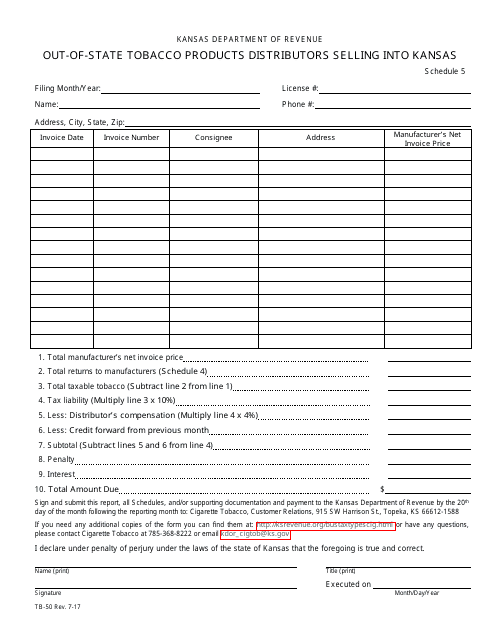

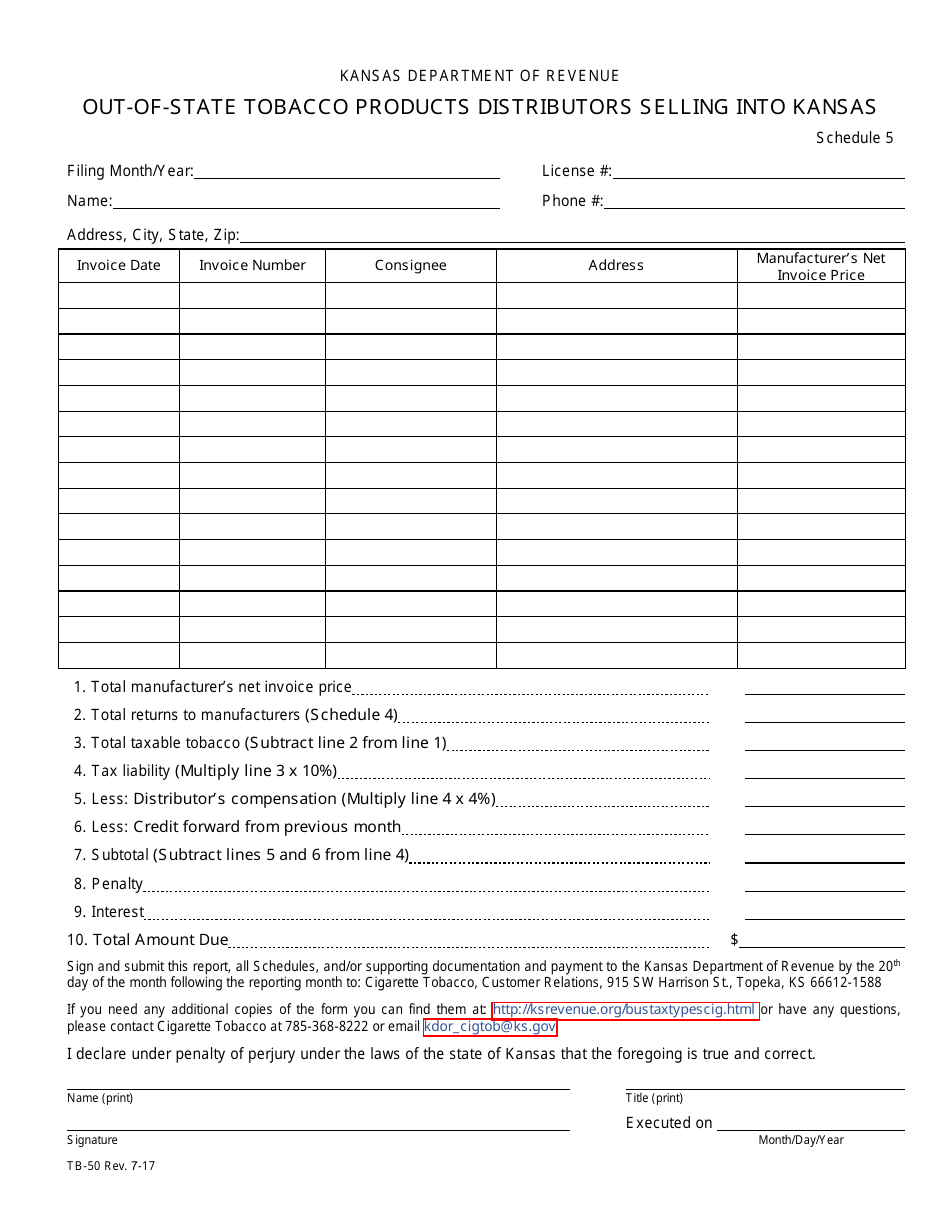

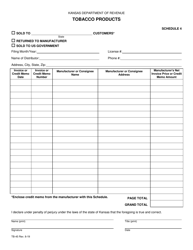

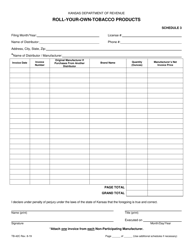

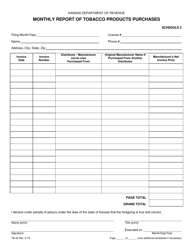

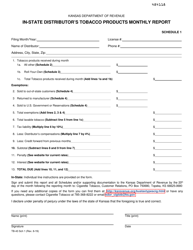

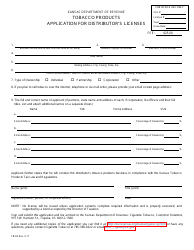

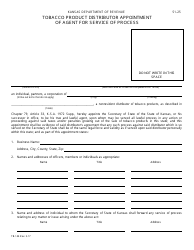

Form TB-50 Out-of-State Tobacco Products Distributors Selling Into Kansas - Kansas

What Is Form TB-50?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TB-50?

A: TB-50 is a form used by out-of-state tobacco product distributors selling into Kansas.

Q: Who needs to use TB-50?

A: Out-of-state tobacco product distributors selling into Kansas need to use TB-50.

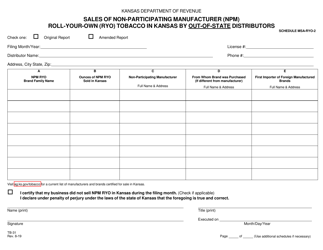

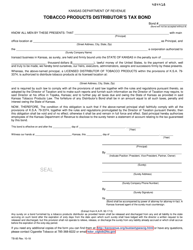

Q: What is the purpose of TB-50?

A: TB-50 is used to report the sales of tobacco products by out-of-state distributors in Kansas and to calculate the corresponding tobacco products tax.

Q: Do out-of-state distributors need to file TB-50?

A: Yes, out-of-state distributors selling tobacco products in Kansas are required to file TB-50.

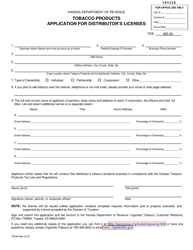

Q: When is TB-50 due?

A: TB-50 is due on or before the 25th day of the month following the month being reported.

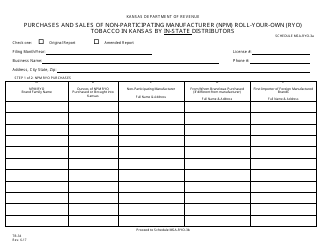

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TB-50 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.