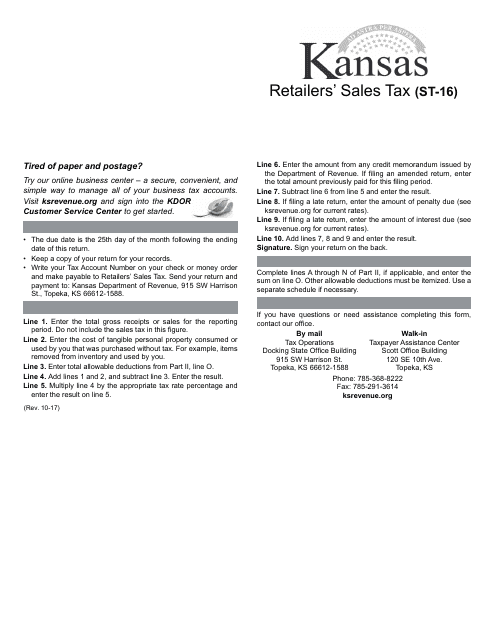

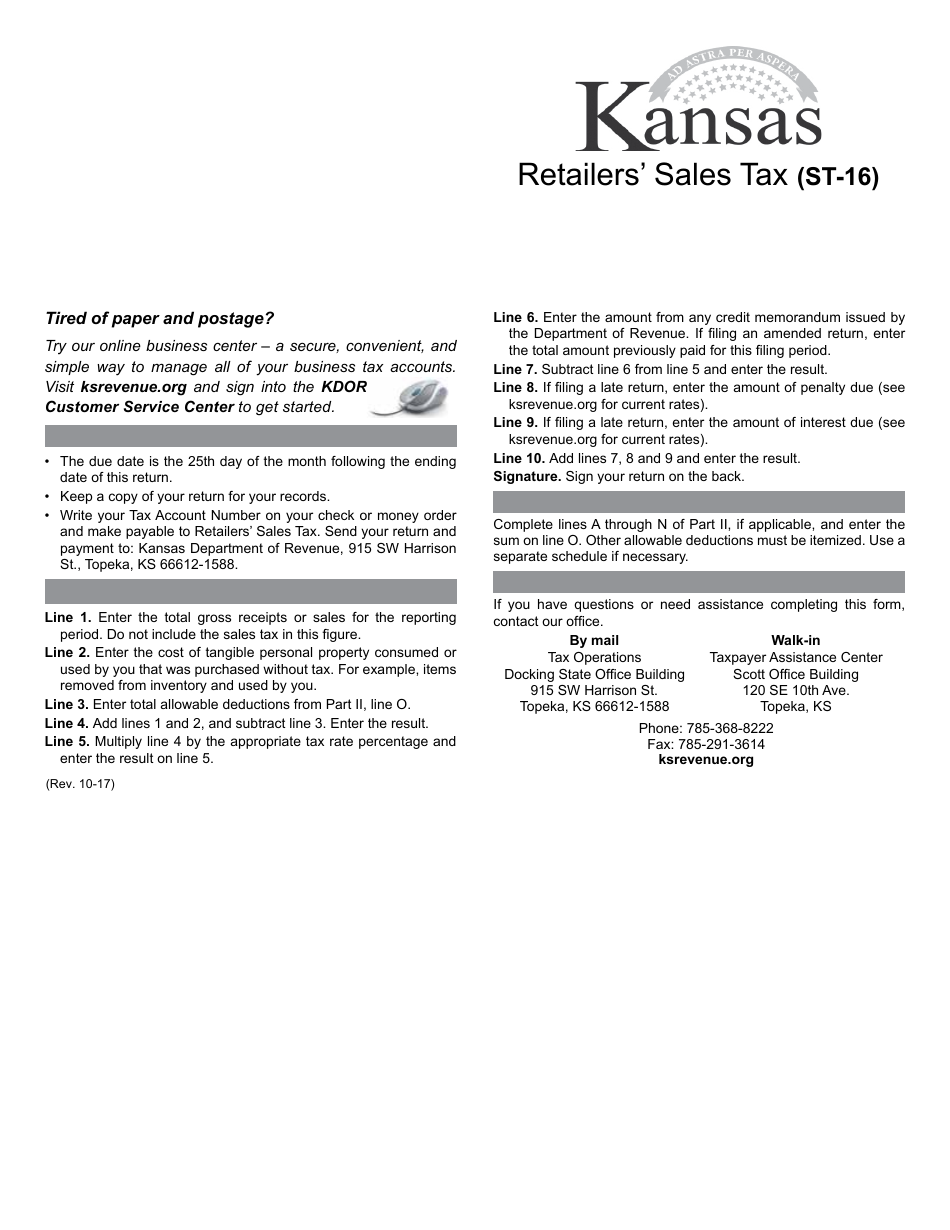

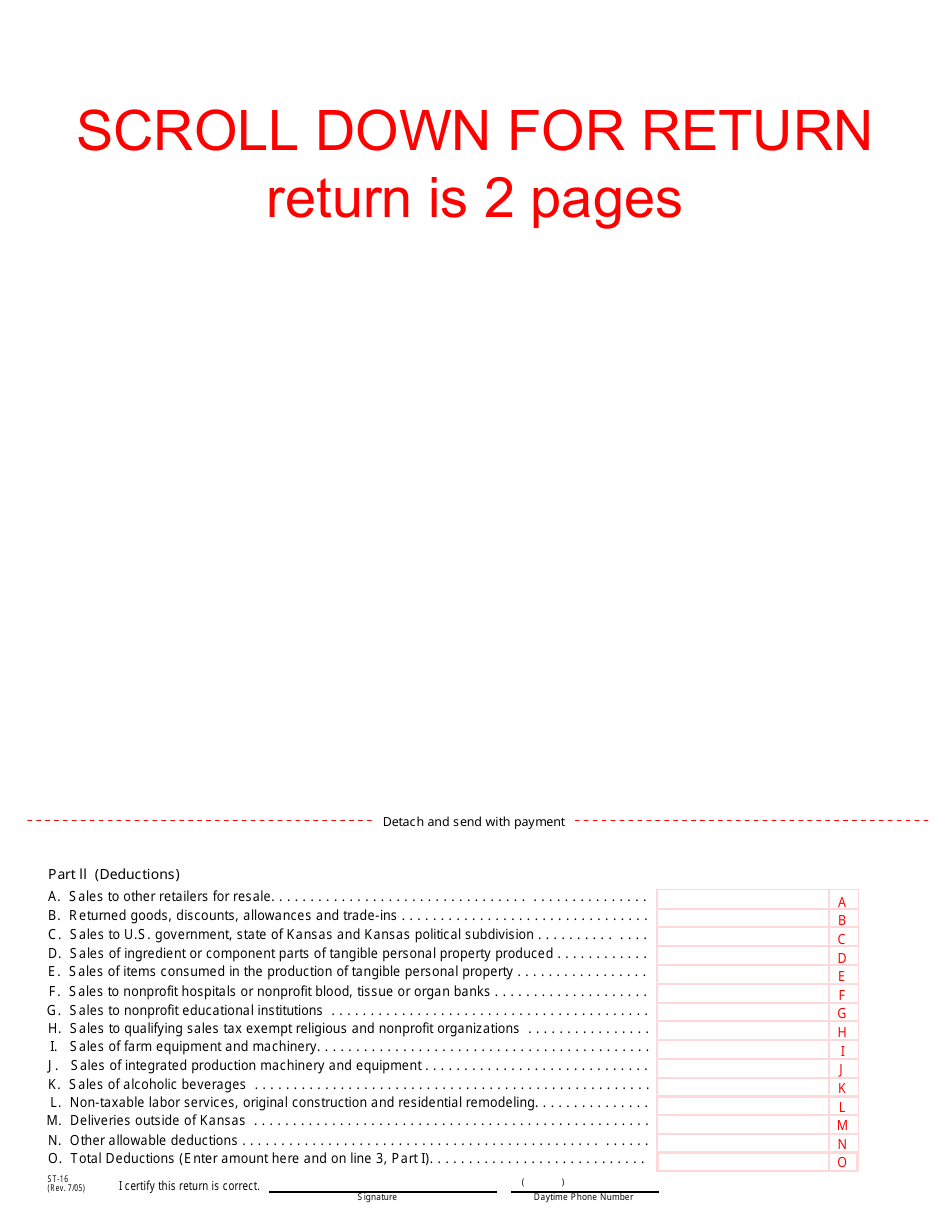

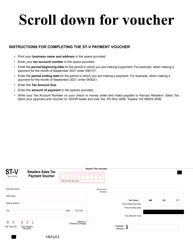

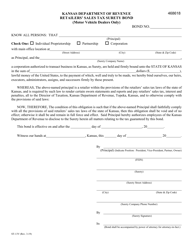

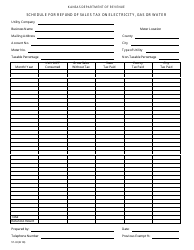

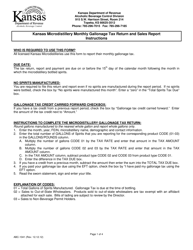

Form ST-16 Retailers' Sales Tax Return - Kansas

What Is Form ST-16?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form ST-16 Retailers' Sales Tax Return?

A: All retailers in Kansas who make sales subject to sales tax must file Form ST-16.

Q: When is Form ST-16 due?

A: Form ST-16 is due on the 25th day of the month following the reporting period.

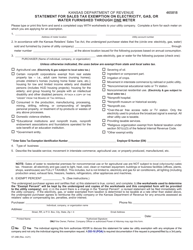

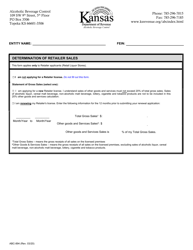

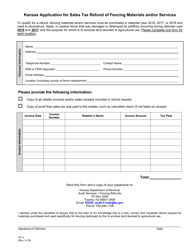

Q: What information do I need to include on Form ST-16?

A: You need to include your total sales, taxable sales, and the amount of sales tax due.

Q: Is there a penalty for late filing of Form ST-16?

A: Yes, there is a penalty for late filing of Form ST-16. The penalty is 10% of the tax due, with a minimum penalty of $50.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-16 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.