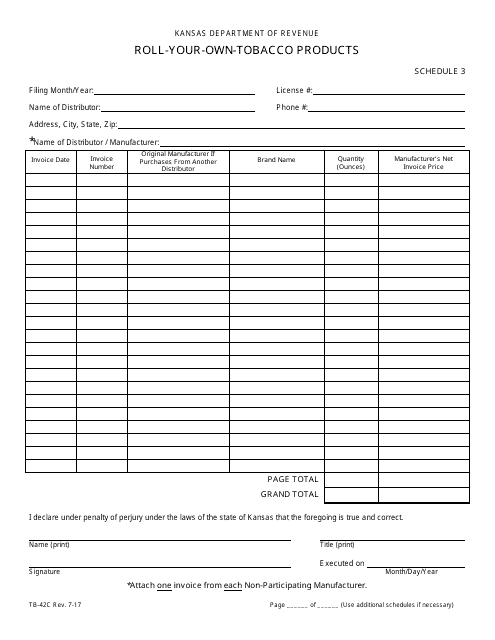

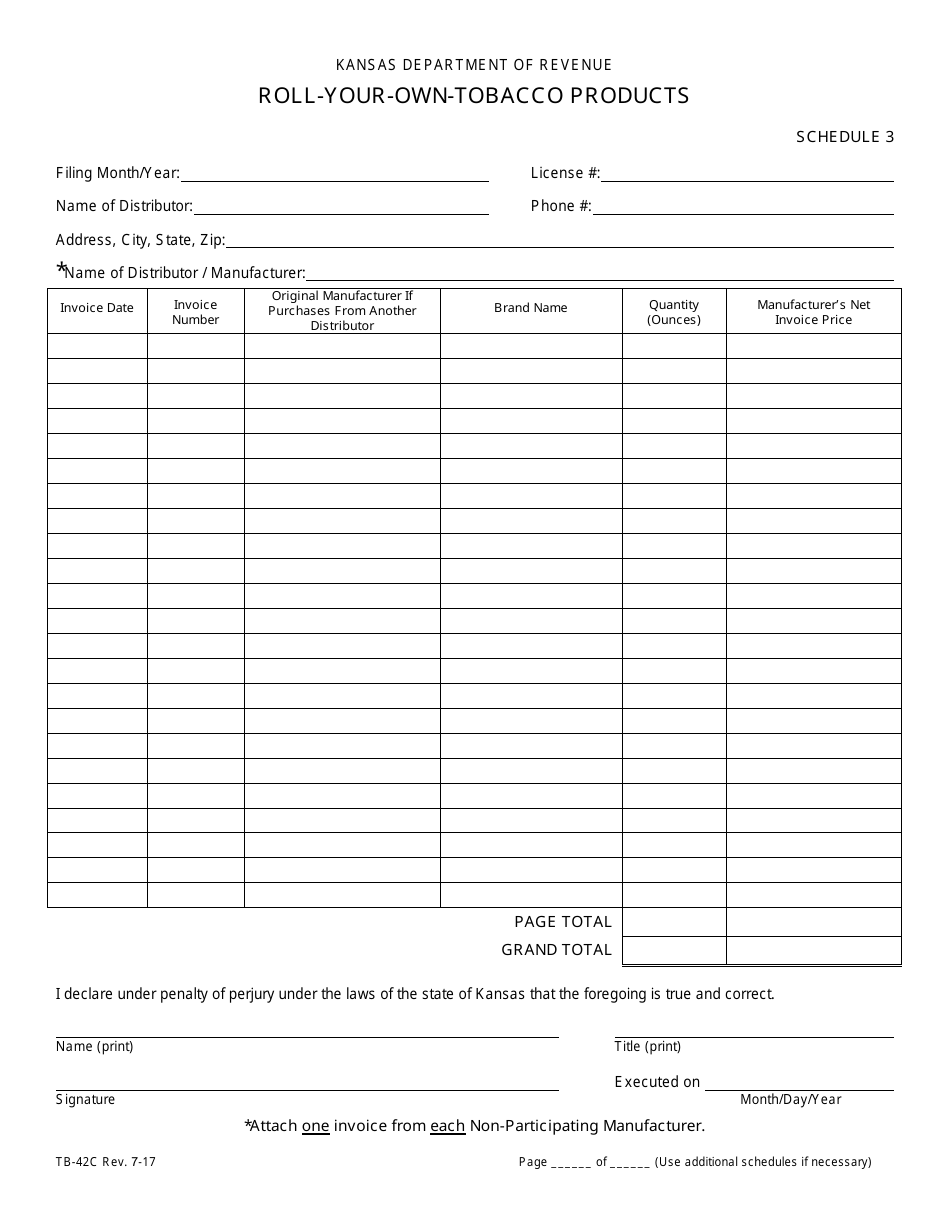

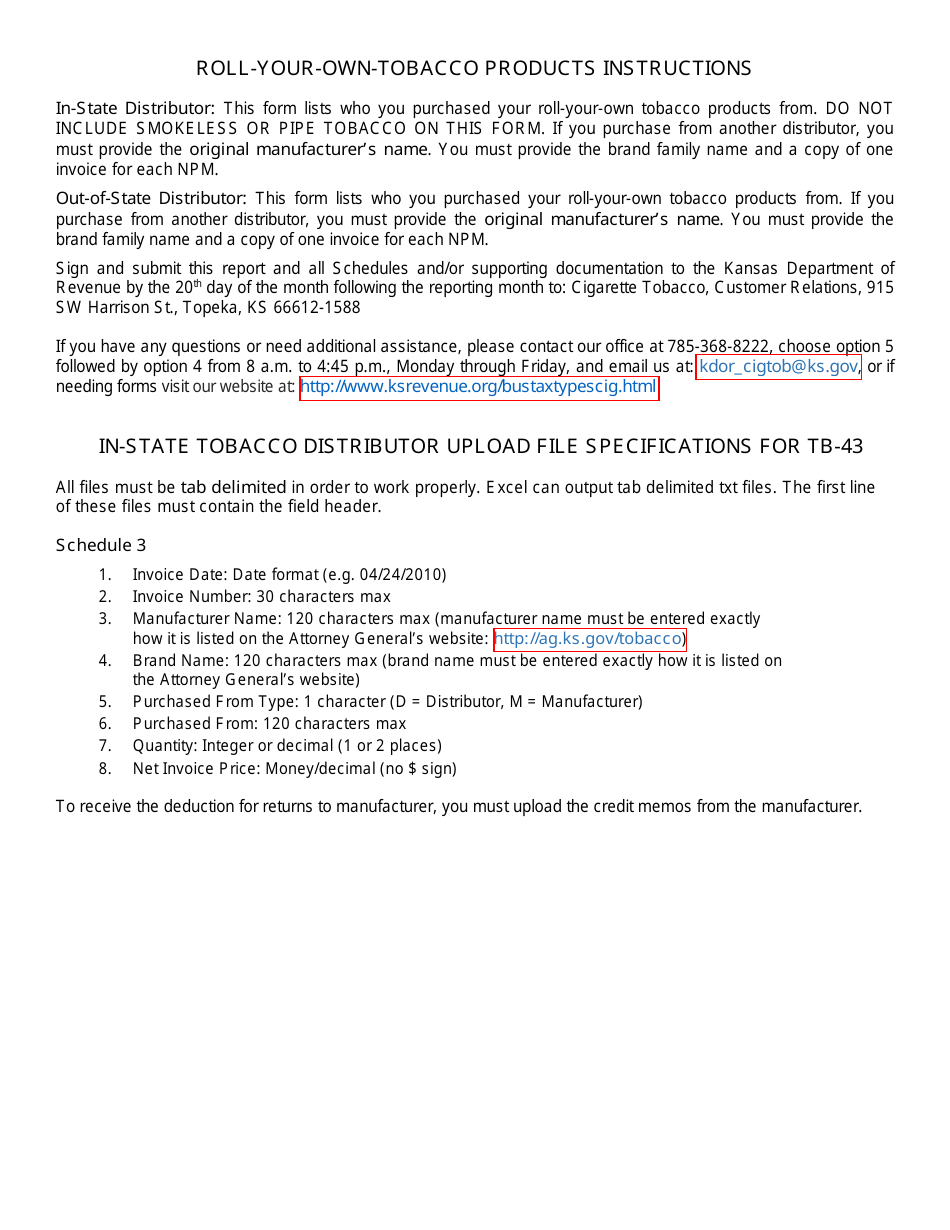

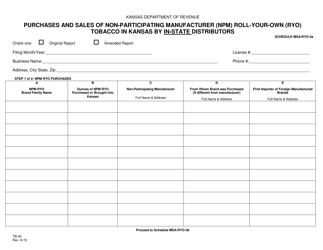

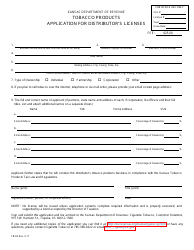

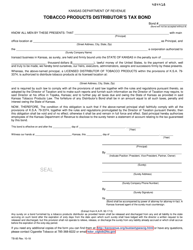

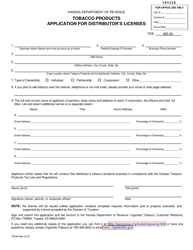

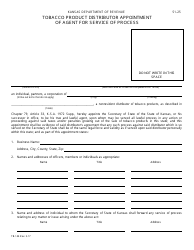

Form TB-42C Roll-Your-Own-Tobacco Products - Kansas

What Is Form TB-42C?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TB-42C?

A: Form TB-42C is a form used for reporting roll-your-own tobacco products in Kansas.

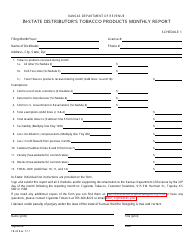

Q: Who needs to file Form TB-42C?

A: Any business or individual who sells roll-your-own tobacco products in Kansas needs to file Form TB-42C.

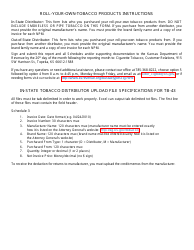

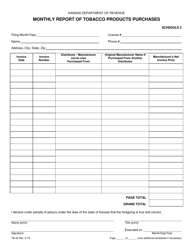

Q: What information is required on Form TB-42C?

A: Form TB-42C requires information such as the name and address of the seller, the quantity of roll-your-own tobacco products sold, and the amount of taxes due.

Q: When is Form TB-42C due?

A: Form TB-42C is due on a monthly basis, and the due date is generally the 20th day of the following month.

Q: Are there any penalties for not filing Form TB-42C?

A: Yes, failure to file Form TB-42C or pay the required taxes can result in penalties, interest, and other enforcement actions.

Q: What should I do if I have questions about Form TB-42C?

A: If you have questions about Form TB-42C, you can contact the Kansas Department of Revenue for assistance.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TB-42C by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.