This version of the form is not currently in use and is provided for reference only. Download this version of

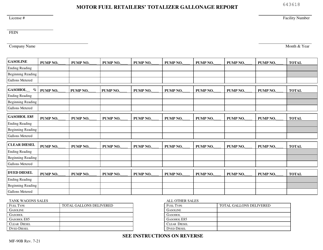

Form MF-90

for the current year.

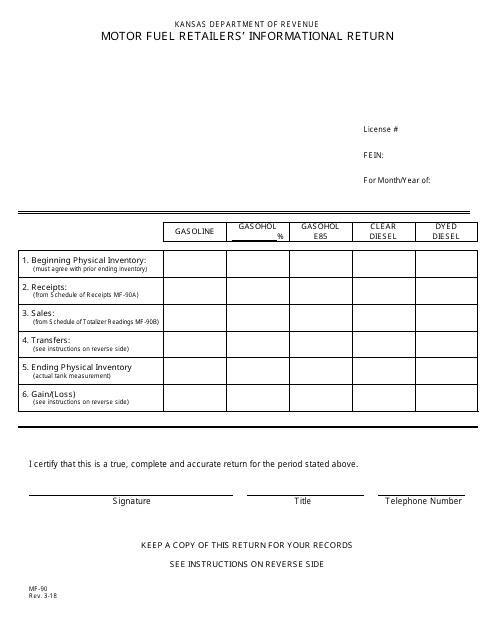

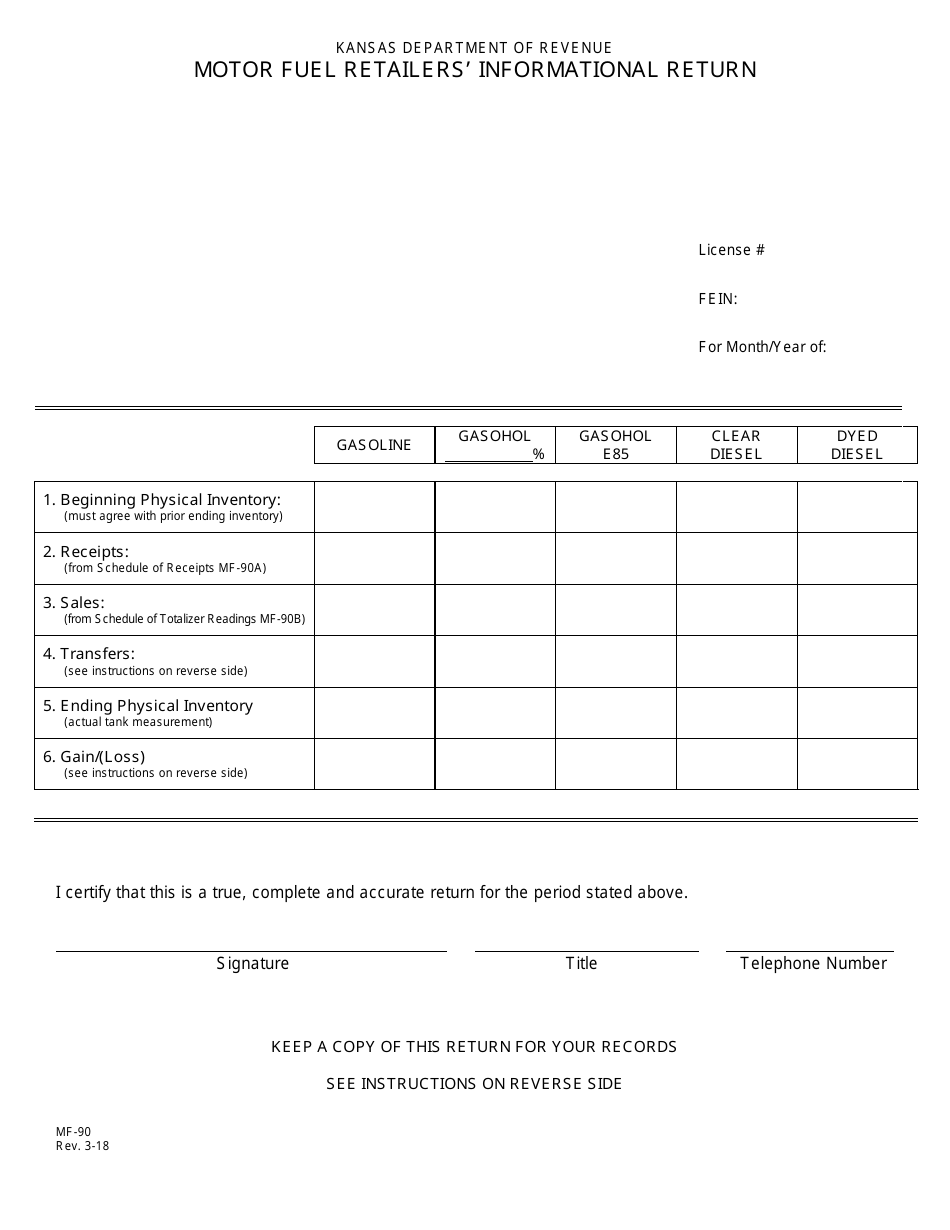

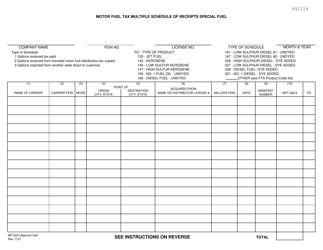

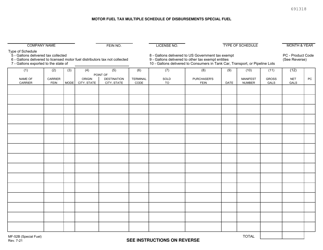

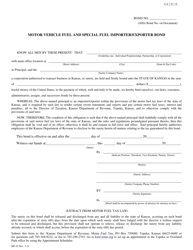

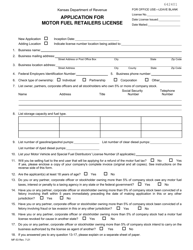

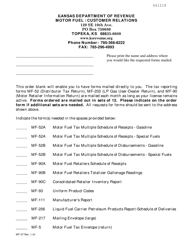

Form MF-90 Motor Fuel Retailers' Informational Return - Kansas

What Is Form MF-90?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-90?

