This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-8B

for the current year.

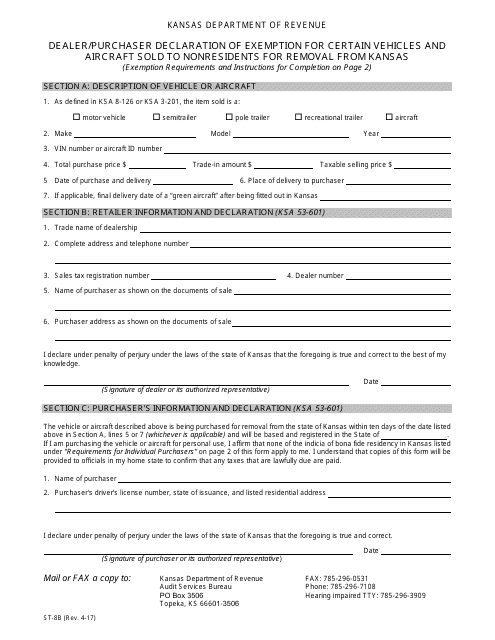

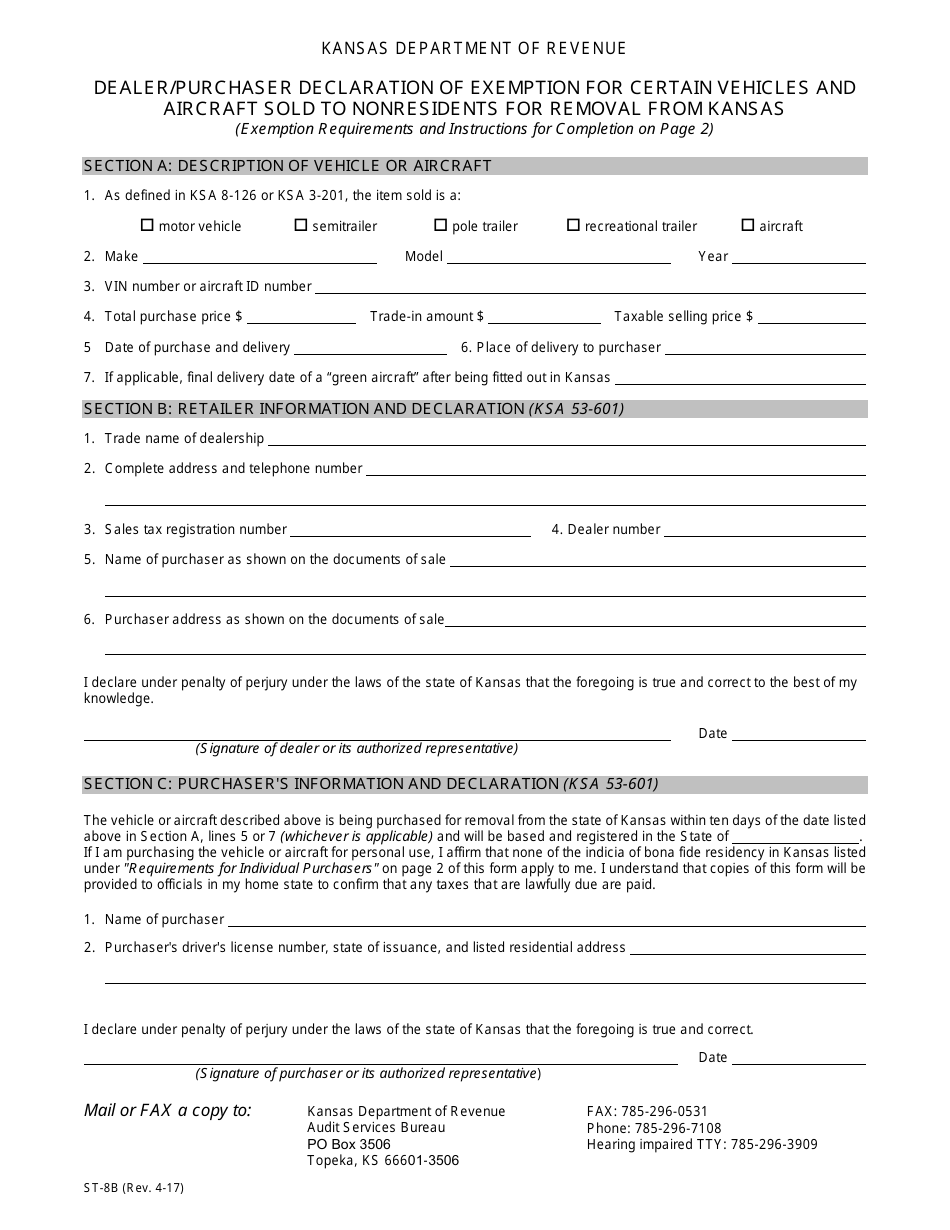

Form ST-8B Dealer / Purchaser Declaration of Exemption for Certain Vehicles and Aircraft Sold to Nonresidents for Removal From Kansas - Kansas

What Is Form ST-8B?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-8B?

A: Form ST-8B is a declaration of exemption for certain vehicles and aircraft sold to nonresidents for removal from Kansas.

Q: Who must fill out Form ST-8B?

A: The dealer or purchaser must fill out Form ST-8B.

Q: What is the purpose of Form ST-8B?

A: Form ST-8B is used to claim exemption from Kansas sales tax when selling vehicles or aircraft to nonresidents who will remove them from Kansas.

Q: Who is eligible for exemption using Form ST-8B?

A: Nonresidents who will remove the vehicles or aircraft from Kansas are eligible for exemption using Form ST-8B.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-8B by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.