This version of the form is not currently in use and is provided for reference only. Download this version of

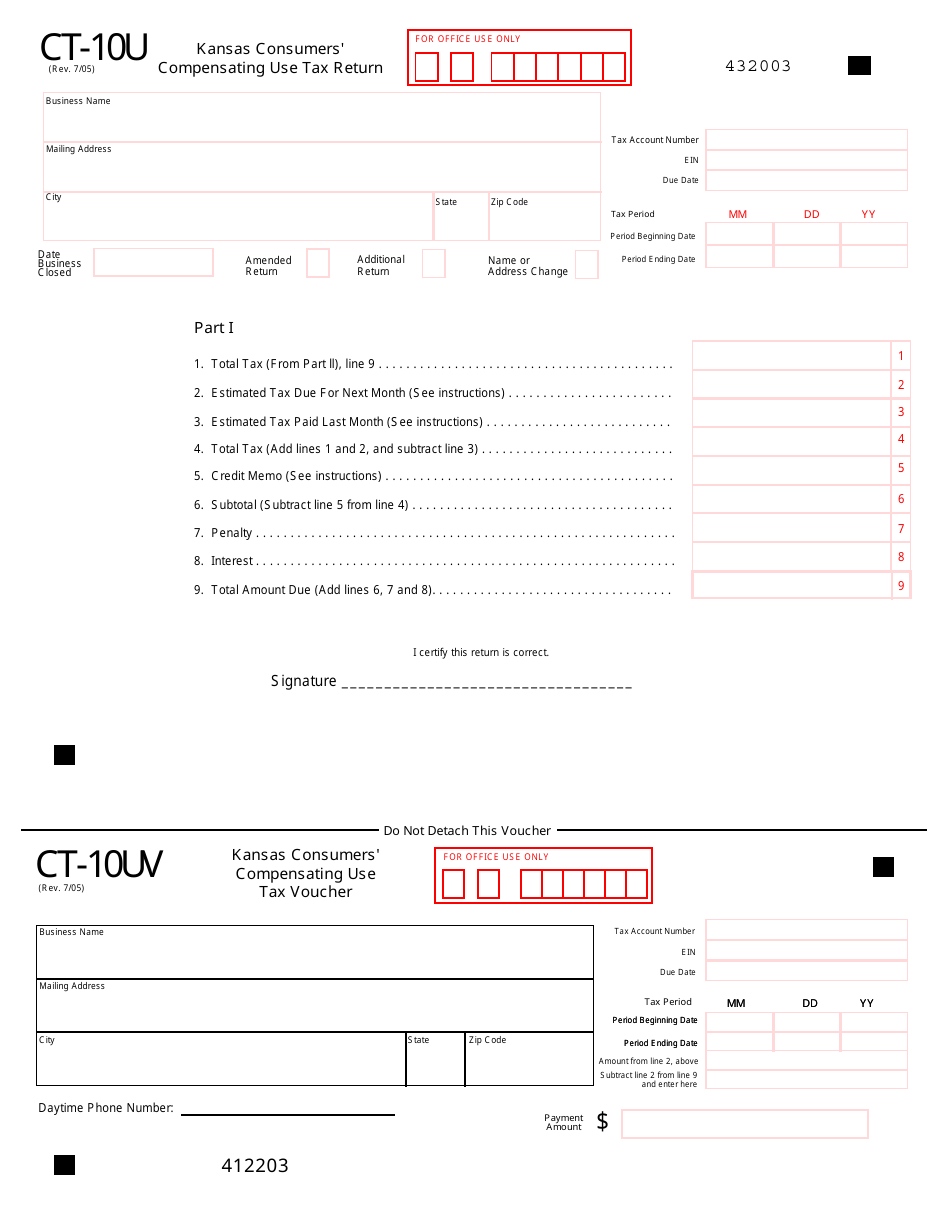

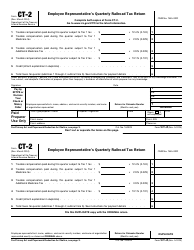

Form CT-10U

for the current year.

Form CT-10U Kansas Consumers' Compensating Use Tax Return - Kansas

What Is Form CT-10U?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-10U?

A: Form CT-10U is the Kansas Consumers' Compensating Use Tax Return.

