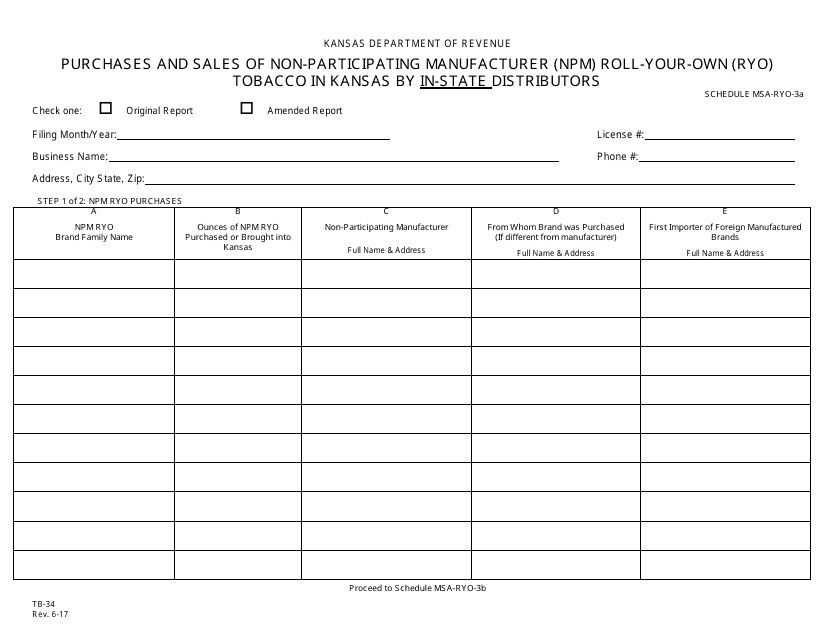

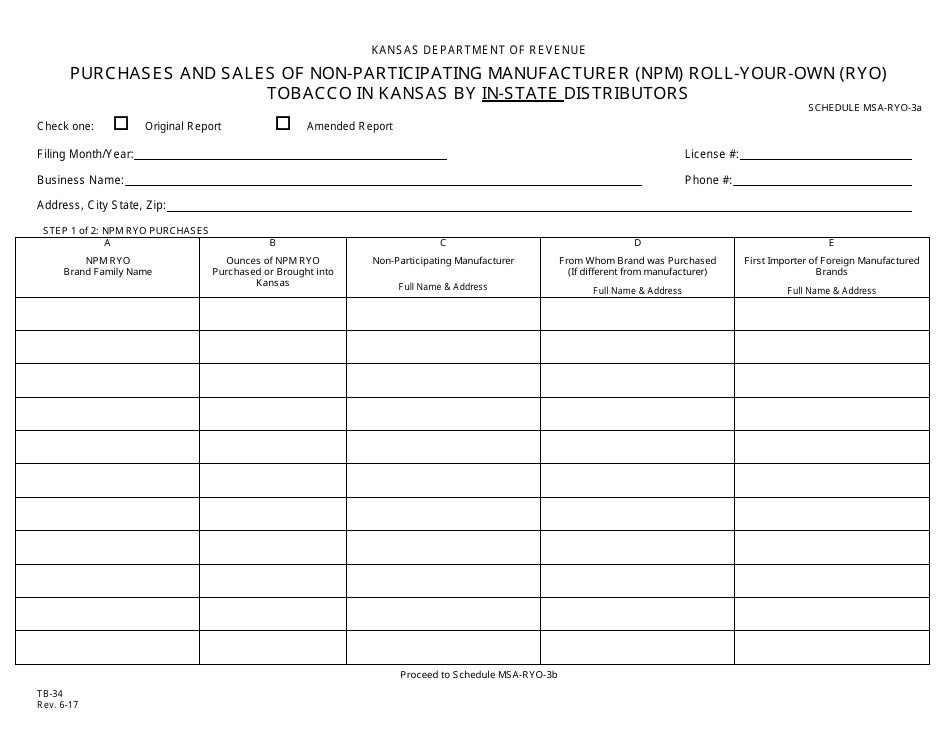

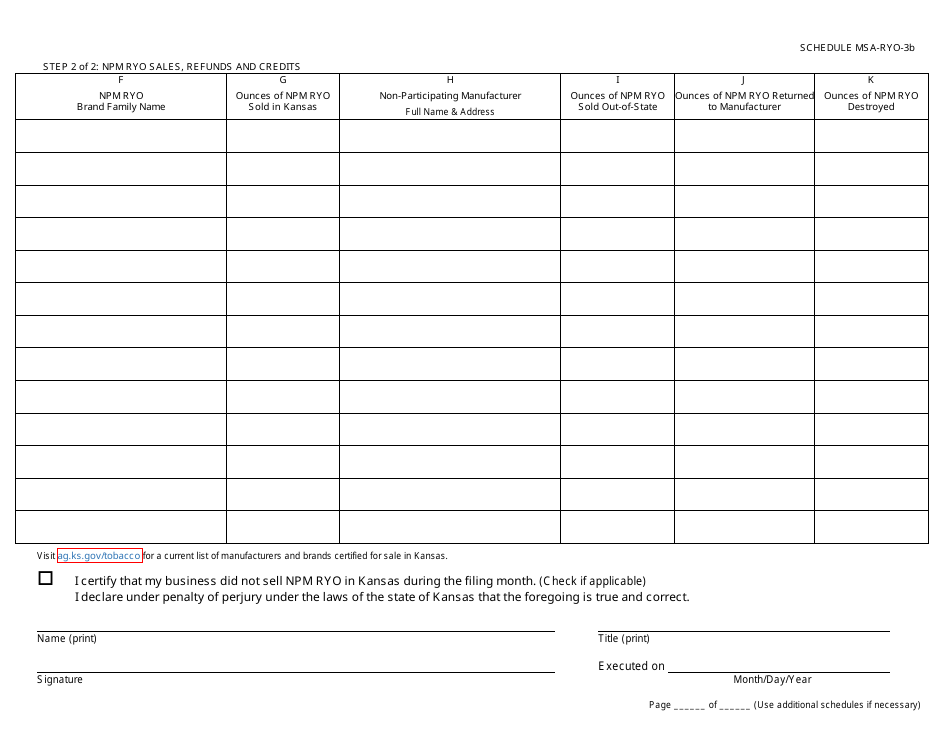

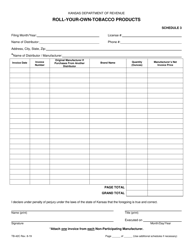

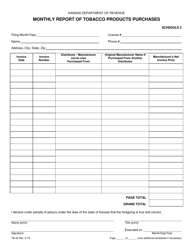

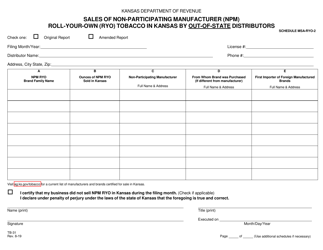

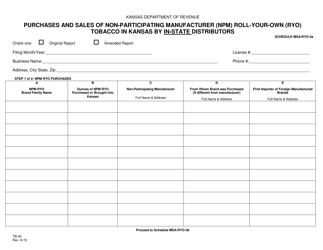

Form TB-34 Purchases and Sales of Non-participating Manufacturer (Npm) Roll-Your-Own (Ryo) Tobacco in Kansas by in-State Distributors - Kansas

What Is Form TB-34?

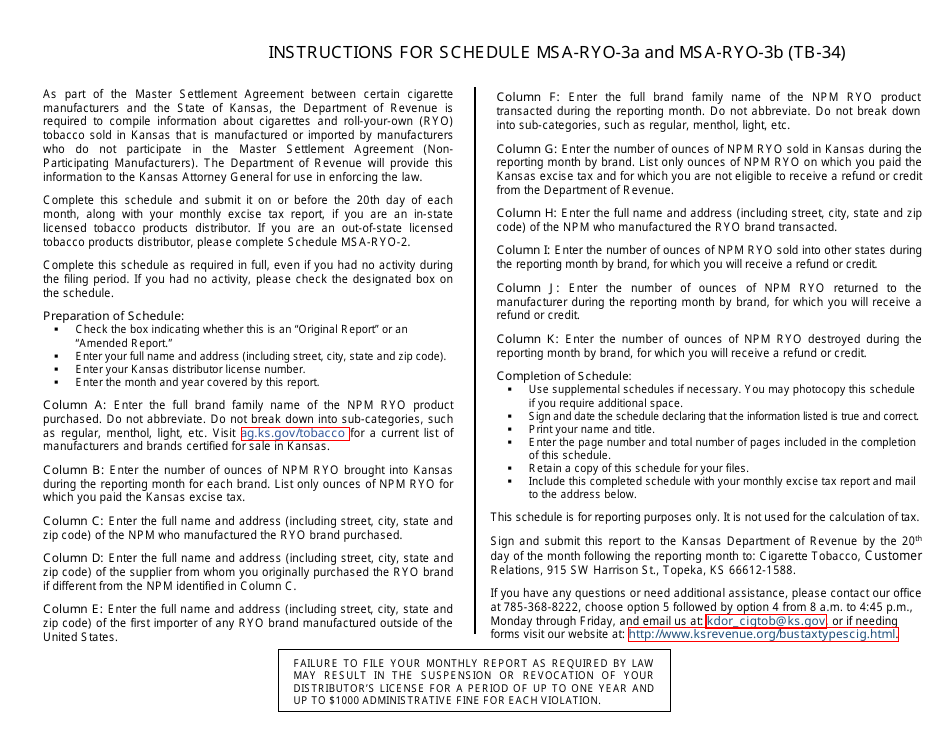

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TB-34?

A: Form TB-34 is a form used by in-state distributors in Kansas to report purchases and sales of Non-participating Manufacturer (NPM) Roll-Your-Own (RYO) Tobacco.

Q: Who is required to file Form TB-34?

A: In-state distributors in Kansas are required to file Form TB-34 if they purchase and sell Non-participating Manufacturer (NPM) Roll-Your-Own (RYO) Tobacco.

Q: What is Non-participating Manufacturer (NPM) Roll-Your-Own (RYO) Tobacco?

A: Non-participating Manufacturer (NPM) Roll-Your-Own (RYO) Tobacco refers to tobacco products manufactured by manufacturers that have not joined the Master Settlement Agreement (MSA) or similar agreements.

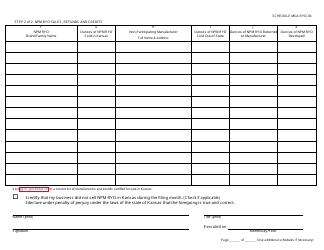

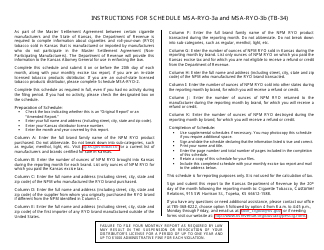

Q: What information is required on Form TB-34?

A: Form TB-34 requires information such as the distributor's name, address, tax ID number, and details of the purchases and sales of Non-participating Manufacturer (NPM) Roll-Your-Own (RYO) Tobacco.

Q: When is the deadline to file Form TB-34?

A: The deadline to file Form TB-34 in Kansas is the last day of the month following the end of each calendar quarter.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TB-34 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.