A: Form MF-90 is the Motor Fuel Retailers' Informational Return.

Q: Who needs to file Form MF-90?

A: Motor fuel retailers in Kansas need to file Form MF-90.

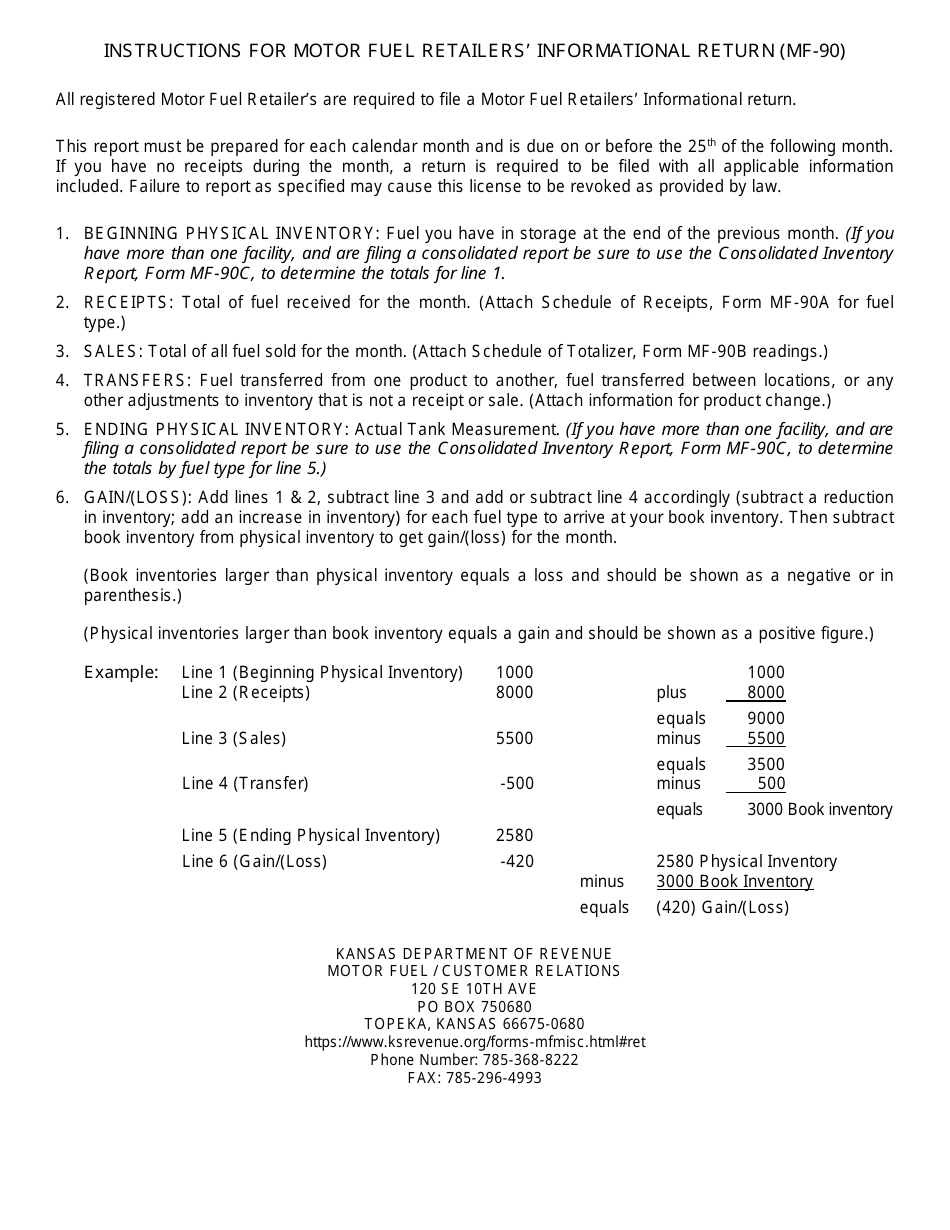

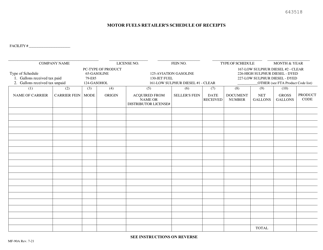

Q: What information is required on Form MF-90?

A: Form MF-90 requires information about the quantities and types of motor fuel sold, as well as other related information.

Q: When is Form MF-90 due?

A: Form MF-90 is due on a monthly basis, by the 25th day of the month following the reporting period.

Q: Are there any penalties for not filing Form MF-90?

A: Yes, penalties may apply for failure to file Form MF-90 or for inaccurate or incomplete reporting.

Q: Is there a fee for filing Form MF-90?

A: No, there is no fee for filing Form MF-90.

Q: Can I amend a previously filed Form MF-90?

A: Yes, if you need to make changes to a previously filed Form MF-90, you can file an amended return.

Q: Who can I contact for more information about Form MF-90?

A: For more information about Form MF-90, you can contact the Kansas Department of Revenue.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-90 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.