Q: What is the purpose of Form CT-10U?

A: The purpose of Form CT-10U is to report and pay compensating use tax in Kansas.

Q: Who needs to file Form CT-10U?

A: Anyone who purchased tangible personal property or taxable services for use in Kansas and did not pay sales tax needs to file Form CT-10U.

Q: How often should Form CT-10U be filed?

A: Form CT-10U should be filed on a quarterly basis.

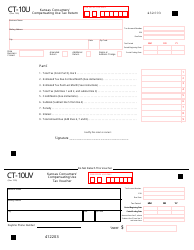

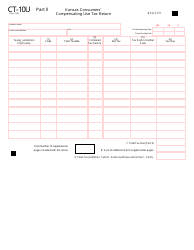

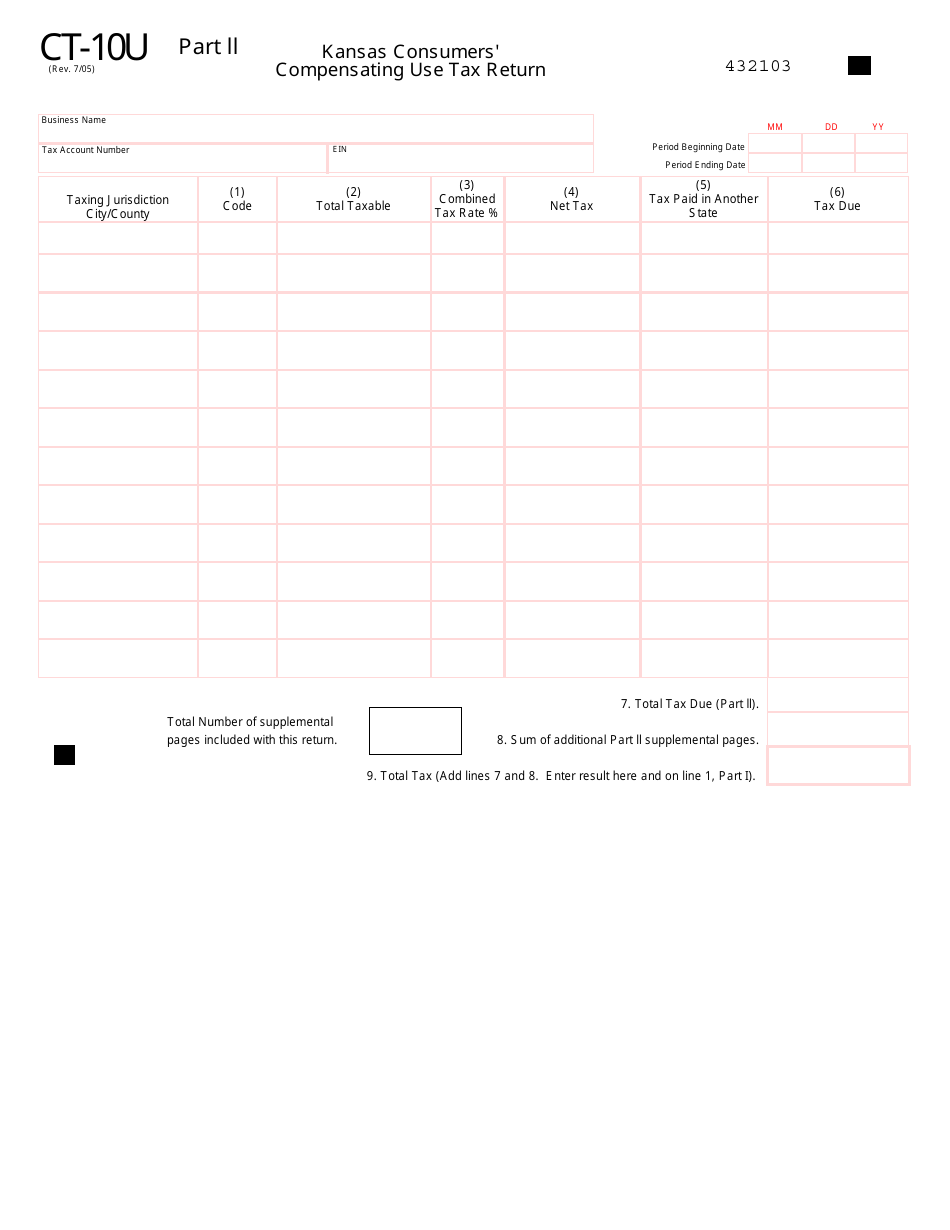

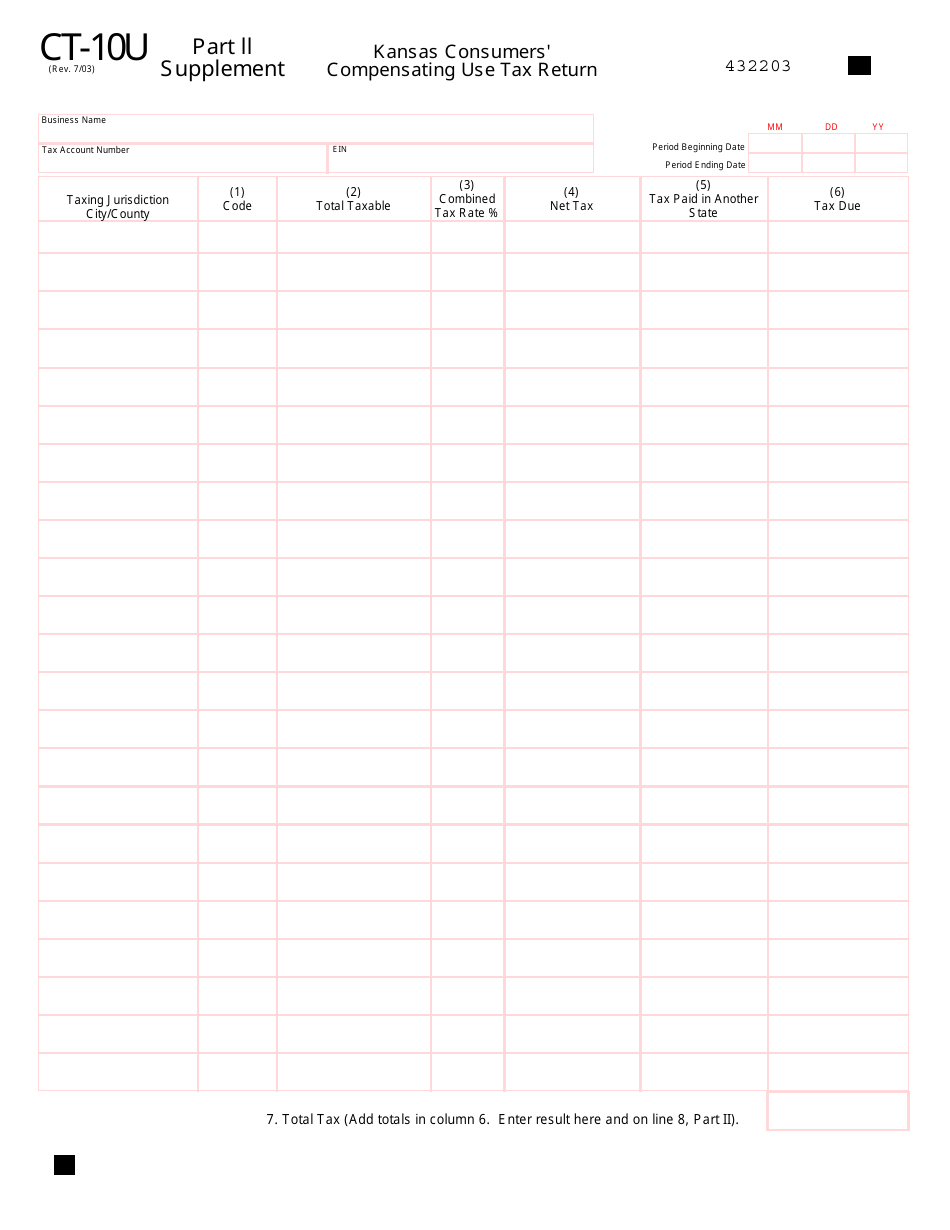

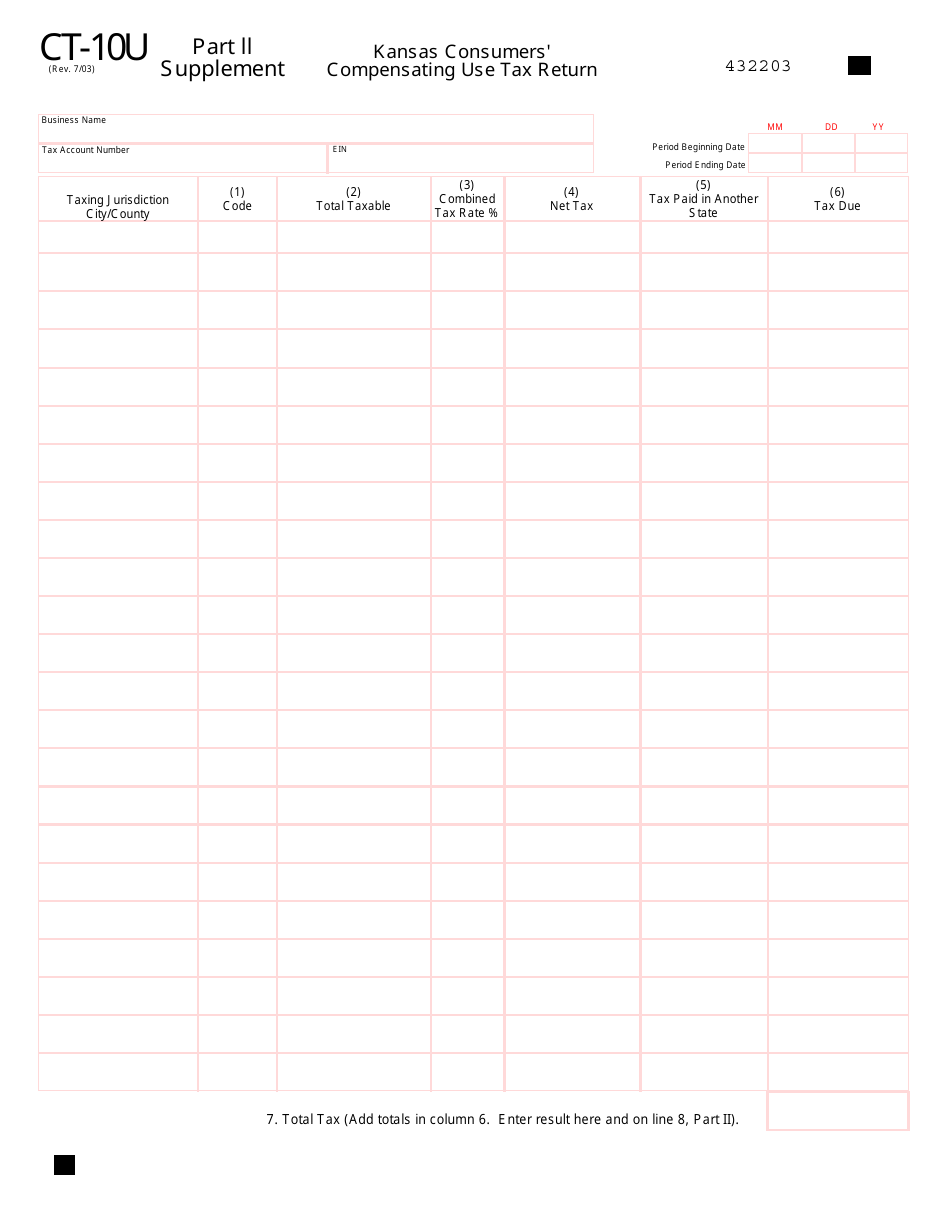

Q: What information is required on Form CT-10U?

A: Form CT-10U requires the taxpayer's contact information, account numbers, and details of the purchases subject to compensating use tax.

Q: When is the deadline to file Form CT-10U?

A: The deadline to file Form CT-10U is the last day of the month following the end of the quarter.

Q: Are there any penalties for late or incorrect filing of Form CT-10U?

A: Yes, there are penalties for late or incorrect filing of Form CT-10U, including interest charges and possible additional penalties.

Q: Is there a minimum threshold for filing Form CT-10U?

A: Yes, if the total compensating use tax due for the year is less than $10, no filing is required.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-10U by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.